|

|

|

|

|||||

|

|

Shopify SHOP and Wayfair W are well-known e-commerce platform providers. While Shopify offers tools, including payments to merchants of all verticals and sizes to develop their businesses, Wayfair’s e-commerce platform provides a marketplace for home goods and furniture. Shopify generates revenues through subscriptions to its platform, payment processing fees and currency conversion fees from Shopify Payments. Wayfair generates net revenues from product sales through its five distinct sites and through sites operated by third parties.

Per Statista, revenues in the e-commerce market are expected to reach $3.66 trillion in 2025 and are expected to see a CAGR of 6.29% between 2025 and 2030 to hit $4.96 trillion at the end of the time frame. The number of e-commerce users is expected to hit 4 billion by 2030. These figures indicate a massive growth opportunity for both Shopify and Wayfair. However, which of these two e-commerce stocks is well-positioned to benefit from this opportunity?

Shopify’s second-quarter 2025 Gross Merchandise Volume (GMV) increased 30.6% year over year to $87.84 billion. Offline GMV rose 29% year over year while B2B GMV jumped 101%. International GMV grew 42% year over year, with Europe’s GMV rallying 42% year over year (49% on a constant-currency basis). Shopify Payments’ GMV penetration hit 64%. The expansion of payment products into more countries,16 launched till the end of the second quarter, drove GMV. Shop Pay GMV increased 65% year over year, and it processed $27 billion in GMV. Shop App native GMV jumped 140% year over year.

Shopify’s growing popularity is driving clientele that includes Starbucks, Canada Goose, Burton Snowboards, Michael Kors, Miele, Beachbody and Signet Jewelers. The Shop App saw 140% year-over-year growth in native GMV, driven by Shop Week, where sales more than doubled compared to last year’s event. Sign-ins through Shop increased by 46% due to improved availability and a much smoother user experience.

Shopify is leveraging AI to transform how consumers discover and shop for products. The company’s investment in AI-driven tools, such as AI store builder, Catalog, Universal Cart and Sidekick, is helping merchants improve customer engagement and streamline operations. Infusion of AI into Shop search and the home feed is helping buyers see the right products at the right time, driving higher engagement and conversion.

For the third quarter of 2025, Shopify expects revenues to grow in the mid-to-high twenties percentage rate on a year-over-year basis. The Zacks Consensus Estimate for revenues is pegged at $2.74 billion, indicating 26.7% growth from the figure reported in the year-ago quarter.

Wayfair’s inventory-light model, powered by a global network of more than 20,000 suppliers offering over 30 million products, has been a key catalyst. The company is seeing year-over-year growth in average order value (AOV) driven by a favorable mix and modest growth in average items per order. Wayfair’s tech replatforming efforts over the last few years are creating new growth opportunities. Ongoing improvements in the shopping experience, generative AI-powered enhancements for customers and suppliers and an expansion of the company’s supply chain capabilities are driving Wayfair’s prospects.

Logistics offering (CastleGate) is creating a competitive moat for Wayfair as it continues to boost the company’s popularity among suppliers. W saw a 40% year-over-year increase in total volume using CastleGate forwarding offerings. Expanding into new markets like Brazil and India is helping in unlocking additional volume and enabling suppliers to more easily diversify their production footprint. CastleGate penetration was roughly 25% at the end of the second quarter of 2025, up roughly 400 basis points on a year-over-year basis.

Expanding physical retail footprint is a key catalyst for W. The company witnessed an impressive in-store response at the Chicago DMA store. The company announced plans to launch additional Wayfair stores in Atlanta in 2026 and New York in 2027, as well as a Wayfair store outside of Denver in late 2026. Wayfair also opened its first Perigold store in May in Highland Village in Houston, and a second store is set to open in West Palm Beach this fall.

Wayfair anticipates revenue growth in the low to mid-single digit range year-over-year for the third quarter of 2025. The Zacks Consensus Estimate for revenues is pegged at $2.99 billion, indicating 3.54% growth from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Shopify’s 2025 earnings is pegged at $1.44 per share, unchanged over the past 30 days, indicating a 10.8% increase over 2024’s reported figure.

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

The consensus mark for Wayfair’s 2025 earnings has increased 7.4% to $1.74 per share over the past 30 days. The company reported earnings of 13 cents per share in 2024.

Wayfair Inc. price-consensus-chart | Wayfair Inc. Quote

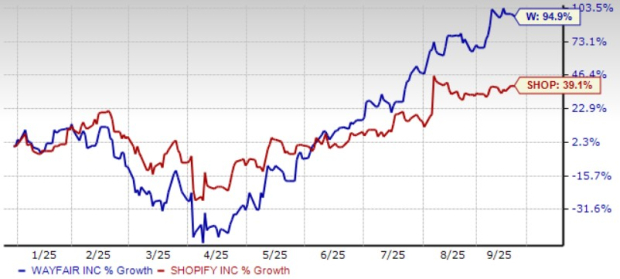

Wayfair shares have outperformed Shopify year to date. While W shares have appreciated 94.9%, Shopify has returned 39.1%.

Both Wayfair and Shopify are overvalued, as suggested by the Value Score of C and F, respectively.

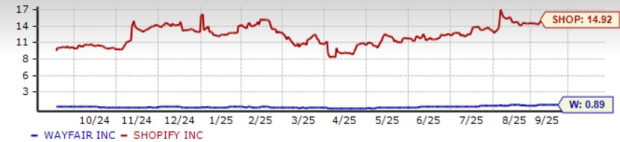

In terms of forward 12-month Price/Sales, Shopify shares are trading at 14.92X, higher than Wayfair’s 0.89X.

Both Wayfair and Shopify benefit from strong demand for e-commerce. Although Shopify benefits from an expanding merchant base, Wayfair is riding on growing AOV, popularity among suppliers and expanding retail footprint.

Wayfair currently carries a Zacks Rank #2 (Buy), which makes the W stock a better buy over Shopify, which currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 55 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 5 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite