|

|

|

|

|||||

|

|

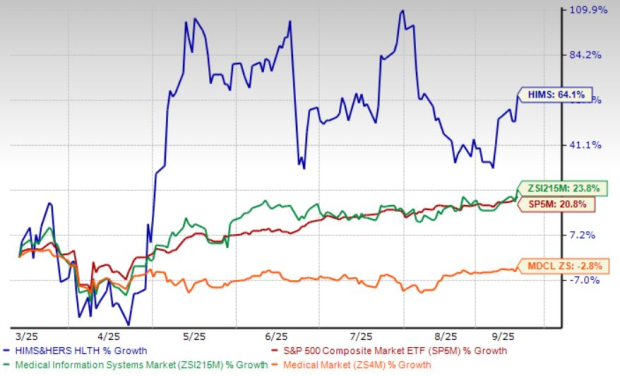

Hims & Hers Health, Inc.’s HIMS investors have been experiencing some short-term gains from the stock lately, despite its bumpy ride over recent months. The San Francisco, CA-based health and wellness platform’s stock gained 64.1% compared with the industry’s 23.8% rise in the same time frame. It has also outperformed the sector and the S&P 500’s decline of 2.8% and gain of 20.8%, respectively.

Two major recent developments of HIMS include the launch of its new category in men’s health (this month) and the announcement of its second-quarter 2025 results (August).

Hims & Hers had recorded a robust improvement in the top and bottom lines and strength in its Online revenue channel in second-quarter 2025. The increase in subscribers and monthly online revenue per average subscriber during the quarter was encouraging. The expansion of the operating margin during the quarter was also seen. However, HIMS’ lower Wholesale revenues in the quarter were disappointing. The gross margin contracted due to rising product costs, which do not bode well for the stock.

Over the past six months, the stock’s performance has remained strong, outperforming its peers like Teladoc Health, Inc. TDOC and American Well Corporation AMWL, popularly known as Amwell. Teladoc Health’s and Amwell’s shares have lost 8.5% and 14.5%, respectively, in the same time frame.

HIMS expects revenues for the third quarter of 2025 and the full year in the bands of $570 million to $590 million (reflecting an uptick of 42-47% year over year) and $2.3 billion to $2.4 billion (representing growth of 56-63% from 2024 levels), respectively. The Zacks Consensus Estimate for revenues for the third quarter and the full year is currently pegged at $581.6 million and $2.35 billion, respectively, while the same for earnings per share is currently pegged at 9 cents and 60 cents, respectively.

Hims & Hers has shown impressive operational momentum, driven by strong customer adoption of personalized treatment plans. Growth in subscribers and higher engagement levels reflect the effectiveness of its digital platform, while operating leverage has begun to enhance profitability. Management’s confidence in reaffirming its full-year outlook highlights both the resilience of the business model and its ability to balance rapid expansion with disciplined execution.

Hims & Hers is actively pursuing international expansion. The acquisition of ZAVA, a digital health platform with 1.3 million active customers and 2.3 million consultations in Europe, accelerates entry into the U.K., Germany, France and Ireland. Additionally, the company announced plans to expand into Canada in 2026, timed with the introduction of generic semaglutide for weight loss. This strategy positions HIMS to capture demand in large, underserved markets while leveraging its scalable platform.

To support growth, Hims & Hers priced an upsized $870 million convertible senior notes offering, aimed at funding global expansion, acquisitions, and AI-driven personalization. Complementing this, the appointment of Mo Elshenawy as chief technology officer underscores the company’s focus on building a next-generation AI-powered healthcare platform. With his expertise in AI and large-scale systems, HIMS is advancing toward delivering globally standardized, personalized care on a large scale.

Hims & Hers has recently launched an exclusive men’s health category by partnering with Marius Pharmaceuticals to introduce oral testosterone therapy (KYZATREX) and personalized dual-action treatments. These offerings address a large unmet need among an estimated 20 million U.S. men struggling with low testosterone, modernizing therapy with needle-free, FDA-approved solutions that improve energy, libido and overall quality of life. This expansion not only diversifies HIMS’ portfolio but also strengthens its credibility as an innovator in precision healthcare.

Hims & Hers is also advancing into broader hormone health management. By integrating comprehensive lab testing capabilities and offering both oral and injectable testosterone options, HIMS is building a scalable care model. The emphasis on convenience (home blood tests, quick results, app-based care access) ensures accessibility and strengthens customer engagement.

In the second quarter of 2025, Hims & Hers’ gross margin contracted 491 basis points due to a surge in the cost of revenues. This poses a challenge for the company if it is unable to control its costs in the future.

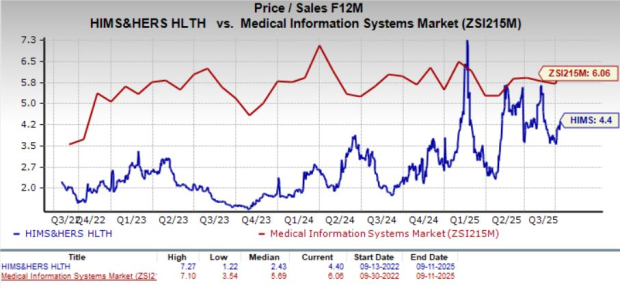

HIMS’ forward 12-month P/S of 4.4X is lower than the industry’s average of 6.1X but is higher than its three-year median of 2.4X.

Teladoc Health and Amwell’s forward 12-month P/S currently stand at 0.5X and 0.4X, respectively, in the same time frame.

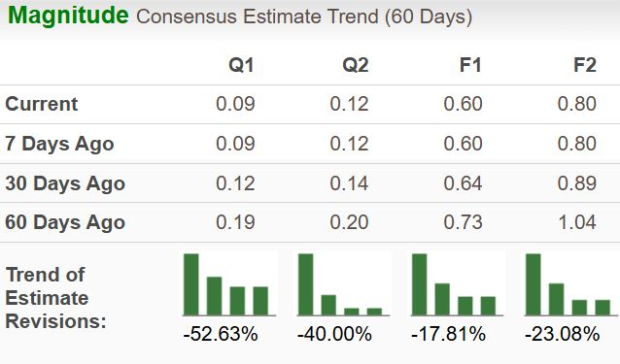

Estimates for Hims & Hers’ 2025 earnings have moved 17.8% south to 60 cents in the past 60 days.

Estimates for Teladoc Health’s 2025 loss per share have narrowed from $1.20 to $1.17 in the past 60 days.

Estimates for Amwell’s 2025 loss per share have narrowed from $6.91 to $6.13 in the past 60 days.

There is no denying that Hims & Hers is poised favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The Zacks Rank #3 (Hold) company’s strong growth prospects present a good reason for existing investors to retain shares for potential future gains. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. The favorable Zacks Style Score with a Growth Score of A suggests continued uptrend potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 min | |

| 24 min | |

| 34 min | |

| 42 min | |

| 48 min | |

| 54 min | |

| 1 hour | |

| 6 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Hims & Hers Health Fourth-Quarter Sales Rise, Gives Soft First-Quarter Guidance

HIMS

The Wall Street Journal

|

| Feb-23 |

Stocks to Watch Monday Recap: Diamondback, Netflix, Novo Nordisk, Lilly

HIMS

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite