|

|

|

|

|||||

|

|

AstraZeneca AZN stock has risen 15% so far this year compared with an increase of 0.2% for the industry. The stock has also outperformed the sector and the S&P 500 index, as seen in the chart below.

AstraZeneca’s key drugs like Lynparza, Tagrisso, Imfinzi, Farxiga and Fasenra are driving revenues. AstraZeneca’s pipeline is also strong, with pivotal late and mid-stage pipeline data readouts lined up. It has also been engaged in external acquisitions and strategic collaborations to boost its pipeline while investing in geographic areas of high growth like emerging markets. However, the impact of the Part D redesign on U.S. oncology sales and biosimilar/generic erosion of some key drugs is hurting the top line in 2025.

Let’s understand AZN’s strengths and weaknesses to better analyze how to play the stock amid the price gain.

AstraZeneca boasts a diversified geographical footprint as well as a product portfolio with several blockbuster medicines. AstraZeneca now has 16 blockbuster medicines in its portfolio with sales exceeding $1 billion, including Tagrisso, Fasenra, Farxiga, Imfinzi, Lynparza (partnered with Merck [MRK]), Calquence and Ultomiris. These drugs are driving the company’s top line, backed by increasing demand trends. Almost every new product that has been launched in recent years has done well.

Newer drugs like Wainua, Airsupra, Saphnelo, Datroway (partnered with Daiichi Sankyo) and Truqap are also expected to continue to contribute to top-line growth in the second half of 2025.

Oncology is AstraZeneca’s biggest segment. The company is working on strengthening its oncology product portfolio through label expansions of existing products and advancing its oncology pipeline candidates. Oncology sales now comprise around 43% of AstraZeneca‘s total revenues and rose 16% in the first half of 2025, generating almost $12 billion in sales. The strong oncology performance was driven by medicines such as Tagrisso, Lynparza, Imfinzi, Calquence and Enhertu (in partnership with Daiichi Sankyo).

A key new cancer drug approval was that of Truqap for HR-positive, HER2-negative (HR+ HER2-) breast cancer. The drug has seen a robust launch, recording sales of $302 million in the first half of 2025. Datroway/datopotamab deruxtecan (Dato-DXd), in partnership with Daiichi, was approved for EGFR-mutated NSCLC and HR+ HER2- breast cancer in the United States and EU in 2025. Datroway witnessed encouraging early launch signals in the United States and recorded $14 million in sales in the first half of 2025.

AstraZeneca expects continued growth of its oncology medicines, particularly Tagrisso, Enhertu and Imfinzi, despite the incremental impact of the Part D redesign.

AstraZeneca faces its share of challenges. The impact of the Medicare Part D redesign hurt sales of AZN’s key drugs, Tagrisso and Lynparza, in the first half of 2025, with the negative impact expected to continue through the rest of the year.

AstraZeneca expects Farxiga to be included in the volume-based procurement (VBP) plans in China in 2025, which could negatively impact its sales in China.

Generic/biosimilar competition in the United States and Europe is hurting sales of key drugs like Brilinta and Soliris in 2025. Generic versions of Brilinta were launched in the United States in 2025.

Biosimilar versions of Soliris were launched in the United States in March 2025, which, along with the successful conversion to Ultomiris and biosimilar pressure in Europe, are expected to lead to a continuous decline in sales of Soliris.

Sales in its Rare Disease segment are expected to be slower in 2025 than in 2024.

From a valuation standpoint, AstraZeneca is slightly expensive. Going by the price/earnings ratio, the company’s shares currently trade at 15.07 forward earnings, slightly higher than 14.77 for the industry. However, AZN’s stock is trading below its 5-year mean of 17.75. The stock is, however, cheaper than other large drugmakers like Eli Lilly LLY and J&J JNJ.

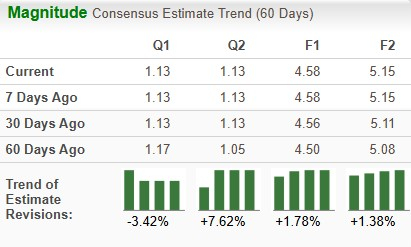

The Zacks Consensus Estimate for 2025 earnings has risen from $4.50 per share to $4.58 per share over the past 60 days. For 2026, earnings estimates have risen from $5.08 per share to $5.15 per share over the same timeframe.

Despite the potential impact of the Part D redesign, Brilinta's loss of exclusivity, Soliris biosimilar and uncertainty regarding Farxiga, AstraZeneca expects total revenues to grow by a high single-digit percentage at CER in 2025.

Backed by its new products and pipeline drugs, AstraZeneca believes it can post industry-leading top-line growth in the 2025-2030 period. AstraZeneca expects to generate$80 billion in total revenues by 2030. By the said time frame, AstraZeneca plans to launch 20 new medicines, with nine new medicines already launched/approved. It believes that many of these new medicines will have the potential to generate more than $5 billion in peak-year revenues. The company is also on track to achieve a mid-30s percentage core operating margin by 2026.

Considering AZN’s growth prospects, one should stay invested in this Zacks Rank #3 (Hold) stock. Consistently rising estimates also indicate analysts’ optimistic outlook for growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Stocks to Watch Monday Recap: Diamondback, Netflix, Novo Nordisk, Lilly

LLY MRK

The Wall Street Journal

|

| 1 hour | |

| 2 hours |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

LLY

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite