|

|

|

|

|||||

|

|

NIKE Inc. NKE is slated to release first-quarter fiscal 2026 results on Sept. 30. The leading sports apparel retailer is estimated to have witnessed year-over-year declines in the top and bottom lines in the fiscal first quarter.

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $11 billion, suggesting a 5% decline from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for the company’s fiscal first-quarter earnings is pegged at 28 cents per share, indicating a decline of 60% from the year-ago reported number. Earnings estimates for the fiscal first quarter moved up by a penny in the last 30 days.

In the last reported quarter, the company delivered an earnings surprise of 16.7%. Its bottom line beat the consensus estimate by 42%, on average, in the trailing four quarters.

Our proven model conclusively predicts an earnings beat for NIKE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

NIKE has an Earnings ESP of +11.64% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

NIKE has been witnessing momentum, driven by the smooth execution of its “Win Now” strategy and wholesale order book recovery. The company’s “Win Now” strategy is essentially a fast-track operational reset designed to restore brand momentum and position the business for sustainable growth after a period of underperformance.

The company is strengthening culture through leadership changes and an athlete mindset; rebalancing the product portfolio away from over-reliance on aging franchises like Air Force 1 and Dunk toward high-demand innovations such as Vomero 18; reigniting marketing through major sport moments; sharpening marketplace segmentation with targeted wholesale partnerships and new distribution; and activating locally through events like the After Dark Run Series. A key element is repositioning NIKE Digital as a premium, full-price destination tied to sport-led storytelling.

Strengthening partner confidence, fresher assortments and improving sell-through trends may position NKE for revenue acceleration in the first quarter of fiscal 2026.

The company’s strategic pricing and supply-chain optimization, including logistics, inventory management and distribution, are expected to have cushioned the bottom line in the to-be-reported quarter. Effective inventory management strategies have been other critical components of NIKE's success.

The company has been prioritizing sports performance, accelerating product innovation and storytelling to enhance brand appeal. With innovations like the Pegasus Premium, Vomero 18 and Air Max platforms, alongside a more segmented and differentiated wholesale strategy, NIKE is positioning itself for sustainable growth by catering to evolving consumer preferences and expanding its market reach across key global regions. NIKE expects these innovations and its focus on the sports performance product category to have supported its fiscal fourth-quarter performance.

NIKE, Inc. price-eps-surprise | NIKE, Inc. Quote

NKE is revitalizing its digital and retail strategy by reducing promotions, improving premium brand positioning and refining its go-to-market processes. By strengthening partnerships with wholesale retailers and optimizing its NIKE Direct ecosystem, the company is creating a more seamless and engaging shopping experience, ultimately driving margins and brand loyalty.

However, NIKE faces mounting near-term challenges on multiple fronts. Aggressive reductions in aging footwear franchises and a deep reset in China are weighing on sales, while promotions and supply-chain cost deleverage pressure margins. Elevated SG&A and ongoing digital traffic declines further limit profitability recovery. New U.S. tariffs add a $1-billion structural cost headwind. Management’s cautious first-quarter fiscal 2026 guidance, projecting revenue and margin declines, highlights the tough path to near-term growth.

The newly implemented U.S. tariffs present a significant cost challenge for NIKE, estimated to increase gross costs by $1 billion. Even with mitigation efforts, such as reallocating production from China to other countries, partnering with suppliers and retailers on cost-sharing, and implementing phased price increases, management expects a 75-bps gross margin impact in fiscal 2026, with greater pressure in the first half.

As a result, management expects revenue to decline in the mid-single digits, indicating the ongoing marketplace resets and the anticipated impacts of new U.S. tariffs on imports from China. The gross margin is projected to contract 350-425 basis points, including a roughly 100-basis-point hit from tariffs at current rates. Our model anticipates a gross margin decline of 350 bps to 41.9% for first-quarter fiscal 2026.

Management expects SG&A expenses to increase in the low-single digit for the first quarter and fiscal 2026, citing ongoing investment in brand and commercial capabilities, including wholesale re-engagement and sport-specific team buildouts. However, without a swift rebound in revenue growth and margin expansion, the current elevated SG&A structure risks prolonging profitability headwinds and delaying full financial recovery. Our model predicts SG&A expenses to increase 2.4% year over year to $4.1 billion in the first quarter and 1.7% to $16.4 billion in fiscal 2026.

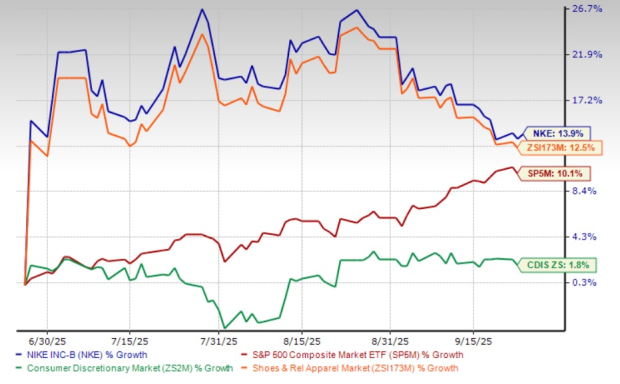

NKE shares have exhibited a recovery in the past three months, rising as much as 13.9%. The stock has outperformed the industry, the broader Consumer Discretionary sector and the S&P 500’s growth of 12.5%, 1.8% and 10.1%, respectively.

However, NIKE's performance is notably weaker than that of its close competitors, including Wolverine World Wide WWW and Steven Madden SHOO, which have risen 55.1% and 37.7%, respectively, in the past three months. Nonetheless, NKE has outperformed Adidas’ ADDYY decline of 3.4% in the same period.

At the current price of $71.22, NIKE trades 36.2% above its 52-week low of $52.28. The current price trades 21.4% below the 52-week high mark of $90.62.

NKE’s valuation appears quite pricey. The company trades at a forward 12-month P/E multiple of 36.13X, exceeding the industry average of 29.83X and the S&P 500’s average of 23.44X.

NKE’s strategic initiatives build a strong foundation for long-term growth by strengthening its competitive position, expanding its product lineup and deepening consumer engagement. With a focus on innovation, improved retail and digital strategies and premium brand positioning, NIKE is adapting to the market shifts while maintaining leadership in sports and lifestyle apparel. Additionally, the company’s “Win Now” strategy bodes well.

While these efforts are expected to create long-term value, they are expected to lead to some short-term revenue challenges. The soft guidance for the first quarter of fiscal 2026 dampens near-term growth prospects. Also, its near-term challenges in lifestyle products and Greater China cannot be ignored.

NIKE stands at a critical crossroads. The company’s long-term strategies, anchored by the “Win Now” initiative, innovation-led product launches, wholesale re-engagement, and a sharper digital and retail focus, are designed to strengthen brand equity, restore growth momentum and capture evolving consumer demand. These initiatives should enhance NIKE’s competitive edge, broaden its global reach and drive sustained growth over time.

However, the near-term picture is far less encouraging. The company faces persistent headwinds from weak demand in lifestyle categories, a reset in China, elevated SG&A costs and the structural challenge of newly imposed U.S. tariffs, which add a significant cost burden. Management’s cautious outlook, projecting declines in revenues and margins for the first half of fiscal 2026, further underscores the difficulty of balancing short-term financial pressure with long-term transformation.

Overall, while NIKE is well-poised for growth, investors should remain mindful of the cloudy near-term earnings trajectory.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite