|

|

|

|

|||||

|

|

Gold prices are witnessing a solid northward journey this year, benefiting the stocks associated with yellow metal mining. Gold price has climbed nearly 40% year to date. On Sept. 9, it touched a new all-time high of $3,647/ounce.

There were several reasons for surging gold prices. Several central banks of emerging economies are continuously buying the yellow metal. Central banks are bolstering their gold reserves following rising global debt levels, President Donald Trump’s trade and tariff-related uncertainties and lingering geopolitical risks, especially in the Middle East.

Moreover, central banks across the world are in the process of cutting interest rates in order to spur economic growth. Gold is known as safe-haven investment. A low market interest rate is beneficial for non-income-bearing bullions like gold.

In the United States, expectations for the first interest rate cut in 2025 by the Fed in its September FOMC meeting have skyrocketed, following the release of tepid nonfarm payrolls data of August. The CME Fedwatch interest rate derivative tool currently shows a 100% probability for 25 basis-point rate cut in September.

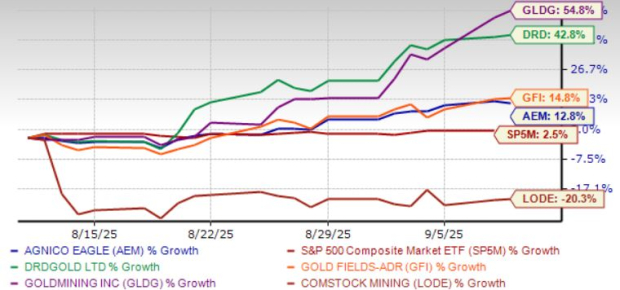

At this stage, it should be prudent to invest in gold mining stocks with a favorable Zacks Rank. Five such stocks are: Agnico Eagle Mines Ltd. AEM, DRDGOLD Ltd. DRD, Gold Fields Ltd. GFI, Comstock Inc. LODE and GoldMining Inc. GLDG.

Each of our picks currently carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gold is gaining ground on the supply-demand imbalance. The World Gold Council said that the gold mining industry is suffering from a scarcity of deposits of the yellow metal. As gold miners have already explored prospective areas, new mines are very hard to be identified. Gold mining is a very lengthy process by its nature. Moreover, slow-moving government clearances create more hurdles for miners.

On the other hand, the use of gold in energy, healthcare and technology is rising. Therefore, an eventual demand-supply imbalance is likely to drive gold prices. Market participants are optimistic about the gold mining industry’s prospects.

Giant investment bankers like JP Morgan and Goldman Sachs have forecasted that gold prices could climb to $4,000 to $5,000 per ounce by 2026, suggesting continued bullish momentum.

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #1 Agnico Eagle Mines is focused on executing projects that are expected to provide additional growth in production and cash flows. AEM is advancing its key value drivers and pipeline projects. The Kittila expansion promises cost savings, while acquisitions like Hope Bay and the merger with Kirkland Lake Gold strengthen AEM’s market position.

The merger with Kirkland Lake Gold established the new Agnico Eagle as the industry's highest-quality senior gold producer. Higher gold prices are also expected to drive AEM’s margins. Strategic diversification mitigates risks, supported by prudent debt management and maintaining financial flexibility.

Agnico Eagle Mines has an expected revenue and earnings growth rate of 30.6% and 64.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.8% over the last 30 days.

Zacks Rank #1 DRDGOLD is a medium-sized, unhedged gold producer with investments in South Africa and Australasia. Incontrovertibly bullish about its product, DRD has recently concluded extensive refocusing of its gold interests. DRD sells gold and silver bullion. DRD is involved in provision care and maintenance services; and operation of training center.

DRDGOLD has an expected revenue and earnings growth rate of 54.3% and 13.3%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 80% over the last 30 days.

Zacks Rank #2 Gold Fields operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. GFI also explores for copper and silver deposits.

Gold Fields has an expected revenue and earnings growth rate of 71% and 93.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.4% in the last 90 days.

Zacks Rank #2 Comstock is a North American precious metals mining company, focused in Nevada, with property in the Comstock Lode District. LODE mines precious metals like gold and silver. LODE operates through five segments: Fuels, Metals, Mining, Strategic Investments, and Corporate Services.

Comstock has an expected revenue and earnings growth rate of 17.4% and 69%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% in the last 30 days.

GoldMining is a mineral exploration company. GLDG is focused on the acquisition and development of gold assets principally in the Americas. GLDG operates a diversified portfolio of resource-stage gold and gold-copper projects in Canada, the United States, Brazil, Colombia, and Peru.

GoldMining has an expected earnings growth rate of 30%, for the current year (ending November 2025). The Zacks Consensus Estimate for current-year earnings has improved 12.5% in the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

AEM +5.36%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite