|

|

|

|

|||||

|

|

Twilio TWLO and RingCentral RNG are two of the leading players in the cloud communications industry. Both companies offer powerful platforms that enable businesses to connect with customers through various channels, but their approaches and market positions differ significantly. While Twilio focuses on programmable Application Programming Interface (“API”) for developers, RingCentral leads in Unified Communications as a Service (UCaaS) with integrated artificial intelligence (AI)-powered solutions.

With AI-driven innovations shaping the industry, the question remains: Which stock makes for a better investment pick today? Let’s break down their fundamentals, growth prospects and valuation to determine which offers a more compelling investment case.

Twilio has made significant strides in improving its profitability, a key milestone for the once cash-burning company. In the fourth quarter of 2024, its revenues increased 11% year over year to $1.19 billion and achieved GAAP operating profitability for the first time. This shift reflects management’s emphasis on cost discipline and efficiency.

The company’s strength lies in its AI-powered communication tools, such as Twilio Verify and Voice Intelligence, which help businesses automate and optimize customer interactions. AI adoption is a major long-term tailwind, and Twilio’s ability to leverage customer data to enhance engagement gives it a competitive edge. Additionally, its API-first model differentiates it from tech giants like Microsoft, Amazon and Cisco, which offer more rigid, bundled solutions.

Twilio is also in a strong financial position, with $2.38 billion in cash and marketable securities compared to $991 million in long-term debt. This financial cushion has allowed the company to reward shareholders through share repurchases, with $2.3 billion returned in 2024 alone. In January 2025, Twilio authorized a $2 billion share buyback program, signaling confidence in its long-term prospects.

However, near-term challenges persist. Management’s first-quarter 2025 revenue guidance of $1.13-$1.14 billion suggests a sequential decline, while its EPS forecast of $0.88-$0.93 fell short of expectations.

Twilio’s usage-based revenue model is vulnerable to economic downturns as businesses tighten spending on messaging services. Fears of a possible global economic slowdown are rising amid an escalating tariff war, which could lead to a rise in inflation and discourage the Federal Reserve from further interest rate cuts. Moreover, increasing competition and pricing pressures in the cloud communications market could weigh on its growth.

RingCentral has established a strong reputation as a leader in the UCaaS market, providing enterprises with a comprehensive cloud-based communication suite that integrates voice, video, messaging and AI-powered contact center solutions. The company’s latest results reflect its steady growth trajectory, with fourth-quarter 2024 revenues reaching $615 million (up 8% year over year).

AI-driven product innovation has been a key differentiator for RingCentral. In February 2025, the company introduced AI Receptionist, an AI-powered virtual phone agent designed to handle customer inquiries and automate call routing. This follows other AI-enhanced tools, reinforcing RingCentral’s position as a leader in intelligent business communications.

RingCentral’s partnerships with major tech companies like Microsoft and Google further enhance its competitive advantage. By integrating its solutions with widely used productivity tools from these companies, including Microsoft 365, Outlook, Teams and G-Suite, RingCentral strengthens its enterprise appeal and expands its user base. It currently serves more than 400,000 organizations and 7 million end-users globally, making it one of the most widely adopted UCaaS providers.

RingCentral’s business model also offers stability. Unlike Twilio’s usage-based pricing, RingCentral operates on a subscription-based model, ensuring predictable, recurring revenues. For the first quarter of 2025, the company expects revenues to be $607-$612 million, marking a 4-5% year-over-year increase.

Nonetheless, RingCentral isn’t without challenges. The company has a weaker liquidity position than Twilio, with just $243 million in cash against $1.35 billion in long-term debt. However, its strong cash flow generation — $403 million in free cash flow for 2024 — allows it to manage debt obligations effectively.

The Zacks Consensus Estimate for Twilio’s 2025 sales and EPS implies year-over-year growth of 7.7% and 15%, respectively. However, the EPS estimates have been trending southward over the past 60 days.

The Zacks Consensus Estimate for RingCentral’s 2025 sales and EPS implies a year-over-year increase of 5.2% and 13.5%, respectively. EPS estimates for 2025 have been trending northward over the past 60 days.

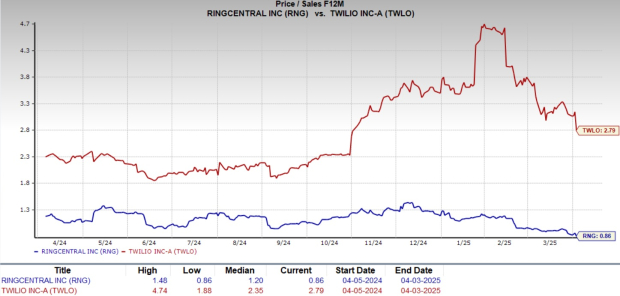

RingCentral is trading at a forward sales multiple of 0.86X, below its median of 1.20X over the past year. Twilio’s forward earnings multiple sits at 2.35X, above its median of 2.79X over the past year.

Both Twilio and RingCentral possess unique strengths and face distinct challenges. RingCentral’s predictable subscription-based revenues, strong profitability and AI-powered product innovations position it well for sustainable growth. Twilio’s long-term potential remains promising, especially as AI reshapes the communications landscape.

However, with near-term growth concerns and a usage-based revenue model that exposes it to economic headwinds, Twilio carries more risk. Additionally, RingCentral’s attractive valuation and favorable estimate revisions make it a better investment choice in the current market environment.

While RNG sports a Zacks Rank #1 (Strong Buy) at present, TWLO carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite