|

|

|

|

|||||

|

|

The Trade Desk's (TTD) strong foothold across CTV, retail media, digital audio, identity, measurement and data positions it to capture greater business opportunities from both new and existing customers. A key contributor to TTD’s growth has been the rapid momentum of its Joint Business Plans (JBPs) with global advertisers, agencies and media partners. Management highlighted during the last earnings call that JBP momentum has hit a record high, a development poised to unlock durable growth in the years ahead.

A JBP is a strategic agreement between partners, such as a brand and a retailer, that defines shared goals, aligned strategies and clear responsibilities. Built on data-driven insights, JBPs aim to strengthen partnerships, improve performance and deliver mutual growth. TTD is currently signing more multi-year JBPs than ever with leading agencies and brands. The number of active JBPs has reached a record high, with spending under these agreements significantly surpassing the rest of the business.

Equally encouraging is the strength of its pipeline, with nearly 100 JBPs in progress, many in late-stage development. While many agreements are signed directly with brands, it collaborates closely with their agencies to execute these partnerships, emphasizing that it is a collaborative model, not an either/or approach. It sees a clear path ahead and is well-positioned to lead ad tech growth in 2026.

The Trade Desk is driving strong progress across its platform and ecosystem. Kokai, powered by Koa AI, is delivering major performance gains as clients are seeing more than 20-point KPI improvements, with spend on Kokai growing 20% faster than non-adopters. OpenPath is streamlining the supply chain, giving publishers transparency and clients confidence, leading to significant revenue and efficiency gains. TTD also champions objectivity in ad tech, offering unbiased access to premium open Internet inventory, helping advertisers reach audiences precisely and cost-efficiently, with live sports as a key use case.

However, the advertising technology landscape is crowded, with competition from walled gardens like Google and Amazon, as well as independent ad-tech companies, such as Magnite (MGNI) and PubMatic (PUBM).

Magnite operates as a leading supply-side platform (SSP), helping publishers manage and monetize ad inventory across channels, including streaming, online video, display and audio.

Processing billions of impressions each month, Magnite’s growth is fueled by its SpringServe ad server and streaming SSP platform. The company has expanded significantly through mergers and strategic alliances, with its partnership with Netflix serving as a major growth driver. For the third quarter of 2025, the company expects total Contribution ex-TAC to be between $161 million and $165 million. For 2025, Contribution ex-TAC is projected to increase more than 10%. In September, it acquired Streamr.ai, a platform that brings AI-powered CTV advertising to small and medium-sized businesses. Magnite plans to offer Streamr.ai’s technology to its ecosystem partners, including agencies, publishers and DSPs.

PubMatic is also an SSP. PubMatic’s growth is fueled by CTV and emerging revenue streams, including Activate, sell-side data targeting and commerce media, as clients increasingly rely on the platform for improved performance, transparency and control over their digital advertising strategies. It strengthened relationships with the world’s largest streamers, with CTV now accounting for nearly 20% of total revenues. The recent addition of a top-five U.S. streamer brings market penetration to 26 of the top 30 global streamers.

Recently, it launched an AI-powered platform that gives publishers control over yield, data and demand. The platform unifies automated revenue optimization, first-party data monetization and direct access to premium media budgets, helping publishers adapt to changing traffic and monetization trends. However, for the third quarter, PUBM is taking a cautious stance due to pressure from a major DSP and ongoing macroeconomic uncertainty, expecting revenues to be in the $61 million to $66 million band.

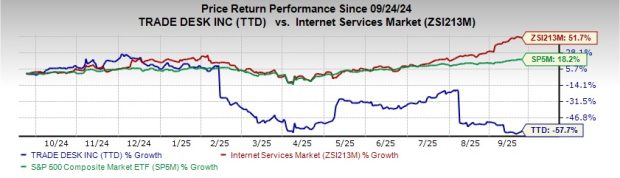

Shares of TTD have declined 57.7% in the past year against the Zacks Internet -Services industry and S&P 500 composites’ rise of 51.7% and 18.2%, respectively.

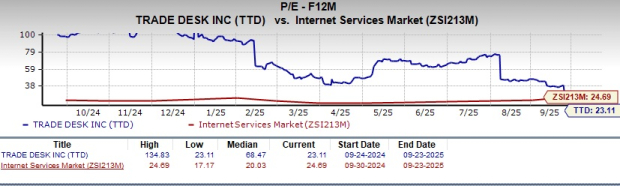

In terms of forward price/earnings, TTD’s shares are trading at 23.11X, lower than the Internet Services industry’s ratio of 24.69.

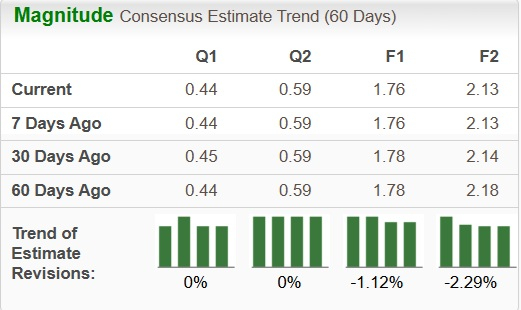

The Zacks Consensus Estimate for TTD’s earnings for 2025 has gone south over the past 60 days.

TTD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite