|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Abbott ABT has consistently demonstrated strong growth and gained market share within its Nutrition business. Its Diabetes Care business continues to benefit from the growing sales of its flagship, sensor-based continuous glucose monitoring (CGM) system, FreeStyle Libre. Within Established Pharmaceuticals (“EPD”), the company’s strategic focus on biosimilars further bolsters its long-term prospects. Meanwhile, macroeconomic challenges and adverse currency fluctuations may hurt Abbott’s financial performance.

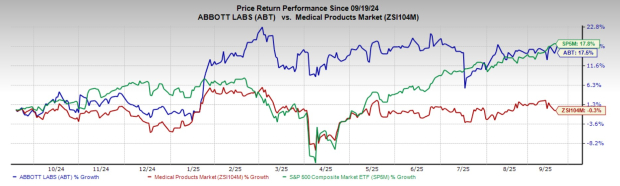

In the past year, this Zacks Rank #3 (Hold) stock has rallied 17.5% against the industry’s 0.3% fall and the 17.8% growth of the S&P 500 composite.

The healthcare giant has a market capitalization of $231.06 billion. The company’s earnings yield of 3.9% is well above the industry’s 0.2%. Abbott surpassed estimates in three of the trailing four quarters and broke even in one, delivering an average earnings surprise of 0.88%.

Sales Recovery Within Nutrition: Despite some ongoing softness in a few international markets for pediatric products, Abbott’s overall Nutrition business is expanding on strong global demand for the company’s adult nutrition offerings that provide a combination of high protein and low sugar to help people optimize their health and wellness.

In the second quarter of 2025, the company reported 3.4% organic growth within this business, led by 6.6% organic growth in Adult Nutrition. The segment continues to benefit from strong demand for Ensure and Glucerna, Abbott’s market-leading brands that support complete and balanced nutrition and help manage dietary requirements for people with diabetes. Within Pediatric Nutrition, Abbott enjoyed continued strength in the United States, where the Similac brand remains the top choice for American parents.

Libre Drives Diabetes Care: In a relatively short span, Abbott’s FreeStyle Libre has achieved global leadership among CGM systems for both Type 1 and Type 2 users. Earlier in 2024, Abbott obtained FDA approvals for two new over-the-counter CGM systems called Lingo and Libre Rio, which are based on Libre’s technology, now used by more than six million people worldwide. This over-the-counter availability of CGM marks the initiation of a new era in the United States for Abbott.

In the second quarter of 2025, sales of CGM exceeded $1.9 billion, growing 19.6% organically. Momentum was particularly strong in the United States, where Libre sales rose nearly 26%. Abbott is witnessing continued expansion across all key segments, intensive insulin users, basal insulin users and non-insulin users, supported by increasing commercial coverage, international reimbursement for basal users and strong product innovation.

EPD Set for Sustainable Growth: Abbott’s EPD operates solely in emerging geographies, with leading positions in many of the largest and fastest-growing pharmaceutical markets for branded generics in the world. Banking on the successful execution of its Branded Generic operating model, EPD is well-positioned for sustained growth in many of these expanding pharmaceutical markets. Focusing on the therapies most needed in faster-growing markets, Abbott continues to sustain its long track record of delivering strong growth, which includes a five-year CAGR for EPD of 8%.

Abbott’s EPD sales in the second quarter of 2025 increased 6.9% on a reported basis and 7.7% organically. More than half of its top 15 markets, now surpassing $1 billion in quarterly sales for the first time, posted double-digit gains. Abbott’s strategic focus on biosimilars further strengthens its prospects, with 10 regulatory approval submissions completed across emerging markets and launches projected to begin in 2026.

Choppy Macro Environment Weighs on Margins: The challenging macroeconomic scenario, including geopolitical tension, is contributing to higher-than-anticipated increases in expenses, such as raw materials and freight. These factors could also result in broader economic impacts and security concerns, affecting Abbott’s business in the upcoming months. Industry-wide, the deteriorating global economic environment continues to reduce demand for several MedTech products, leading to lower sales and product pricing, while increasing the cost of goods and operating expenses.

Foreign Exchange Translation Impacts Sales: Foreign exchange is a major headwind for Abbott due to a considerable percentage of its revenues coming from outside the United States. The strengthening of the euro and some other developed market currencies has constantly been hampering the company’s performance in the international markets. In the first half of 2025, foreign exchange had an unfavorable year-over-year impact of 1.1% on sales.

In the past 30 days, the Zacks Consensus Estimate for ABT’s 2025 earnings has remained constant at $5.15 per share.

The Zacks Consensus Estimate for the company’s 2025 revenues is pegged at $44.68 billion, suggesting a 6.5% rise from the year-ago reported number.

Some better-ranked stocks in the broader medical space are Masimo MASI, Phibro Animal Health PAHC and Cardinal Health CAH.

Masimo has an estimated long-term earnings growth rate of 12.5% compared with the industry’s 9.9%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 9.17%. MASI shares have rallied 26.4% against the industry’s 16.6% fall in the past year.

MASI sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Phibro Animal Health, carrying a Zacks Rank #2 (Buy), has an earnings yield of 6.3% against the industry’s -0.3%. Shares of the company have surged 76.8% compared with the industry’s 0.7% growth. PAHC’s earnings outpaced estimates in each of the trailing four quarters, with the average surprise being 27.9%.

Cardinal Health, carrying a Zacks Rank #2, has an estimated long-term earnings growth rate of 12.5% compared with the industry’s 9.7% growth. Shares of the company have rallied 35% against the industry’s 1.6% fall. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 9.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite