|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

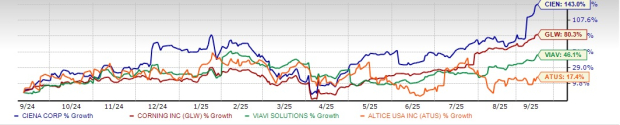

Ciena Corporation’s (CIEN) shares have jumped 143% in the past year, outperforming the Zacks Communication-Components industry, the Zacks Computer and Technology sector and the S&P 500 composite’s growth of 88%, 30.5% and 19.8%, respectively. The stock has risen 112.6% in the past six months.

CIEN also topped several of its peers, including Corning Incorporated (GLW), Viavi Solutions Inc. (VIAV) and Altice USA, Inc. (ATUS). GLW, VIAV and ATUS have gained 80.3%, 46.1% and 17.4% respectively, during the same time frame. Closing at $132.5 as of last day’s trading session (Sept. 11, 2025), CIEN stock is currently trading near its 52-week high of $134.31.

Hanover, MD-based Ciena is a leading provider of optical networking equipment, software and services. The company classifies its reporting segments into — Networking Platforms, Platform Software and Services, Blue Planet Automation Software and Services and Global Services.

Ciena’s Adaptive Network helps businesses evolve by combining AI-driven automation, programmable infrastructure, advanced analytics and expert services. It uses software control and automation to manage services across complex, multi-vendor networks, while its programmable infrastructure offers flexible virtual and physical resources through open interfaces. With built-in analytics and intelligence, the network can predict issues and anticipate trends before they happen, supported by real-time telemetry. Ciena also provides services to help build, operate and continuously improve network performance.

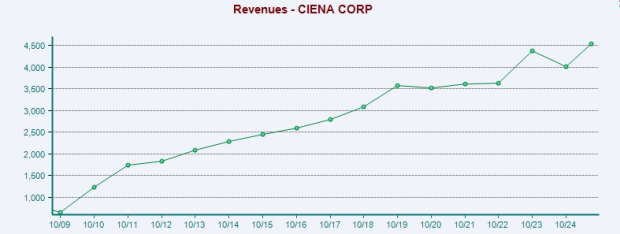

The company is experiencing stronger customer spending as AI drives increased network traffic and bandwidth demand. Cloud and service providers are investing in networks to support AI growth, creating long-term opportunities for its Systems and Interconnects. To capture this, Ciena is focusing R&D on Coherent Optical Systems, Interconnects, Coherent Routing and DCOM, while decreasing investment in residential broadband. Its Navigator Network Control Suite posted more than 30% order growth in early fiscal 2025, and Blue Planet continues to support major AI-driven digital transformation projects. With this momentum, Ciena anticipates around 17% revenue growth in fiscal 2026, reaching its three-year CAGR target ahead of schedule.

Its revenues are fueled by strong demand for packet optical transport, switching products and service management software, with growing diversification into data center connectivity. Its investments in optical fiber and data markets position it well for rising bandwidth needs and telecom network upgrades. Interconnects are a key growth driver, supported by record routing and switching shipments, strong DCOM demand and a major hyperscaler’s first large 400ZR+ order. The company expects Interconnect revenues to at least double in 2025, with further growth in 2026.

Ciena continues to benefit from increasing network traffic, rising bandwidth demand and growing cloud adoption, driving stronger profits across a mix of new and existing customers. Its portfolio—led by WaveLogic, RLS, Navigator and Interconnect solutions—remains an industry standard, with WaveLogic 6 providing an 18–24 month technology advantage and fueling global AI network growth. Ciena is the only provider with a 1.6Tbps WAN solution, already securing industry-first AI infrastructure wins in North America and expanding deals with global service providers like Lumen, Etisalat and Korea Telecom. WaveLogic 6 Extreme and Nano products are gaining momentum, with shipments underway and revenues expected to increase, while WaveRouter is entering international enterprise markets with the world’s first 1.6Tbps router trial.

In fiscal 2026, management plans to continue investing in its roadmap, financed by portfolio choices and efficiencies, with operating expenses expected to remain flat at around $1.5 billion, consistent with fiscal 2025. Ciena now anticipates reaching its 15–16% operating margin target a year earlier, in fiscal 2026, supported by stronger leverage and margin improvements. It forecasts gross margins to increase to approximately 43%. Globally, more than $7 trillion is projected to be invested in data centers, GPU clusters, power grids and AI model development by 2030, with networking expected to capture a growing share of this spending.

Ciena faces potential disruptions from new tariffs and retaliatory trade actions, which could increase costs for raw materials and components, disrupt supply chains and negatively impact global demand. These challenges may weigh on margins and slow down international growth, requiring strategic adjustments to mitigate risks.

A key part of Ciena’s business strategy relies on its ability to commercialize and gain market acceptance for its Blue Planet Automation Software platform. Its hardware and software networking solutions, including coherent optical modem components, are based on complex technology. Ciena might experience unexpected delays in developing, manufacturing and launching these solutions. Delays in product development or supply chains could harm its reputation and limit its ability to capitalize on market opportunities.

Customer concentration is a concern. Most of its revenue is concentrated among a few large global communications service providers. Due to the competitive nature of the industry, losing any one of these key customers could significantly affect the company's performance. Two customers, each with more than a 10% stake, accounted for 28.8% of revenues in the fiscal third quarter.

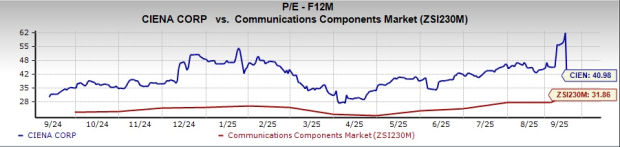

From a valuation standpoint, CIEN appears to be trading at a premium relative to the industry. Going by the price/earnings ratio, the company’s shares currently trade at 40.98 forward earnings, higher than 31.86 for the industry.

In comparison, GLW, VIAV and ATUS are trading at multiples of 27.58, 21.11 and negative 12.38, respectively.

To determine whether Ciena remains a strong investment, investors should monitor revenue growth in the fiscal fourth quarter and fiscal 2026, especially from cloud and hyperscaler clients, along with improvements in gross and operating margins supported by a better product mix and lower incentive costs. Order backlog trends will show demand visibility, while competitive factors such as pricing, new competitors and substitute technologies could influence momentum. Broader macroeconomic factors like interest rates, capital spending, inflation and supply chain stability also play a crucial role, along with market sentiment and valuation, which will determine whether Ciena continues to grow or faces a downturn.

With a Zacks Rank #1 (Strong Buy) at present, CIEN seems to be a good investment bet now. You can see the complete list of today’s Zacks #1 Rank stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite