|

|

|

|

|||||

|

|

Novo Nordisk NVO announced positive data from a sub-analysis of its phase III REDEFINE 1 study assessing the efficacy and safety of once-weekly cagrilintide 2.4 mg as a monotherapy, alongside lifestyle intervention, in adults with obesity or overweight and a related comorbidity, but without diabetes. The findings were presented at a recent medical conference in Vienna. NVO shares gained 2.8% on Tuesday following the news.

Cagrilintide, a next-generation injectable long-acting amylin analogue, mimics the natural hormone amylin and represents a differentiated mechanism from GLP-1-based weight-loss therapies currently on the market.

Following the sub-analysis of Novo Nordisk’s REDEFINE 1 study after 68 weeks, assuming all people adhered to treatment, it was observed that cagrilintide monotherapy led to clinically meaningful weight loss, with an average body weight reduction of 11.8% (12.5 kg) compared to 2.3% (2.5 kg) with placebo. Additionally, nearly one in three patients (31.6%) treated with cagrilintide achieved at least 15% weight loss compared to roughly one in twenty (4.7%) in the placebo group.

The sub-analysis data, regardless of treatment adherence, showed that obese or overweight patients treated with cagrilintide monotherapy achieved an average weight loss of 11.5% compared with 3% with placebo after 68 weeks. In the REDEFINE 1 study, cagrilintide was overall well-tolerated and demonstrated an acceptable safety profile. Adverse events related to treatment were mostly gastrointestinal, which were mild to moderate in severity.

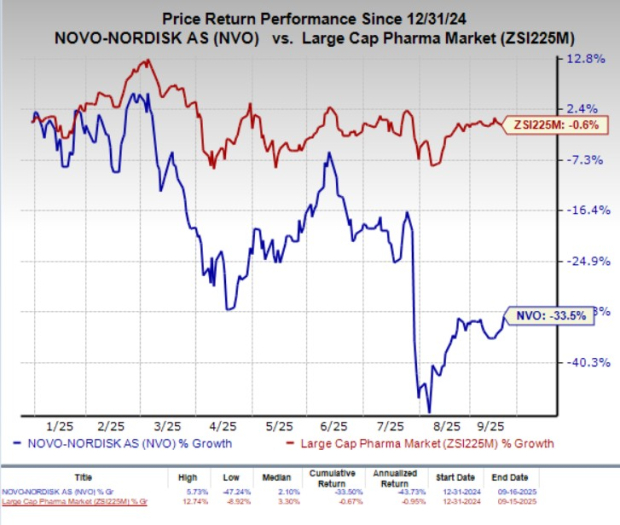

Year to date, Novo Nordisk shares have lost 33.5% compared with the industry’s 0.6% decline.

Importantly, this marks the first phase III study to generate data on an investigational long-acting amylin analogue monotherapy in obesity management, highlighting NVO’s continued push to diversify its metabolic treatment pipeline.

Based on the encouraging data, Novo Nordisk is gearing up to initiate a dedicated phase III RENEW program in the fourth quarter of 2025 to evaluate the efficacy and safety of cagrilintide in people with obesity or overweight.

The REDEFINE 1 study was designed to evaluate the efficacy and safety of once-weekly subcutaneous obesity treatment candidate, CagriSema, in obesity or overweight patients with one or more obesity-related comorbidities, and without type II diabetes (T2D) over 68 weeks. Novo Nordisk’s CagriSema is a fixed-dose combination of cagrilintide 2.4 mg and its blockbuster obesity injection, Wegovy (semaglutide 2.4 mg). NVO suffered a massive setback in December 2024 after the 22.7% weight loss observed with the candidate in the phase III REDEFINE 1 study failed to meet the company’s guidance for 25% weight loss at week 68.

Novo Nordisk has experienced strong momentum in the past, driven by the commercial success of its blockbuster semaglutide products, Wegovy (obesity) and Ozempic (T2D). However, the company’s growth trajectory has suffered recently.

In July 2025, the company revised its sales and profit outlook for the year, reflecting slower-than-expected uptake for Wegovy and Ozempic, due to intensifying competition from arch-rival Eli Lilly LLY and compounded semaglutide alternatives in its largest obesity market, the United States. Eli Lilly’s tirzepatide-based drugs, Mounjaro (T2D) and Zepbound (obesity), have captured rapid demand and market share, pressuring NVO’s position in both obesity and diabetes markets. Despite being on the market for less than three years, Mounjaro and Zepbound have become LLY’s key top-line drivers. In the first half of 2025, the drugs generated combined sales of $14.7 billion, accounting for 52% of Eli Lilly’s total revenues.

To tackle the same, Novo Nordisk is developing several next-generation obesity candidates in its pipeline, especially targeting the lucrative U.S. market, to entrench its leadership position. Apart from cagrilintide and CagriSema, NVO is also developing an early-stage candidate, Amycretin, a unimolecular GLP-1 and amylin receptor agonist, which had outperformed Wegovy in a phase I study.

Novo Nordisk has also been pursuing licensing deals and acquisitions to further expand its obesity pipeline. In 2023, it acquired Inversago Pharmaceuticals, which added a small-molecule oral CB1 inverse agonist, monlunabant, to its pipeline. Novo Nordisk signed a $2.2 billion deal with Septerna for developing and commercializing oral small-molecule medicines for treating obesity, T2D and other cardiometabolic diseases.

Novo Nordisk A/S price-consensus-chart | Novo Nordisk A/S Quote

The obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs, which means fierce competition is inevitable. Eli Lilly and Novo Nordisk presently dominate the market.

Several other companies, like Amgen AMGN and Viking Therapeutics VKTX, are also making rapid progress to develop more potent and convenient GLP-1-based candidates in their clinical pipeline.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity. The company recently announced mixed top-line results from a mid-stage study evaluating the safety and efficacy of the oral formulation of VK2735. Though patients on the highest drug dose lost up to 12.2% of their body weight after 13 weeks of daily dosing compared with 1.3% in the placebo group, a significant number of patients also dropped out of the study. Phase III obesity studies with the subcutaneous formulation of VK2735 have also been initiated.

Amgen is developing MariTide, a GIPR/GLP-1 receptor, as a single dose in a convenient autoinjector device with a monthly and maybe less frequent dosing. In March 2025, Amgen initiated two phase III studies on MariTide in obesity as part of its comprehensive MARITIME phase III program. Since June, Amgen has initiated two more phase III studies in other obesity related conditions.

Novo Nordisk currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 21 min | |

| 43 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Stocks to Watch Monday: Merck, Netflix, Novo Nordisk, Eli Lilly

NVO -16.74% LLY

The Wall Street Journal

|

| 1 hour | |

| 2 hours |

Novo Nordisk Dives As Next-Gen Obesity Drug Lags Eli Lilly's Kingpin

NVO -16.74% VKTX +10.30% LLY

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite