|

|

|

|

|||||

|

|

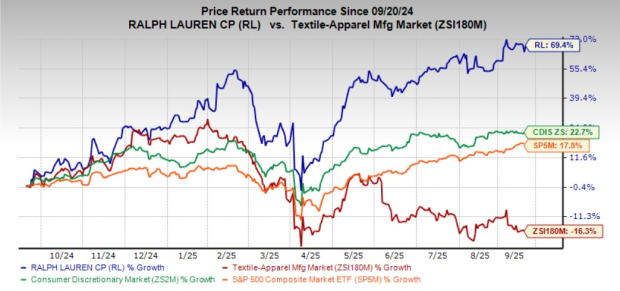

Ralph Lauren Corporation RL has delivered an impressive 69.4% surge in its stock price in the past year. This strong rally raises a crucial question: Should investors take profits now, or is there still room for further upside?

Ralph Lauren continues to enhance its market position by focusing on brand elevation, digital expansion and disciplined global growth. The company’s ability to adapt to evolving consumer demand has been a key driver, strengthening its competitive edge in the global luxury lifestyle market. In the past year, RL stock has outperformed the industry, which fell 16.3%. Meanwhile, the broader Consumer Discretionary sector and the S&P 500 posted gains of 22.7% and 17.8%, respectively, during the same timeframe.

Ralph Lauren’s momentum reflects the company’s disciplined execution of its long-term strategic roadmap, the “Next Great Chapter: Accelerate Plan.” The plan focuses on brand elevation, consumer centricity and operational agility while driving growth through a more balanced global presence. Ralph Lauren continues to expand in high-potential markets like Asia and strengthen its core regions, ensuring diversified revenue streams. By consistently introducing new products and reinforcing its luxury lifestyle positioning, the company has sustained strong brand equity and increased its competitive edge.

Digital transformation remains a central pillar of Ralph Lauren’s growth strategy, with investments in mobile, omnichannel capabilities and fulfillment driving double-digit gains in digital sales across all regions. In the first quarter of fiscal 2026, digital sales jumped 19% in North America, 11% in Europe and an impressive 35% in Asia, further underscoring the brand’s global digital momentum.

Digital sales now account for a growing share of total revenues, supported by initiatives in personalization, loyalty programs and data-driven engagement. These efforts not only expand Ralph Lauren’s reach among younger and more diverse consumers but also reinforce its premium positioning through curated storytelling and seamless shopping experiences.

The company is also making notable progress in integrating digital strength with its retail and wholesale channels. In retail, Ralph Lauren is enhancing flagship stores to deliver immersive brand experiences aligned with its luxury identity, while comparable store sales climbed 13% in the latest quarter. At the same time, wholesale operations are being optimized to focus on premium distribution and productivity, with streamlined lower-margin accounts preserving pricing power and brand image. Key partnerships with leading retailers and strategic expansion in Europe and Asia further broaden Ralph Lauren’s international footprint, ensuring a balanced mix of retail and wholesale revenues.

Strong first-quarter fiscal 2026 performance underscores the effectiveness of Ralph Lauren’s strategies. In North America, both brick-and-mortar stores and wholesale operations recorded healthy gains, while Europe delivered robust growth across channels, highlighted by notable improvements in wholesale revenues. Asia remained a standout region, achieving impressive momentum in physical retail driven by strong consumer demand. Supported by disciplined inventory management, supply chain efficiencies and a continued focus on brand elevation, Ralph Lauren has built a foundation for sustainable growth.

Ralph Lauren issued an upbeat outlook for fiscal 2026, underscoring its confidence in navigating a complex macroeconomic and geopolitical environment. The company expects constant-currency revenue growth in the low-to-mid single digits, supported by sustained momentum in Asia and Europe, with performance skewed toward the first half of the year. A weaker U.S. dollar is anticipated to provide a meaningful tailwind, boosting reported revenues and enhancing margins.

Operating margin is projected to expand in constant currency, reflecting the benefits of expense leverage, strategic pricing initiatives and disciplined discount management. Gross margin improvements are also expected, aided by a favorable product mix and regional strength, even as tariff and inflationary pressures persist.

In the second quarter of fiscal 2026, Ralph Lauren anticipates revenue growth in the high single digits on a constant-currency basis, with foreign exchange movements providing additional support. Operating margin is expected to expand meaningfully, driven by operating efficiency gains and more normalized marketing investments compared to the prior year.

Currency tailwinds are also set to deliver incremental benefits to both gross and operating margins. Overall, the guidance reflects the company’s ability to balance near-term headwinds with its long-term strategy of disciplined growth, profitability and brand elevation.

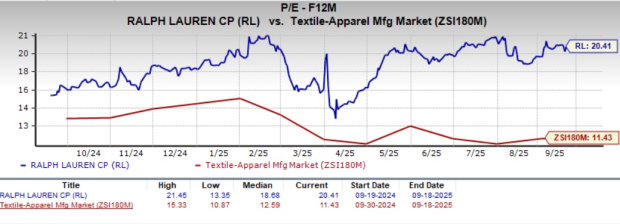

RL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 20.41X, higher than the industry’s average of 11.43X. Such a premium valuation often signals high investor expectations for growth. This premium suggests strong investor confidence and high expectations for future growth. While such a valuation may raise caution for value-focused investors, the key consideration is whether the company’s solid fundamentals and strategic execution support this higher price.

Ralph Lauren remains a compelling investment, driven by its differentiated product offerings, strong brand positioning and expansion strategy. The company’s emphasis on brand elevation and strategic investments has driven increased consumer demand across various channels. While the stock trades at a premium, its solid execution and robust financial outlook justify investor confidence. With a positive earnings trajectory, this Zacks Rank #1 (Strong Buy) stock presents an attractive opportunity for investors.

Boyd Gaming BYD, a leading gaming company, currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

BYD delivered a trailing four-quarter earnings surprise of 9.1%, on average. The Zacks Consensus Estimate for BYD’s current financial-year EPS indicates growth of 5.2% from the year-ago number.

Guess?, Inc. GES is a designer and marketer of casual apparel and accessories. It currently carries a Zacks Rank #2 (Buy).

GES delivered a trailing four-quarter earnings surprise of 26.7%, on average. The Zacks Consensus Estimate for GES’ current financial-year sales indicates growth of 7% from the year-ago number.

Hanesbrands Inc. HBI, a designer and manufacturer of apparel essentials for men, women and children in the United States and internationally, currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for HBI’s current financial-year EPS is expected to rise 65% from the corresponding year-ago reported figure. HBI delivered a trailing four-quarter earnings surprise of 56.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite