|

|

|

|

|||||

|

|

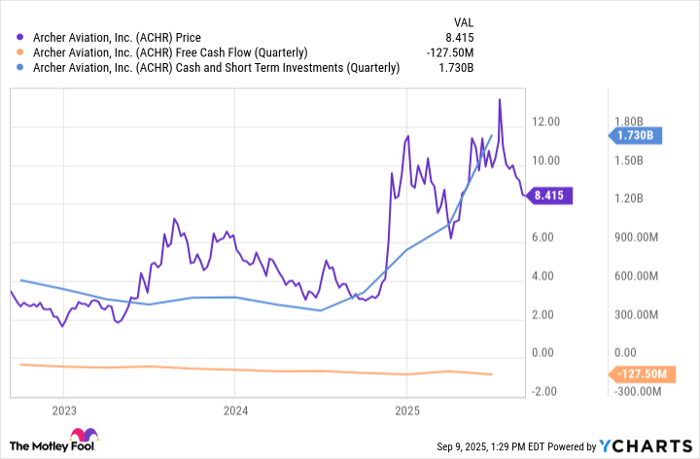

Archer is a pre-revenue company that's burning between $95 million and $110 million a quarter.

It doesn't have FAA type certification to fly its Midnight craft, and it doesn't yet have the infrastructure in place for when it does.

The stock is a high-risk, high-reward play that assumes travelers will buy potentially expensive flights to escape gridlock and save time.

Archer Aviation (NYSE: ACHR) is on the cusp of something potentially disruptive: Electric air taxi services, a concept that once seemed much more grounded in science fiction than reality. Electric air taxis will (in theory) fly paying passengers above gridlocked traffic, which will cut travel time significantly enough to warrant paying a premium for a flight.

But here's the thing (or several things, rather): As of writing, the electric air taxi market is nonexistent. Archer, a pre-revenue company, is bleeding cash in the belief that this market will emerge. Regulation around air taxis has been slow, and the company still lacks the approval to fly passengers commercially.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

As a result, Archer's story is complicated and involves many more moving parts than most conservative investors will be willing to stomach.

The stock is down about 11% on the year, but up over 157% year to date (as of writing). Will this company disrupt the transportation industry, or are investors better off waiting this one out? Let's take a peek.

Let's start with the elephant in the room. The biggest concern right now with Archer is that it doesn't have the regulatory approval to fly passengers at a commercial scale.

That approval comes from the Federal Aviation Administration (FAA) and involves a five-step process to gain FAA type certification, which is needed to put customers in the air. The challenge here is that Archer is designing a completely new category of craft -- an electric vertical takeoff and landing, or eVTOL -- and the FAA doesn't have a tried-and-true method for evaluating these crafts.

Luckily, progress is being made on that front. In February 2025, Archer obtained a Part 141 certificate for its pilot training academy. This combined with a previous certificate (Part 135) for commercial operations to give Archer the regulatory framework to both train pilots and eventually operate its air taxi ("Midnight") as a service once that type certification is secured.

But -- and this is key -- it doesn't have the type certification, and it's not clear when it will get it. In its first-quarter financial presentation, management said that it was "focused on the fourth and final phase of the certification program and have received FAA approval for 15% of the compliance verification documents."

Disappointingly, management said basically the same thing for its second-quarter presentation. In other words, year to date, no big step forward has made to secure that FAA type certification.

Until Archer gets FAA type certification, expect this pre-revenue company to burn (a lot of) cash.

To put it in numbers: Archer's cash burn rate is typically between $95 million and $110 million a quarter. It ended its latest quarter with about $1.7 billion in cash on the balance sheet. That gives it at least three or four years to persist at today's cash burn rate. It's a survivable number, but a finite one nonetheless.

But here's where it gets sticky. It would be one thing if Archer was designing craft for a pre-existing market with strong demand for it. But it's not. It's designing craft for a market that doesn't exist yet. For Archer to succeed at scale, it needs vertiport infrastructure, charging stations, and pilots, none of which are trivial capital expenditures.

It also needs manufacturing power to produce its aircraft at scale. To be fair, it appears to have some capacity in this regard (such as its manufacturing plant in Georgia), but it has a long road ahead if it wants to operate at such a rate as to put ticket prices within the reach of average travelers.

Image source: Archer Aviation.

That brings up another point: Who exactly is Archer going after with eVTOLs? Right now, the likely answer is higher-end travelers, but I imagine Archer will want to make its flights affordable to a wider audience. However, if it can't achieve an affordable price point in the mid-term, it might face a challenge with travelers who don't want to pay $200 for a 10-minute ride to the airport.

The challenges outlined above aren't insurmountable. Indeed, the bull case for Archer rests on the fact that eVTOLs could offer a solution to a massive problem: Urban congestion.

Additionally, let's not overlook Archer's credibility boosters. It has aviation friends, like United Airlines (NASDAQ: UAL), and manufacturing partners, like Stellantis (NYSE: STLA), which provide it with much-needed expertise. It was also named the official air taxi provider for the 2028 Los Angeles Olympics. That doesn't guarantee it will stick around until 2028, but it might give it paying customers if it does.

Archer is riding on an intriguing concept, one that can change urban mobility. At the same time, context matters. Interested investors should keep an eye on its balance sheet and FAA certification timeline. For Archer to grow into its $5.4 billion market cap, it needs a service network and several craft in operation. Most investors will likely want to wait until FAA type certification is within reach before taking a sizable position in this growth stock.

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,037!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,086,028!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Steven Porrello has positions in Archer Aviation. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite