|

|

|

|

|||||

|

|

HSBC used IBM's quantum computers to improve a process involved in algorithm bond trading.

The collaboration demonstrated that pairing quantum computers with classical techniques can provide real-world benefits.

IBM's long-term quantum computing opportunity is enormous, and this development is a step in the right direction.

International Business Machines (NYSE: IBM) has been working on quantum computing technology for decades. The company's quantum computing roadmap calls for a demonstration of quantum advantage, where a quantum computer outperforms a classical computer, by 2026 through combining the two technologies. The first fault-tolerant quantum computer is expected by 2029, with IBM scaling up after that.

While large-scale quantum computers are still many years away, IBM and HSBC announced a significant quantum computing breakthrough on Thursday. Detailed in a recently submitted scientific paper and a press release on HSBC's website, the bank used IBM's quantum computers paired with standard techniques to improve a particular process in algorithmic bond trading. This was just a trial, but it demonstrates the potential for IBM's quantum computing technology to deliver real-world benefits.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

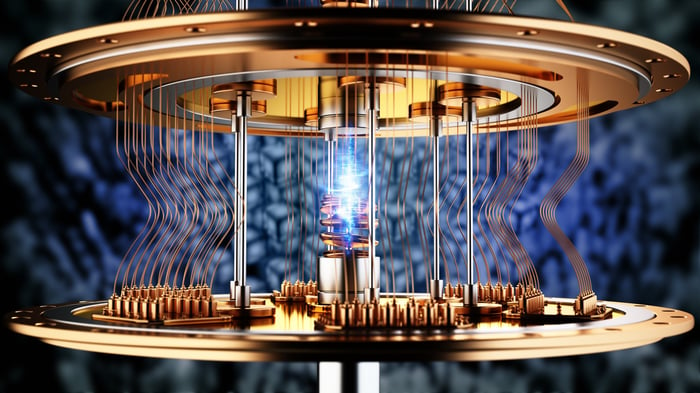

Image source: Getty Images.

In the corporate bond market, customer inquiries are priced in a competitive bidding process using computer models and classical algorithms. This process is complicated and must incorporate real-time market conditions, risk estimates, and other factors.

In collaboration with IBM, HSBC leveraged a quantum algorithm running on IBM's Heron quantum processor to tackle the process of estimating how likely a trade is to be filled at a quoted price in the over-the-counter European bond market. By pairing quantum computing with standard machine learning techniques, HSBC was able to improve this process by as much as 34% compared to using solely nonquantum techniques.

"This is a ground-breaking world-first in bond trading. It means we now have a tangible example of how today's quantum computers could solve a real-world business problem at scale and offer a competitive edge, which will only continue to grow as quantum computers advance," said HSBC quantum head Philip Intallura in the press release.

This development follows IBM's announcement in August that it was collaborating with AMD to develop next-generation computing architectures that combine quantum computers and high-performance classical computers. IBM's strategy, dubbed quantum-centric supercomputing, is a hybrid approach that combines quantum computers with CPUs, GPUs, and other standard chips to take on real-world problems.

The HSBC announcement is a strong signal that this hybrid approach is promising and could pay off within the next few years in the form of a quantum-centric computer that can accelerate real-world business or scientific computations.

IBM's quantum computing business has already generated nearly $1 billion in bookings. Those signings are in the form of tests, trials, and explorations like the HSBC collaboration. IBM works with a wide variety of partners, including national laboratories, universities, and companies including HSBC, Boeing, Wells Fargo, and Bosch.

The HSBC findings suggest that it may not be long before IBM's quantum computing business begins generating revenue from real-world deployments of quantum computers and algorithms working in tandem with classical techniques, perhaps within a few years. While there are plenty of tricky problems to solve in the field of quantum computing before large-scale, fault-tolerant systems are viable, the technology may be useful in some real-world applications earlier in IBM's roadmap.

McKinsey estimates that the quantum computing market could reach $97 billion by 2035 and $198 billion by 2040. While these estimates should be taken with a grain of salt, they demonstrate the size of IBM's opportunity to translate its decades of quantum computing research into a multibillion-dollar business.

Meaningful quantum computing revenue isn't coming in the near term for IBM, but HSBC's results suggest that the tech giant is on the right track as it builds toward a viable quantum computing business that solves real-world problems.

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,280!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,084,802!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

HSBC Holdings is an advertising partner of Motley Fool Money. Wells Fargo is an advertising partner of Motley Fool Money. Timothy Green has positions in International Business Machines. The Motley Fool has positions in and recommends Advanced Micro Devices and International Business Machines. The Motley Fool recommends HSBC Holdings. The Motley Fool has a disclosure policy.

| 7 hours | |

| Feb-06 |

Top Dow Contributors Over the Past 10,000 Points: Goldman, Caterpillar, IBM

IBM

The Wall Street Journal

|

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 |

Stock Market Today: Dow Rises But Nasdaq Lags On Surprise Jobs Data; Eli Lilly Soars (Live Coverage)

IBM

Investor's Business Daily

|

| Feb-04 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite