|

|

|

|

|||||

|

|

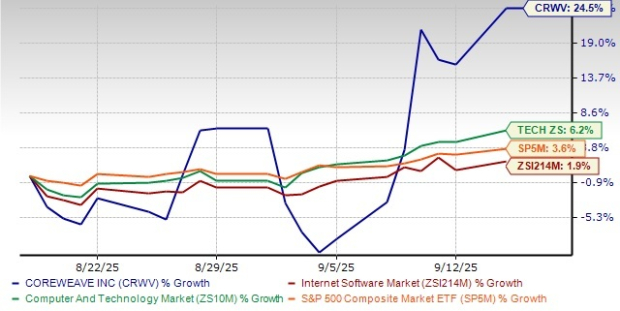

CoreWeave, Inc. CRWV stock has gained 24.5% in the past month, significantly outperforming the Zacks Internet-Software Market’s gain of 1.9% while the Zacks Computer & Technology sector and the S&P 500 Composite have gained 6.2% and 3.6% over the same time frame.

The momentum can be attributed to overall strong AI demand trends as well as company-specific developments. Yesterday, CoreWeave announced a new order form with an initial value of $6.3 billion under its existing Master Services Agreement (originally dated April 10, 2023) with NVIDIA Corporation NVDA. Under this arrangement, NVDA will be purchasing residual unsold capacity through April 13, 2032, subject to certain conditions. Shares of CoreWeave rose 7.6% following the announcement on Sept 15, 2025.

Before that, last week, CRWV announced the launch of a Ventures Group to invest in AI start-ups and position itself at the forefront of the AI wave. Investing in start-ups will aid CRWV to gain access to the latest technologies and strengthen its competitive moat against the other players in the AI infrastructure space. It is also set to purchase OpenPipe, which focuses on training AI agents with reinforcement learning.

Now, the question arises whether this momentum has the staying power. Let’s unpack the company’s fundamentals and challenges to determine if staying invested is a smart move.

With its GPU-based cloud services tailored specifically for AI workloads, CRWV is at the center of the AI infrastructure boom. Management has raised 2025 revenue guidance to $5.15-$5.35 billion compared $4.9 billion to $5.1 billion projected earlier, citing accelerating demand and a robust pipeline.

Strategic partnerships with major players, such as OpenAI and NVIDIA, bode well, along with a massive $30.1 billion revenue backlog. On the last earnings call, management had highlighted a $4 billion expansion with OpenAI, adding to the previously announced $11.9 billion deal and onboarding of a new hyperscaler customer that expanded within the quarter. OpenAI’s (which is a leading AI company) massive contract not only enhances revenue visibility for CRWV but also validates its AI infrastructure as cutting-edge and reliable.

CoreWeave’s partnership with NVIDIA is a big plus. CoreWeave was one of the first cloud providers to deliver NVIDIA H100, H200, and GH200 clusters into production for AI workloads. The company's cloud services are also optimized for NVIDIA GB200 NVL72 rack-scale systems and entered into a multiyear contract with Moonvalley (an AI video generation startup) for the same earlier in the year. It also deployed NVIDIA GB200 NVL72 and HGX B200 systems at scale, integrated into its “Mission Control” for reliability and performance.

CRWV also continues to add new products and innovations to meet clients’ requirements. It has expanded object storage offerings with automatic tiering and launched new offerings like CoreWeave and Weights & Biases Inference service. The new inference service supports a research-friendly API for OpenAI’s new open-source model, Kimi K2, Meta’s Llama 4, DeepSeek and QnA3. It is investing in SUNK (Slurm on Kubernetes) for large AI labs and enterprises and is now offering support for third-party storage systems (VAST, WEKA, IBM Spectrum Scale, DDN and Pure Storage) integrated into its technology stack with large-scale production deployments.

CoreWeave is aggressively building out its data center network, allowing it to serve a diverse client base with low latency and strong reliability. With over 900 MW of active power targeted by year-end, CRWV is positioning itself as a top-tier provider capable of meeting the needs of large-scale AI training and inference workloads. CRWV had nearly 470 megawatts (MW) of active power and contracted power of 2.2 gigawatts (GW) at the quarter-end. Key projects include a $6 billion data center investment in Lancaster, PA and another data center in Kenilworth, NJ, through a joint venture with Blue Owl.

CoreWeave is supplementing its growth through inorganic expansion. CRWV acquired Weights and Biases earlier in the year, which added 1,400 AI labs and enterprises as clients for CoreWeave.

It announced the Core Scientific buyout in July 2025 and the OpenPipe buyout recently. The $9 billion Core Scientific buyout is a strategic move to accelerate growth, enhance operational efficiency and achieve long-term market leadership. By taking ownership of Core Scientific's 1.3 GW power infrastructure footprint, with an additional 1 GW expansion potential, it gains ample room to grow its AI infrastructure. With demand for AI compute soaring, this extra capacity provides a strong long-term advantage.

CRWV’s aggressive expansion strategy is powered partly by hefty leverage. On the last earnings call, CRWV noted that it raised a staggering $25 billion in debt and equity since 2024. Interest expense surged to $267 million compared with $67 million a year ago. For the third quarter, it expects interest expenses to be between $350 million and $390 million, owing to high leverage. Higher interest expenses can exert pressure on the adjusted net income and potentially affect free cash flow generation and undermine near-term profitability. In the second quarter of 2025, CRWV posted a net loss of $291 million and an adjusted net loss of $131 million, primarily due to heavy interest expenses.

Overall, CRWV capex is massive, with the second quarter capex coming in at $2.9 billion, an increase of $1 billion from the last quarter. In comparison, revenues for the second quarter were $1.2 billion. The full-year capex guidance was reaffirmed at $20-$23 billion. CRWV expects capex for the third quarter to be $2.9 billion and $3.4 billion. Higher capex can be a concern if revenues do not keep up the required pace to sustain such high capital intensity, especially in a macro environment where AI demand cycles could fluctuate due to competitive pricing and regulatory changes.

Moreover, CoreWeave faces tough competition in the AI cloud infrastructure space, which boasts behemoths like Amazon and Microsoft MSFT and other players like Nebius NBIS.

Nebius is another upcoming AI infrastructure provider with hyper revenue growth of 625% in the last reported quarter. The recent deal with MSFT boosts Nebius’ position in the AI infra space and will bolster its revenue growth going ahead. NBIS will offer dedicated GPU capacity to Microsoft from its new data center in Vineland, NJ, beginning later this year. The GPU services will roll out in several tranches during 2025 and 2026, with the agreement valued at approximately $17.4 billion through 2031. Microsoft could also purchase extra services or capacity as per the terms of the deal, which would raise the total value to around $19.4 billion.

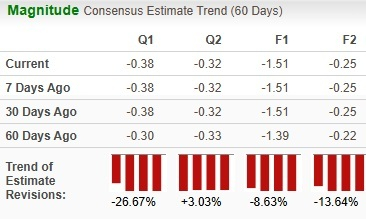

Analysts have significantly revised earnings estimates dwonward for the current quarter.

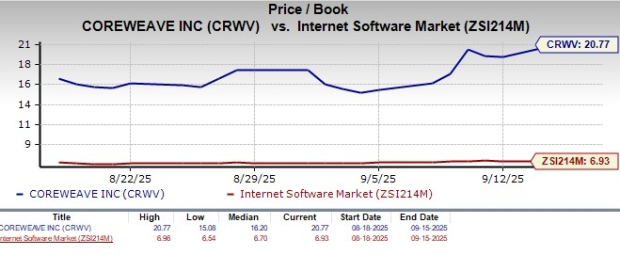

Valuation-wise, CoreWeave seems overvalued, as suggested by the Value Score of F.

In terms of Price/Book, CRWV shares are trading at 20.77X, way higher than the Internet Software Services industry’s ratio of 6.93X.

CRWV’s explosive growth and robust backlog are compelling, but near-term risks are substantial. CoreWeave’s ballooning capex poses risk, especially if revenues fall short. Elevated interest expenses add further pressure on margins. Tremendous competition and stretched valuation are other concerns.

At present, CRWV carries a Zacks Rank #3 (Hold).

For investors already holding shares, the story remains compelling, but for new entrants, it may be wise to wait for a better entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min |

AI Stealth Play Receives Bullish Initiation; Data Center Revenue Expected To Grow 64%

NBIS

Investor's Business Daily

|

| 51 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite