|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

In the apparel industry, two names stand out for very different reasons: lululemon athletica inc. LULU and Hanesbrands Inc. HBI. While lululemon has carved out a premium niche in athleisure, building a cult-like following with its sleek activewear and strong direct-to-consumer presence, Hanesbrands represents the other end of the spectrum with its mass-market essentials and broad retail distribution. lululemon thrives on brand prestige, high margins and innovative product launches, whereas Hanesbrands leans on volume, affordability and legacy market share in everyday basics.

As both companies navigate shifting consumer trends and intensifying competition, their contrasting business models and market positions set the stage for a compelling face-off: a high-growth premium brand versus a volume-driven staple giant.

lululemon continues to be a dominant force in the premium activewear segment, commanding growing market share even as the broader U.S. athletic wear category softens. In second-quarter fiscal 2025, revenues rose 7% to $2.5 billion, while EPS of $3.10 beat expectations. The company’s digital channel contributed $1 billion, or 39% of total sales, underscoring its strong omni-channel model.

With more than 784 stores worldwide and 30 million members in its loyalty program, lululemon has built a powerful consumer base that spans all age demographics. Despite short-term challenges in North America, the brand’s international performance, particularly in China, with 25% revenue growth, highlights its global expansion potential.

lululemon is doubling down on innovation and agility to sharpen its competitive edge. The company’s “Science of Feel” product development platform has fueled demand for new franchises like Align No Line, Daydrift and BeCalm, reinforcing its reputation for performance apparel in yoga, run, golf and tennis. At the same time, LULU is addressing weaknesses in casual and lounge categories by accelerating the share of new styles in its assortment from 23% to 35% by spring 2026. Its investments in design talent and fast-track supply chain processes are aimed at shortening lead times and capturing shifting consumer preferences.

lululemon’s robust balance sheet, with $1.16 billion in cash, provides flexibility to navigate tariff pressures and invest in long-term growth. Its gross margin remained industry-leading at 58.5%, even with markdown and tariff impacts, reflecting strong brand equity and pricing power.

While guidance for fiscal 2025 was trimmed due to U.S. softness and higher costs, the company remains well-positioned to outperform peers. Its premium brand positioning, expanding international footprint, loyal customer base and disciplined digital-first strategy make Lululemon a compelling long-term investment case within the consumer goods industry.

Hanesbrands, a global leader in everyday basic apparel, has demonstrated resilience and operational improvement in second-quarter 2025, delivering results that exceeded expectations. Net sales were $1.5 billion and adjusted operating profit surged to $185 million, supported by a significant gross margin expansion of 420 basis points (bps) to 40.1%.

The company’s core Innerwear segment has been a cornerstone, benefiting from disciplined pricing, cost efficiencies and its strong market position in mass-market essentials. With globally recognized brands such as Hanes, Champion, Bali and Playtex, HBI continues to hold a significant market share in the consumer goods industry, particularly in value-driven categories, wherein affordability and volume drive consumer loyalty.

HBI is strengthening its market position through portfolio simplification and operational efficiency. The company is refocusing on core Innerwear and Activewear, while divesting non-core businesses to streamline operations and unlock shareholder value. Despite near-term demand challenges, Champion remains a key growth lever in global activewear, wherein brand repositioning and innovation are being prioritized.

Hanesbrands is also pursuing digital transformation through investments in e-commerce, supply-chain modernization and technology-led customer engagement, aiming to enhance consumer accessibility across geographies. Its omnichannel presence ensures broad reach, from big-box retailers to digital platforms, cementing its relevance across demographics.

From a financial standpoint, HBI’s raised full-year outlook underscores improved fundamentals and confidence in execution. The company expects higher profitability, driven by gross-margin gains, debt reduction and working capital efficiencies. While it does not command the premium brand positioning of rivals like lululemon, Hanesbrands’ value-oriented portfolio, entrenched retail partnerships and diversified customer base provide a more defensive investment case. For investors seeking exposure to consumer essentials with steady cash flow and improving operational discipline, HBI presents a compelling turnaround story within the broader apparel industry.

The Zacks Consensus Estimate for lululemon’s fiscal 2025 sales suggests year-over-year growth of 4.8%, while that for EPS indicates a decline of 0.7%. The EPS estimate has edged down 0.1% in the past seven days.

The Zacks Consensus Estimate for Hanesbrands’ 2025 EPS implies year-over-year growth of 65%, while that for sales indicates a decline of 11.3%. The EPS estimate has moved up 24.5% in the past 30 days.

The estimate revision trends highlight the contrasting trajectories of lululemon and Hanesbrands. While lululemon remains a premium growth brand with steady sales momentum, the modest downward revisions in EPS reflect near-term margin pressures and tariff-related headwinds. In contrast, Hanesbrands’ estimates tell a turnaround story, despite a projected sales decline, its sharp upward EPS revisions underscore improving profitability and operational discipline.

For investors, this divergence suggests that lululemon offers consistency with tempered near-term earnings visibility, whereas Hanesbrands presents a higher-risk, higher-reward setup, driven by cost efficiencies and restructuring gains.

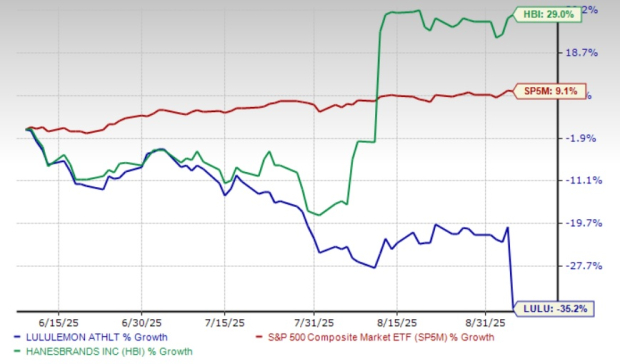

In the past three months, the Hanesbrands stock had the edge in terms of performance, recording a total return of 29%. This has noticeably outpaced lululemon’s decline of 35.2% and the benchmark S&P 500’s return of 9.1%.

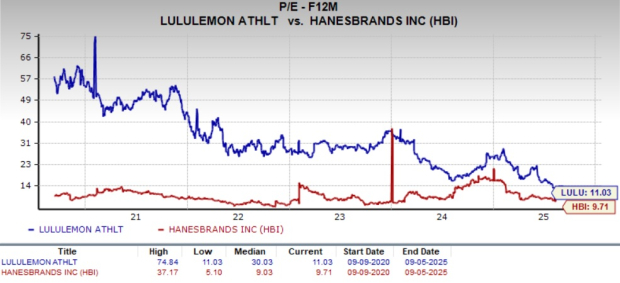

From a valuation perspective, lululemon trades at a forward price-to-earnings (P/E) multiple of 11.03X, which is below its 5-year median of 30.03X. Moreover, the lululemon stock trades above Hanesbrands’ forward 12-month P/E multiple of 9.71X, with a 5-year median of 9.03X.

lululemon continues to command a premium relative to Hanesbrands, reflecting its strong brand equity and growth potential. However, this premium also makes the stock appear expensive, particularly given recent earnings pressures and modest estimate revisions.

Hanesbrands, by contrast, offers a more value-oriented entry point, aligning with its stable fundamentals and turnaround momentum. For investors, this suggests that while lululemon carries long-term appeal, its current valuation leaves less margin for error compared with the more attractively priced Hanesbrands.

Hanesbrands appears more strongly placed in the current market backdrop. Its sharp upward estimate revisions, improving profitability trends and robust price performance highlight growing investor confidence in its turnaround. Coupled with a valuation that remains firmly in value territory, HBI offers an attractive entry point for those seeking exposure to the apparel sector with a defensive tilt.

lululemon, despite its premium brand positioning and long-term growth potential, faces near-term earnings pressures and continues to trade at a premium, making it a costlier bet. For investors, this places Hanesbrands as the more compelling opportunity, combining operational discipline with favorable earnings momentum at a reasonable valuation.

Honesbrands has a Zacks Rank #2 (Buy), while lululemon currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

LULU

The Wall Street Journal

|

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite