|

|

|

|

|||||

|

|

Wells Fargo & Company WFC touched a new 52-week high of $85.28 during yesterday’s trading session before closing slightly lower at $85.16.

In the past year, WFC shares have surged 70.1%, outperforming the industry’s growth of 54.2%. It has also outpaced its close peers, Bank of America BAC and Citigroup’s C rallies of 40% and 83.7%, respectively, over the same time frame.

Price Performance

The recent rally has been fueled by optimism around the Federal Reserve’s rate cuts. On Sept. 17, the Fed trimmed rates by 25 basis points to 4.00-4.25%, ending a nine-month pause. Officials cited a softening labor market rather than inflation concerns and anticipate two additional cuts by December 2025, which may bring rates down to 3.50-3.75%.

For Wells Fargo, this shift in monetary policy is significant. Its net interest income (NII) and the net interest margin (NIM) have been under pressure, given the relatively high-interest-rate environment. In the first half of 2025, NII fell 4% and NIM contracted to 2.67% from 2.78% in the same period a year ago. On the contrary, Bank of America and Citigroup's NII rose in the first half of 2025.

Looking ahead, lower rates are expected to stabilize funding costs and boost lending activity, which may support WFC’s NII and NIM expansion. Management projects 2025 NII to match the $47.7 billion registered in 2024.

With the stock hitting a new high and the economic backdrop turning favorable, investors are now faced with a key question: Is there more upside potential, or is it time to take profits? Let us explore the factors shaping Wells Fargo’s outlook.

Wells Fargo reached a key inflection point in June 2025, when the Federal Reserve removed the $1.95-trillion asset cap imposed in 2018 following the bank’s fake-account scandal. The decision underscores the Fed’s confidence in Wells Fargo’s remediation efforts and marks the end of years of regulatory constraints.

At the Barclays 23rd Annual Global Financial Services Conference (Sept. 10, 2025), management highlighted a strategic shift from regulatory repair to profitable expansion. The bank has already sharpened its focus by exiting 13 non-core businesses and achieving $12 billion in cost savings, which are now being reinvested to strengthen core operations.

With the balance sheet restriction lifted, Wells Fargo can accelerate balance sheet growth by expanding deposits, loans and securities holdings, driving higher NII. It can scale fee-based businesses, such as payment services, asset management and mortgage origination, enhancing non-interest income.

Management also signaled a “high bar” for acquisitions, indicating a preference for organic growth over large-scale M&A. This approach positions the bank to compete more aggressively across commercial banking, corporate and investment banking, and wealth management, while maintaining disciplined capital allocation.

The Fed’s decision removes a long-standing overhang on the stock, providing Wells Fargo with greater flexibility to deploy capital, expand earnings, and potentially unlock higher profitability.

Wells Fargo has been making progress on various initiatives to achieve cost efficiency. The company is actively engaged in cost-cutting measures, including streamlining organizational structure, branch closure, and headcount reductions. Its non-interest expenses witnessed a negative CAGR of 1.3% over the last four years (ended 2024), with the declining trend continuing in the first half of 2025.

WFC keeps investing in and optimizing its branch network. It is being more deliberate about branch location strategy, as the number of branches declined 2% year over year to 4,135 at the end of the second quarter of 2025. Its headcount was reduced by 4.5% year over year in the second quarter of 2025.

Due to its strategic efforts, management expects non-interest expenses to be $54.2 billion in 2025, lower than $54.6 billion in 2024. This sustained decline is expected to enhance profitability, enabling greater investment in strategic growth areas and stronger shareholder returns in the upcoming period.

As of June 30, 2025, Wells Fargo’s long-term debt was $176.2 billion, and short-term borrowings were $187.9 billion. The company has a strong liquidity position, with a liquidity coverage ratio of 121% as of the second quarter of 2025. Its liquid assets (including cash and due from banks, as well as interest-earning deposits with banks) totaled $194.5 billion as of the same date.

Hence, WFC rewards shareholders handsomely. The company cleared the 2025 Fed stress test and announced a 12.5% increase in its third-quarter 2025 common stock dividend to 45 cents per share. In the past five years, it has raised its dividend six times. It currently has a dividend yield of 2.3%.

Similarly, Bank of America raised its dividends five times in the last five years. It has a dividend yield of 2.2%. Also, Citigroup has raised its dividends three times in the last five years. It has a dividend yield of 3.6%.

Coming back to WFC, it also has a share repurchase program in place. In April 2025, the company’s board of directors authorized a common stock repurchase program of up to $40 billion. In July 2023, its board of directors authorized a share repurchase program worth $30 billion. As of June 30, 2025, the company had remaining board authority to repurchase up to $40.8 billion worth of common stock.

The company's future outlook is underpinned by stable deposit trends, healthy consumer activity, continued loan growth and the ability to pursue growth opportunities aggressively, thanks to the recent removal of a long-standing asset cap barrier that had previously restricted expansion. Also, supported by solid liquidity, the bank is well-positioned to enhance shareholder returns.

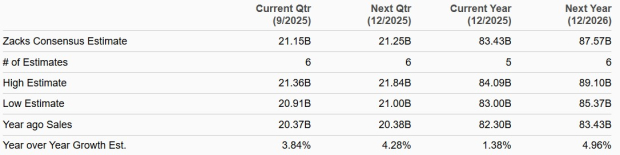

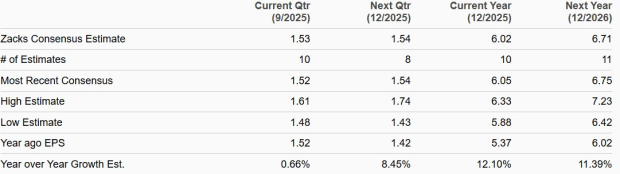

Management’s focus on organic growth, cost discipline, and targeted reinvestment provides a clear path to sustainable performance in the coming period. WFC’s earnings and sales are expected to witness year-over-year increases in 2025 and 2026.

Sales Estimates

Earnings Estimates

From a valuation standpoint, Wells Fargo appears somewhat inexpensive relative to the industry. The company is currently trading at a discount with a forward 12-month price-to-earnings (P/E) multiple of 13.1X, below the industry average of 15.3X. C and BAC are trading at forward P/E multiples of 11.3X and 12.6X, respectively.

Price-to-Earnings F12M

While the recent rally may invite short-term pullbacks, the stock’s attractive valuation and solid growth trajectory suggest that long-term investors may find holding the stock rewarding.

WFC carries a Zacks Rank #3 (Hold) now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 2 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite