|

|

|

|

|||||

|

|

The Boeing Company (BA) recently opened a new 65,000-square-foot Engineering Center at Embry-Riddle Aeronautical University. The facility will accelerate critical defense programs by strengthening the partnership with the school, providing access to an exceptional talent pipeline, and driving aerospace innovation. The new center is expected to create 400 high-paying jobs.

This strategic move, highlighting Boeing’s commitment to long-term growth and stable defense revenues, might encourage investors to add this stock to their portfolios. However, investors must also consider the company's broader growth potential, its performance on the bourses, and operational challenges before making a strategic decision, such as an investment. Let’s discuss them below.

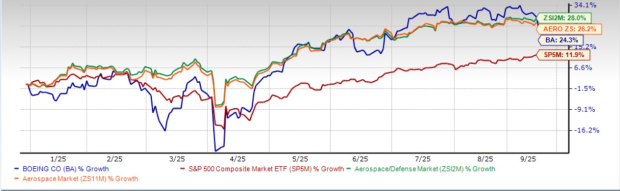

Shares of Boeing have surged a solid 24.3% in the year-to-date period, underperforming the Zacks aerospace-defense industry’s growth of 28% and the broader Zacks Aerospace sector’s rise of 26.2%. The stock has, however, outpaced the S&P 500’s return of 11.9% in the same time frame.

Shares of other prime aircraft makers like Embraer (ERJ) and Airbus Group (EADSY) have risen considerably year to date. Notably, shares of Embraer and Airbus have gained 60.3% and 43.2%, respectively, during the said period.

With Boeing being the largest commercial aircraft manufacturer in the United States, steadily growing air passenger traffic resulting in solid jet deliveries must have boosted investors’ confidence in this stock lately. This got duly reflected in its year-to-date share price performance. The company’s commercial airplanes segment registered 63% year-over-year growth in its delivery count for the second quarter of 2025, which resulted in an 81% surge in this unit’s revenues.

The growing demand for air travel is expected to continue boosting Boeing Commercial Airplanes (“BCA”), which develops, produces, and markets commercial jets, and provides related support services. To this end, it is imperative to mention that, as per the latest Boeing Commercial Market Outlook, the company anticipates that the world will need 43,600 new commercial planes through 2044, backed by passenger traffic growth of 4.2% annually over the next 20 years. This should continue to fuel demand for Boeing-built commercial planes, thereby boosting its BCA segment’s growth prospects significantly.

Apart from the commercial aerospace industry, defense remains another major industry, wherein this American jet giant is a prominent contractor, with the Boeing Defense, Space & Security (“BDS”) segment contributing 36% to the company’s total revenues (as of 2024-end).

To this end, it is imperative to mention that the U.S. fiscal 2026 defense budget proposal, including funding worth $3.1 billion for continued F-15EX Eagle II fighter jet production and $3.5 billion for the Air Force's planned F-47 Next Generation Air Dominance fighter jet platform, should bode well for the BDS unit.

Against this backdrop, the inauguration of Boeing’s latest engineering facility is expected to further advance the development of more lethal and effective defense products, enhance existing product lines, and ultimately reinforce the BDS unit’s operational performance and competitive positioning over the long term.

In line with this, the Zacks Consensus Estimate for BA’s long-term (three-to-five years) earnings growth rate is pegged at 17.9%, higher than the industry’s 14.5%.

Now, let’s take a sneak peek at the company’s near-term estimates to understand whether the figures mirror similar growth prospects.

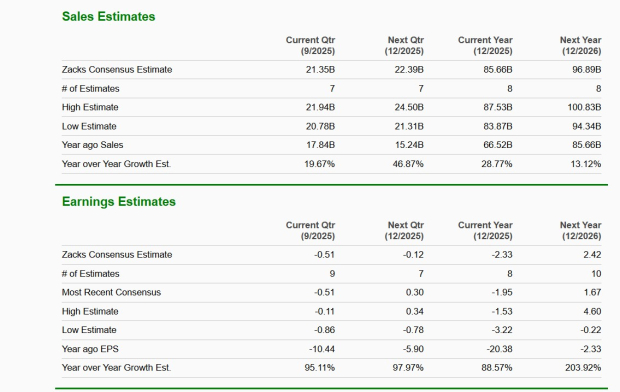

The Zacks consensus estimate for BA’s third-quarter 2025 sales suggests an improvement of 19.7% from the year-ago quarter’s reported figure, while that for full-year 2025 sales indicates a rally of 28.8%. A similar improvement trend can be expected in its 2026 sales estimates.

Its quarterly as well as yearly earnings estimates also imply similar robust performance on a year-over-year basis.

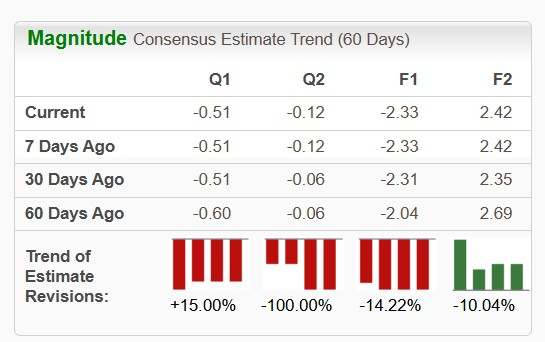

However, the company’s near-term earnings estimates have moved south over the past 60 days, except for the third quarter of 2025. The downward revision reflects investors’ loss of confidence in the stock’s earnings-generating capabilities.

While steady growth in air travel has benefited aerospace giants like Boeing, Airbus, and Embraer, persistent supply-chain challenges continue to pose a significant risk to industry players. In particular, sustained part shortages are slowing down jet production, which has contributed to a record 17,000-aircraft backlog as of June 2025, per a report by the International Air Transport Association. Delivery delays as a result of these part shortages thus threaten Boeing’s near-term revenue prospects from jet deliveries.

Apart from this, escalating trade tensions between the United States and China pose a significant risk to Boeing. The company has approximately 20 737-8 aircraft awaiting delivery to Chinese customers, but a recurrence of the April 2025 incident, where China refused to accept new jets, could severely hurt Boeing's revenues and increase its inventory costs.

The image below shows that BA stock’s trailing 12-month return on invested capital (ROIC) not only lags the industry’s average return but also reflects a negative figure. This suggests that the company's investments are not yielding sufficient returns to cover its expenses.

However, the ROIC of its peers, Embraer and Airbus, is currently better than that of Boeing. While the ROIC for ERJ is currently 13.63, the same for EADSY is 4.86.

While Boeing's recent operational successes and a surge in its share price are positive signs, it still lags behind its aerospace industry peers. This, combined with its negative return on invested capital and downward earnings revisions, suggests that investors should adopt a cautious approach and wait for a more appropriate time to buy this stock. Its unfavorable VGM Score of F also does not make it an attractive investment pick at present.

However, those who already own this Zacks Rank #3 (Hold) stock may continue to do so, considering its solid sales and earnings growth potential. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 11 hours | |

| 13 hours | |

| 14 hours | |

| 23 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 |

Defense Funds Poised For Breakouts As Trump Readies Potential Iran Strike

BA

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite