|

|

|

|

|||||

|

|

Both Palantir Technologies Inc. PLTR and UiPath Inc. PATH stand out as leading innovators in AI-driven software.

Palantir has built its reputation on large-scale data analytics and decision intelligence platforms, delivering powerful solutions for government agencies, defense organizations and major enterprises that require seamless data integration and real-time situational awareness. UiPath, on the other hand, specializes in robotic process automation (RPA), applying artificial intelligence to eliminate repetitive tasks and boost operational efficiency across diverse industries.

Where Palantir focuses on enabling advanced, data-driven decision-making, UiPath excels in automating workflows, positioning both companies as indispensable contributors to the expanding AI ecosystem.

PLTR is experiencing significant growth due to the rapid adoption of its Artificial Intelligence Platform (AIP), which offers turnkey solutions that allow organizations, both government and commercial, to integrate advanced AI-driven data analytics and autonomous decision-making tools directly into their operational workflows. This removes technical complexity and accelerates deployment. As businesses increasingly rely on real-time data to drive decisions, Palantir’s sticky solutions have become highly sought after. The ability to provide scalable, secure and highly customized AI applications positions PLTR for sustained revenue growth and long-term customer retention.

In the second quarter of 2025, AIP significantly propelled U.S. commercial revenues, which soared 93% year over year. The momentum is also reflected in the total U.S. commercial contract value, which surged 222% year over year, while the remaining deal value climbed 145% to $2.79 billion. Customer count also grew 43% year over year, underscoring PLTR’s ability to scale rapidly while maintaining high customer satisfaction.

A key driver of this adoption is the popularity of Palantir’s AIP bootcamps, short, focused training programs that help customers rapidly onboard and deploy AIP within their organizations. These bootcamps enable clients to quickly implement production-grade AI workflows, dramatically reducing time-to-value and showcasing AIP’s simplicity and real-world applicability.

Palantir’s AIP empowers enterprises to deploy autonomous AI agents that not only speed up decision-making but also multiply productivity gains. Unlike peers focused on building AI models, Palantir is dominating the application layer, delivering practical, enterprise-ready AI systems that deliver measurable value from day one. As a result, the U.S. commercial segment is now the company’s most dynamic and scalable growth driver, with AIP at the heart of that acceleration.

UiPath remains a strong force in the booming RPA market. Its end-to-end automation platform positions the company to seize opportunities as demand for AI-driven solutions surges.

A critical driver of PATH’s success is its strategic partnerships with leading technology companies. Microsoft MSFT, Amazon AMZN and Salesforce CRM continue to play pivotal roles in expanding UiPath’s reach and capabilities. These partnerships not only bolster PATH’s credibility but also integrate its offerings into broader enterprise ecosystems powered by Microsoft Azure, Amazon’s AWS and Salesforce Cloud solutions.

The company boasts high customer retention, with net retention rates of 108%, underscoring its ability to expand usage within existing accounts. In the second quarter of fiscal 2026, UiPath reported a 14% year-over-year increase in revenues to $362 million. Additionally, its annual recurring revenues rose 11% to $1.72 billion, reflecting the strength of its subscription-based business model and customer loyalty.

With a strong global presence, a robust partner ecosystem, particularly with Microsoft, Amazon and Salesforce, and a continued focus on intelligent automation, UiPath is well-positioned to maintain its leadership in the evolving RPA and enterprise automation market.

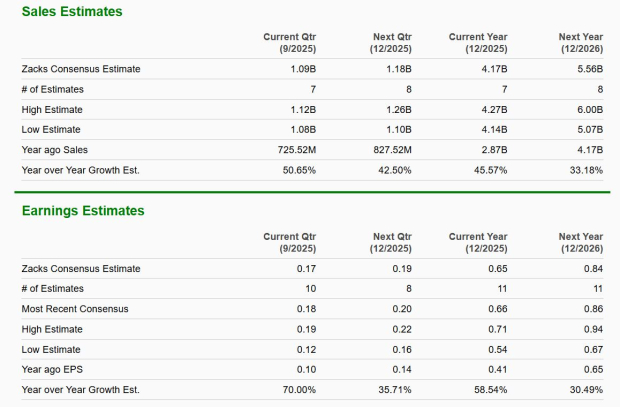

The Zacks Consensus Estimate for PLTR’s 2025 sales and EPS indicates year-over-year growth of 46% and 59%, respectively. EPS estimates have been trending upward over the past 60 days.

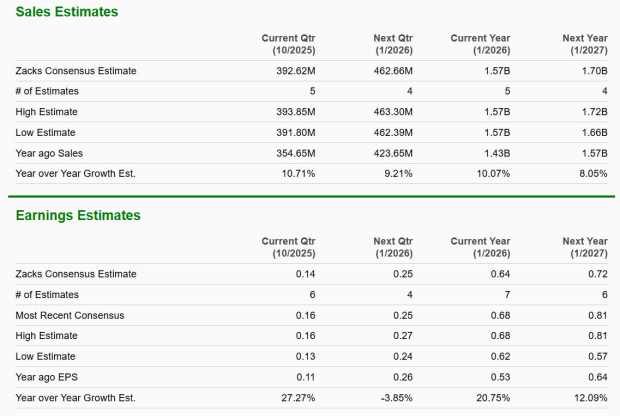

The Zacks Consensus Estimate for UiPath’s current year sales suggests 10% year-over-year growth, while EPS is expected to grow 21%. EPS estimates have been trending upward over the past 60 days.

UiPath is trading at a forward sales multiple of 4.22X, below its 12-month median of 4.35X. Palantir’s forward sales multiple stands at 82X, above its median of 55X.

While both Palantir and UiPath merit a “Buy” rating, UiPath stands out as the stronger bet for investors seeking a compelling blend of growth, scalability and valuation. Palantir’s AIP momentum is undeniable, but PATH offers a more attractive entry point with its forward sales multiple of just 4.22X, well below PLTR’s lofty 82X. Coupled with its robust Microsoft, Amazon and Salesforce alliances, rising annual recurring revenues and sticky subscription model, UiPath provides durable, cost-efficient automation solutions across industries. This positions PATH as the smarter, value-driven choice in the evolving AI-first enterprise software landscape.

While PATH carries a Zacks Rank #1 (Strong Buy), PLTR carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AMZN

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite