|

|

|

|

|||||

|

|

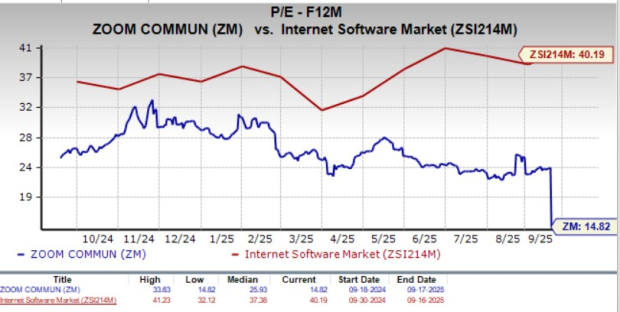

Zoom Communications ZM shares are trading at a significant discount, with a forward 12-month Price/Earnings of 14.82X compared with the Zacks Internet - Software industry’s 40.19X. Zoom has undergone a substantial transformation from its pandemic-era video conferencing origins into a broader workplace collaboration platform. This strategic evolution encompasses unified communications, contact center solutions and artificial intelligence-powered productivity tools that compete with established players such as Microsoft’s Teams MSFT,Cisco Systems' Webex CSCO and Alphabet’s Google Meet GOOGL. Even with the diversification into hybrid work solutions, Zoom continues to trade at a discount to peers. Microsoft, Cisco Systems and Alphabet are currently trading at 32.06X, 16.59X and 23.94X, respectively.

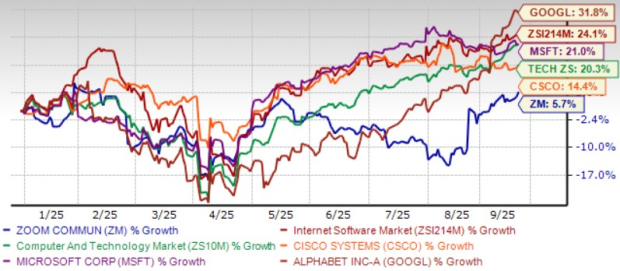

Zoom shares have returned 5.7% Year to Date (YTD), while the Zacks Internet - Software industry and the Zacks Computer and Technology sector have returned 24.1% and 20.3%, respectively. Microsoft, Cisco and Alphabet have appreciated 21%, 14.4% and 31.8% in the year-to-date period, respectively.

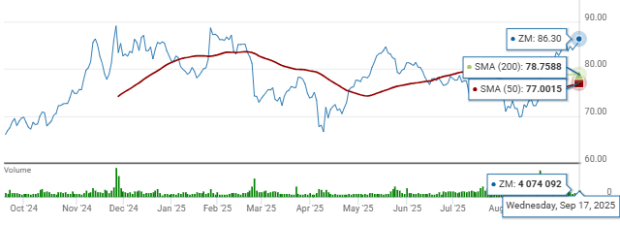

This performance divergence suggests the market has not fully recognized Zoom's operational improvements and strategic positioning enhancements. Despite the modest stock performance, technical indicators suggest potential momentum shifts. Zoom shares are currently trading above both their 50-day and 200-day simple moving averages, indicating underlying technical strength and potential bullish momentum.

The key question is whether Zoom’s fundamentals and growth drivers support a potential re-rating at these discounted levels. Let’s delve deep to find out.

Zoom's revenue momentum in the second quarter of fiscal 2026 illustrates a fundamental shift in business trajectory, with total revenues reaching $1.22 billion, representing 4.7% year-over-year growth, suggesting improved business fundamentals. Enterprise revenues rose 7% and accounted for 60% of total revenues, driven by strength in Zoom Phone and Contact Center solutions. Customers contributing more than $100,000 in trailing 12-month revenues grew 8.7% to 4,274, suggesting steady upmarket traction. Geographically, revenues from the Americas increased 5% year over year, while EMEA advanced 6% and APAC improved 4%. The balanced performance across regions highlights diversified demand and reduces reliance on any single geography, strengthening visibility for sustained revenue momentum.

The Zacks Consensus Estimate for third-quarter fiscal 20265 revenues is pegged at $1.21 billion, indicating 2.99% growth year over year. The consensus mark for earnings is pegged at $1.42 per share, up four cents in the past 30 days and suggesting a 2.9% year-over-year improvement, while the Current Remaining Performance Obligations are pegged at $2.44 billion for the third quarter, up 6.5% year over year, reinforcing visibility into sustained enterprise demand.

Zoom Communications, Inc. price-consensus-chart | Zoom Communications, Inc. Quote

The strategic implementation of artificial intelligence capabilities across Zoom's platform creates substantial competitive advantages and revenue expansion opportunities. AI Companion monthly active users have increased over 4X year over year in the second quarter, with millions utilizing these capabilities throughout the meeting lifecycle and beyond traditional summaries. The launch of Custom AI Companion and Virtual Agent 2.0 demonstrates monetization potential, as evidenced by a Fortune 200 technology company deploying the paid AI add-on for nearly 60,000 employees. This AI-first approach differentiates Zoom from Microsoft Teams, which relies heavily on Office 365 integration, Cisco Webex, which maintains a more traditional feature set despite recent improvements and Alphabet's Google Meet, which leverages Google Workspace connectivity.

Zoom's expansion into contact center and unified communications markets provides significant growth vectors beyond core video conferencing. Zoom Contact Center customers with over $100,000 annual recurring revenue grew 94% year over year to 229, highlighting the successful penetration of enterprise accounts. The solution's artificial intelligence capabilities, including Expert Assist and quality management features, contributed to all top ten contact center deals being competitive displacements. Zoom Phone continues generating mid-teens annual recurring revenue growth while gaining market share against established providers, demonstrating the effectiveness of the "better together" strategy that integrates voice, collaboration and customer engagement solutions.

Employee experience solutions through Workvivo continue showing strong momentum, with customers generating over $100,000 in annual recurring revenues, reaching 168 customers, up 142% year over year. Notable enterprise wins include Marubeni Corporation, a large Japanese conglomerate that transitioned from Meta Workplace with more than 10,000 licenses to elevate employee communications and engagement. This diversification into employee experience platforms complements Zoom Phone's unified communications capabilities, creating comprehensive workplace solutions that compete effectively against Microsoft Teams, Cisco Webex, and Alphabet's Google Meet in the broader collaboration market.

Zoom Communications represents a compelling investment opportunity at current valuation levels. The combination of attractive valuation metrics, accelerating business fundamentals, successful product diversification and technical momentum indicators suggests investors should consider purchasing shares. While competition from peers remains intense, Zoom's specialized focus, superior profitability and innovation capabilities position the company for sustained outperformance as the market eventually recognizes the disconnect between current pricing and underlying business value.

Zoom Communications currently sports a Zacks Rank #1 (Strong Buy), which implies that investors should start accumulating the stock right now. You can see the complete list of today's Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite