|

|

|

|

|||||

|

|

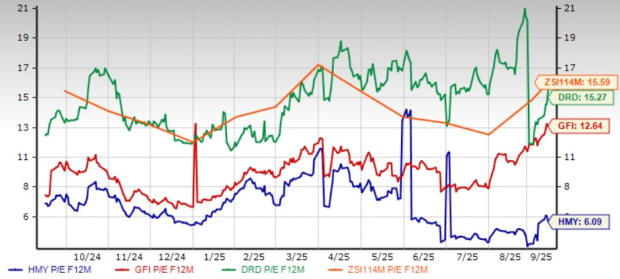

Harmony Gold Mining Company Limited’s HMY stock looks attractive from a valuation perspective. HMY is currently trading at a forward price/earnings of 6.09X, a roughly 60.9% discount, when stacked up with the Zacks Mining – Gold industry’s average of 15.59X.

HMY is also trading at a discount to its peers Gold Fields Limited GFI and DRDGOLD Limited DRD. Harmony Gold has a Value Score of B, while both Gold Fields and DRDGOLD have a Value Score of C.

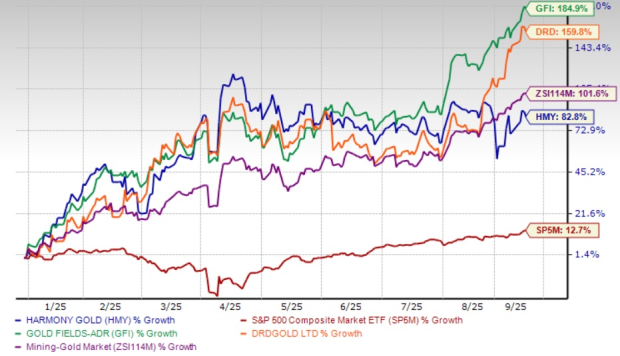

HMY’s shares have popped 82.8% this year, outperforming the industry’s rise of 101.6% and the S&P 500’s rise of 12.7%. The rally has been driven by record-high gold prices. Gold Fields and DRDGOLD have surged 184.9% and 159.8%, respectively, over the same period.

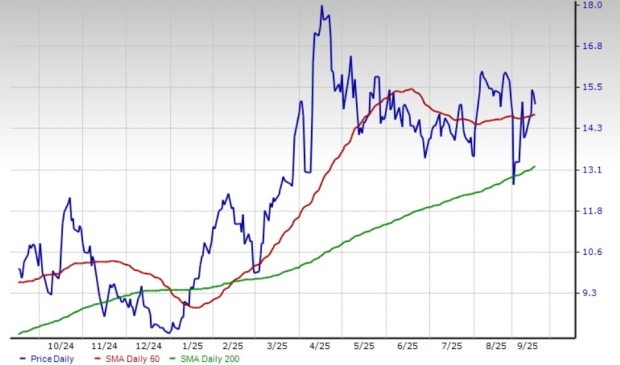

Technical indicators show that HMY stock is currently trading above its 200-day simple moving average (SMA) and 50-day SMA. The stock, for the most part, has traded above its 200-day SMA so far this year. The 50-day SMA continues to read higher than the 200-day SMA following a golden crossover on Feb. 13, 2025, indicating a bullish trend.

Harmony’s cheap valuation should lure investors seeking value. But is the time right to buy HMY’s shares based on its attractive valuation? Let’s delve deeper.

Harmony is South Africa's biggest gold producer by volume, with production of roughly 1.56 million ounces in fiscal 2024. It has a diverse portfolio of gold development projects spread across South Africa and Papua New Guinea (PNG). The company’s development projects currently in progress include the development of the Wafi-Golpu copper-gold project in PNG and the Eva Copper project in Australia.

The Wafi-Golpu project is believed to be a game-changer for the company, with an estimated gold reserve of 13 million ounces. HMY is currently in negotiations with its joint venture partner, Newmont Corporation (NEM) and the PNG Government regarding the terms of a Mining Development Contract, which is required for a Special Mining Lease.

The low-risk Eva Copper project in Australia offers additional upside, giving HMY a significant global copper-gold footprint. HMY acquired Eva Copper in 2022, adding a tier-one mining jurisdiction to its portfolio. The acquisition is in line with HMY’s objective of transitioning into a low-cost gold and copper mining company. HMY has received a conditional grant funding from the Queensland government, which will help accelerate the development of this project. It is subject to several conditions, including HMY reaching a positive final investment decision. Eva Copper is expected to produce 55,000-60,000 tons of copper per annum, with first production expected in 2028.

Gold prices are shooting higher this year, largely attributable to aggressive trade policies, including sweeping new import tariffs announced by President Donald Trump that have intensified global trade tensions and heightened investor anxiety. Also, central banks worldwide have been accumulating gold reserves, led by risks arising from Trump’s policies.

Bullion has surged 39% so far this year, with rising hopes of an interest rate cut by the Federal Reserve at the September policy meeting, a weak U.S. dollar and tariff-related uncertainties triggering the rally lately, driving prices north of $3,600 per ton for the first time. Concerns over the labor markets have heightened rate cut expectations. Increased purchases by central banks and geopolitical and trade tensions are factors expected to help the yellow metal sustain the upswing in gold prices.

For fiscal 2025, HMY recorded a roughly 31% increase in average gold prices received to $2,620 per ounce. Higher gold prices are expected to boost HMY’s profitability and drive cash flow generation.

Harmony boasts a strong balance sheet and generates substantial cash flows, which allows it to finance its development projects and drive shareholder value. Its net cash surged roughly 295% to $628 million in fiscal 2025 (ended June 30, 2025), from $159 million at the end of fiscal 2024. HMY ended the fiscal year with liquidity of $1,179 million. HMY also has a dividend policy to pay 20% of the net free cash generated to its shareholders at its board’s discretion. HMY offers a dividend yield of 1.3% at the current stock price. It has a five-year annualized dividend growth rate of about 19.4%.

HMY saw a roughly 20% surge in all-in-sustaining costs (AISC) to $1,806 per ounce (oz) in fiscal 2025. Total cash operating costs also climbed 19% year over year to $1,499 per oz in the fiscal year, hurt by lower production and higher labor and electricity costs. Increased cash operating costs and higher sustaining capital led to the uptick in AISC.

Harmony remains exposed to higher costs, which are likely to weigh on its margins over the near term. Labor and electricity remain the largest components of its cost structure. HMY experienced a 16% increase in electricity and water costs in fiscal 2025 due to higher annual tariffs charged by Eskom. While the company is implementing various energy-saving initiatives and launching a renewable energy program, the burden of higher electricity costs is unlikely to abate over the near term due to higher tariffs. The company’s AISC guidance for fiscal 2026 indicates a year-over-year increase, reflecting inflationary pressure and higher sustaining capital expenditures.

The company’s capital expenditure guidance reflects the higher spending required for both sustaining and major capital projects. Capital expenditures for fiscal 2026 are projected to increase to $699 million as a result of HMY’s investment in high-quality ounces and driving long-term growth across its portfolio.

Harmony’s gold production for fiscal 2025 fell 5% to around 1.48 million tons from roughly 1.56 million a year ago. While the company met its guidance, production was impacted by interruptions from unfavorable weather conditions stemming from unprecedented rainfall in South Africa, as well as safety-related stoppages that led to a temporary halt in production. These conditions affected output in the third and fourth quarters. Harmony Gold expects to produce 1.4-1.5 million oz of gold in fiscal 2026, indicating continued production challenges.

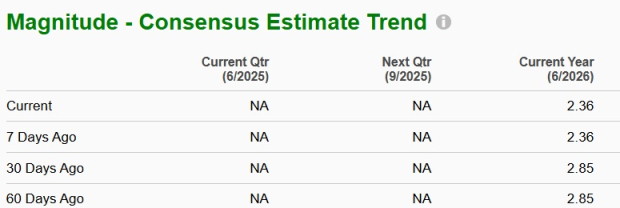

Earnings estimates for HMY for fiscal 2026 have been going down over the past 60 days. The Zacks Consensus Estimate for fiscal 2026 has been revised downward over the same time frame.

Harmony is advancing several key development projects, including Wafi-Golpu and Eva Copper, which are expected to enhance production. The favorable gold price environment is also likely to aid HMY’s performance. A solid balance sheet and efforts to drive cash flow also augur well. Despite HMY’s attractive valuation, its high electricity and labor costs warrant caution. The company also remains challenged by operational issues that may impact production. With earnings estimates going down and production challenges persisting, the risk/reward skews negative for this Zacks Rank #5 (Strong Sell) stock. Investors should consider locking in gains as cost inflation erodes profitability.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite