|

|

|

|

|||||

|

|

Walmart Inc. WMT and Target Corporation TGT remain two of the most influential players in the U.S. retail space, each with strong footprints and evolving digital strategies. Both companies recently reported second-quarter results, reflecting resilience in a tough consumer environment pressured by tariffs and discretionary pullbacks.

Walmart, the world’s largest retailer, operates more than 10,500 stores across 19 countries. Its model is built on “everyday low prices,” spanning groceries, general merchandise, membership (Sam’s Club) and fast-growing digital businesses. Target, with nearly 2,000 stores, blends affordable style with essentials, leaning on its stores as fulfillment hubs while investing in digital growth.

Walmart commands a market cap of around $819 billion, while Target stands at roughly $40 billion. Together, these companies showcase two distinct models of modern retail — one purely built on scale and everyday value, and the other on curated style and brand experience. With both navigating tariff pressures, shifting consumer habits and the make-or-break holiday season, their diverging strategies set up a compelling face-off.

Walmart’s strength lies in its unmatched scale and its ongoing transformation into a tech-inflected omnichannel powerhouse. Its vast store network remains a major asset, serving both as traditional retail outlets and as hubs for fulfillment through curbside pickup, same-day delivery and in-store pickup. This omnichannel strategy has been a key driver of growth, with global e-commerce sales climbing 25% in the second quarter of fiscal 2026, reflecting strong momentum in digital adoption.

Adding another layer of growth is Walmart Connect, the company’s advertising business. By leveraging its shopper data and digital reach, Walmart is carving out a high-margin revenue stream that complements its core retail business. Apart from this, its membership program, Walmart+, provides recurring income while strengthening loyalty.

Technology and operational efficiency remain central to Walmart’s strategy. The company continues to invest heavily in AI, automation and advanced supply chain tools to cut costs, improve inventory flow and deliver better execution. These capabilities not only help the company sustain its everyday low-price promise but also protect profitability in the face of inflation, tariffs and other cost pressures.

Walmart’s international presence adds another leaf to its growth story. Recent performance in markets like China, Flipkart and Walmex showcases the company’s ability to capture opportunities in high-growth regions while spreading geographic risk. Walmart’s strong balance sheet and efficient capital allocation position it well to keep investing in expansion and innovation while returning value to shareholders.

However, tariff costs, wage inflation and healthcare-related expenses are putting pressure on Walmart’s margins. Volatile foreign currency movements are also a concern. That said, with fiscal 2026 guidance calling for sales and operating income growth, Walmart continues to stand out as a resilient company. For fiscal 2026, the company expects consolidated net sales growth of 3.75-4.75% (at constant currency), while the adjusted operating income is expected to increase 3.5-5.5% at cc.

Target’s greatest strength is its brand identity — one that blends affordability with style in a way that keeps customers coming back. Further, the company has turned its extensive store network into mini-hubs for e-commerce, enabling same-day services like Drive Up, order pickup and delivery. This omnichannel approach allows it to compete effectively with other retailers while keeping costs efficient and maintaining the relevance of physical stores.

The company is also strengthening customer loyalty through its Target Circle program, now expanding into Target Circle 360. This evolution offers personalized perks and a deeper digital connection with guests. Apart from this, high-margin ventures such as the Roundel ad network and the Target Plus marketplace are scaling quickly, giving Target new avenues for profitable growth.

Technology investments add another layer of strength. In the second quarter of 2025, Target deployed more than 10,000 AI licenses to improve forecasting, automate routine work and sharpen replenishment. These tools delivered the best on-shelf availability in years and supported more reliable digital fulfillment, showing how operational upgrades can translate directly into better customer experiences.

On the merchandising side, the company continues to focus on innovation through private labels, partnerships and store concepts like shop-in-shops. Coupled with supply-chain modernization, these initiatives are building a more resilient and flexible platform for long-term growth. Taken together, Target’s brand power, digital evolution and operational improvements make it a retailer with meaningful upside potential.

However, Target is navigating a cautious consumer backdrop. It witnessed a comparable sales decline of 1.9% in the second quarter of fiscal 2025, with overall traffic down 1.3%. For fiscal 2025, Target expects a low-single-digit decrease in sales. Further, tariff-related pressure and increased promotional activity pose a threat to margins.

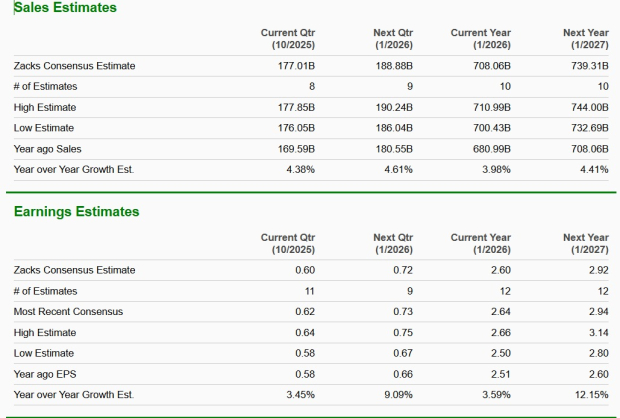

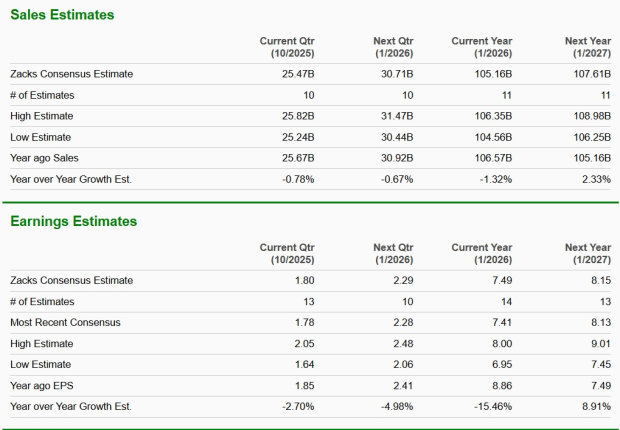

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and EPS suggests a year-over-year increase of around 4% and 3.6%, respectively. The consensus estimate for EPS for the current fiscal year has remained unchanged at $2.60 over the past 60 days.

The Zacks Consensus Estimate for Target’s current fiscal-year sales and EPS implies year-over-year declines of 1.3% and 15.5%, respectively. The consensus estimate for EPS for the current fiscal year has declined from $7.55 to $7.49 over the past 60 days.

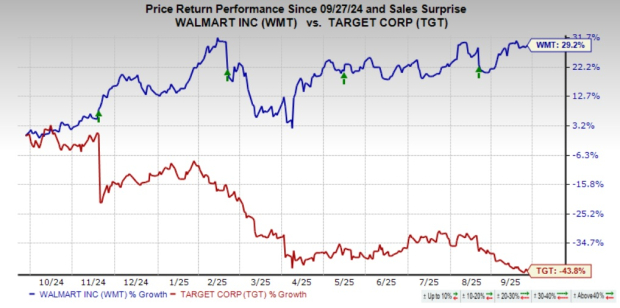

Over the past year, shares of Walmart have gained 29.2%, while Target has slumped 43.8%. Currently, WMT trades just 2.9% shy of its 52-week high compared with Target, which sits 46% below its peak. For now, investor sentiment leans more toward Walmart.

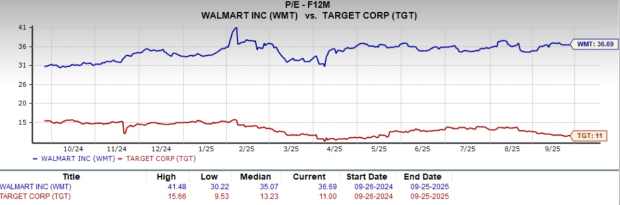

Walmart’s forward P/E of 36.69 sits above its median of 35.07. Target is trading at a forward 12-month price-to-earnings (P/E) ratio of 11, below its one-year median of 13.23. On valuation grounds, Target looks better, as its forward P/E is below its historical median, signaling relative undervaluation compared to Walmart’s premium multiple above its median.

Walmart’s unmatched scale, global reach and steady push into higher-margin businesses like advertising, membership and e-commerce make it better positioned to deliver growth, even in a tough retail climate. Target’s strengths in brand appeal, style-driven merchandising, and digital innovation remain meaningful, but its near-term challenges in sales momentum and consumer demand limit visibility. While valuation favors Target, the stronger momentum, resilience and confidence built into Walmart’s story make it the better bet at this juncture.

Both Walmart and Target currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite