|

|

|

|

|||||

|

|

Dave & Buster's Entertainment, Inc. PLAY is scheduled to release second-quarter fiscal 2025 results on Sept. 15.

The Zacks Consensus Estimate for PLAY’s fiscal second-quarter earnings per share (EPS) is pegged at 88 cents, suggesting a 21.4% decline from $1.12 reported in the prior-year quarter. The consensus mark has declined in the past 30 days.

The consensus mark for fiscal second-quarter revenues is pegged at $562 million, indicating growth of 0.9% from the year-ago quarter’s reported figure.

The company has a modest earnings surprise history. PLAY’s earnings outpaced the Zacks Consensus Estimate in two of the trailing four quarters and missed on two occasions, the average surprise being 2.2%.

Our proven model predicts a likely earnings beat for Dave & Buster's this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is exactly the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Dave & Buster's has an Earnings ESP of +3.41% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dave & Buster’s fiscal second-quarter performance is expected to have reflected early momentum from improved traffic trends, revitalized promotional offerings, and continued ramp-up of new entertainment initiatives. Strategic efforts centered on simplifying marketing, enhancing food-and-beverage attachment, and re-establishing value-driven bundles are likely to have supported overall operational performance in the to-be-reported quarter.

The relaunch of the company’s historically successful Eat & Play combo, alongside the introduction of the new Summer Pass program, is expected to have been central to the quarter’s trajectory. Both offerings are designed to deepen customer engagement, drive repeat visitation and boost average check. With double-digit opt-in rates for Eat & Play and strong early adoption of the all-you-can-play upgrade option, these promotions likely contributed positively to fiscal second quarter sales growth.

The rollout of new games and attractions — including exclusive titles such as Hot Wheels and NASCAR Pit Stop, as well as Pac-Man Roller and the Human Crane — is expected to have supported guest activity in the fiscal second quarter. The nationwide “Summer of Games” campaign, complete with leaderboard competitions and sweepstakes, likely provided additional traffic lift, particularly across weekends.

Strong contributions from store openings in New Jersey and North Carolina, alongside the successful relocation of the Honolulu unit, are likely to have aided the company’s top line in the fiscal second quarter.

Dave & Buster’s fiscal second-quarter margins are expected to have reflected a balance of sales recovery and ongoing reinvestments in marketing and store operations. In the fiscal first quarter, adjusted EBITDA margin stood at 24%, pressured by elevated pre-opening and marketing costs. For the fiscal second quarter, marketing expenses are anticipated to normalize, though incremental repair and maintenance spending tied to game room upgrades may have persisted. Our model predicts fiscal second quarter adjusted EBITDA to fall 18.6% year over year to $123.4 million.

Management has reiterated its full-year guidance for capital expenditures not to exceed $220 million, with approximately $20 million in pre-opening costs and $130–$140 million in interest expense expected for fiscal 2025. These measures, combined with disciplined cash flow conversion and strong unit economics from remodels and new stores, may have provided a partial offset to expense pressures during the quarter.

Nevertheless, structural headwinds — including labor inflation and macro-related softness in discretionary consumer spending — may have constrained margin expansion in the to-be-reported quarter. Our model predicts fiscal second-quarter total operating expenses to rise 2.6% year over year to $484.7 million.

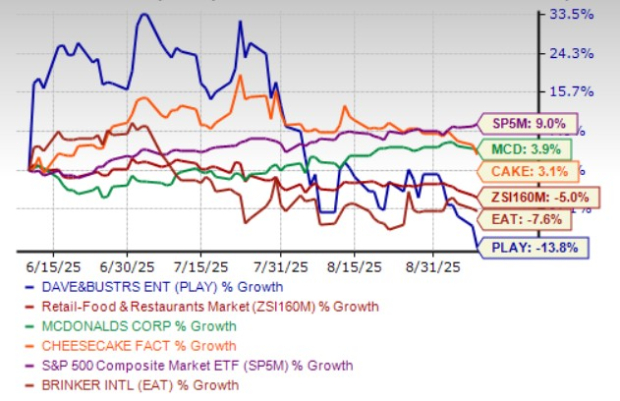

In the past three months, shares of Dave & Buster’s have declined 13.8% compared with the Zacks Retail - Restaurants industry’s 5% drop. Over the same timeframe, the stock has underperformed the S&P 500’s growth of 9%. The company’s peers, including McDonald's Corporation MCD and The Cheesecake Factory Incorporated CAKE, have gained 3.9% and 3.1%, respectively, while Brinker International, Inc. EAT has declined 7.6% in the same time frame.

From a valuation perspective, Dave & Buster’s stock is currently trading at a discount. PLAY is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 11.98, below the industry average of 24.14X. Other industry players, such as McDonald's, Cheesecake Factory and Brinker, have P/E ratios of 23.93, 14.59 and 14.94, respectively.

Dave & Buster’s is focused on strengthening its position in the experiential dining and entertainment market through a “back-to-basics” strategy that emphasizes guest value, operational execution and disciplined growth. The reintroduction of the Eat & Play combo, the launch of the Summer Pass, and the rollout of exclusive new games are designed to drive traffic, enhance guest engagement, and improve food-and-beverage attachment. Remodel performance has been encouraging, with upgraded stores consistently outperforming the system, while new unit development and international franchising agreements provide additional avenues for capital-efficient expansion. These efforts, coupled with a focus on simplified marketing and disciplined capital allocation, support the company’s objective of driving sustainable growth and improved cash flow generation.

However, challenges remain. Inflationary pressures on labor and operating costs, competitive promotional activity, and uneven demand across dayparts could limit near-term margin expansion. Reinvestment in marketing, store remodels, and menu refreshes, while necessary for long-term brand health, may weigh on profitability in the short run. In addition, discretionary consumer spending trends remain a key variable, with weekend strength offset by softer midweek traffic. Continued progress in broadening demand, optimizing costs, and stabilizing margins will be critical for Dave & Buster’s to fully capture its turnaround potential and deliver improved shareholder returns.

While Dave & Buster’s is making progress on its turnaround with revitalized promotions, new game launches, and encouraging remodel performance, near-term challenges cloud the stock’s outlook. Margin pressures from labor inflation, higher operating costs, and necessary reinvestments in marketing and store refreshes may weigh on profitability. At the same time, discretionary spending headwinds and uneven demand across dayparts limit visibility into a sustained recovery. Although the stock trades at a discount to peers on a forward P/E basis, the stock’s recent weakness reflects investor skepticism.

Given the lack of clear earnings momentum this quarter and ongoing cost pressures, we believe the current setup does not favor aggressive buying. Existing investors may consider holding positions, but fresh entry appears less compelling until there is greater evidence of sustained traffic growth and operating leverage. In our view, PLAY stock remains more of a wait-and-see story rather than a near-term buying opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| Feb-26 | |

| Feb-26 |

Burger King is testing AI headsets that will know if employees say "welcome" or "thank you"

MCD

Associated Press Finance

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite