|

|

|

|

|||||

|

|

Buffett's forever stocks include some of Berkshire Hathaway's largest and longest-held holdings.

Each meets his criteria of being "outstanding businesses with outstanding managements."

One member of the group could have more exciting long-term prospects than the others.

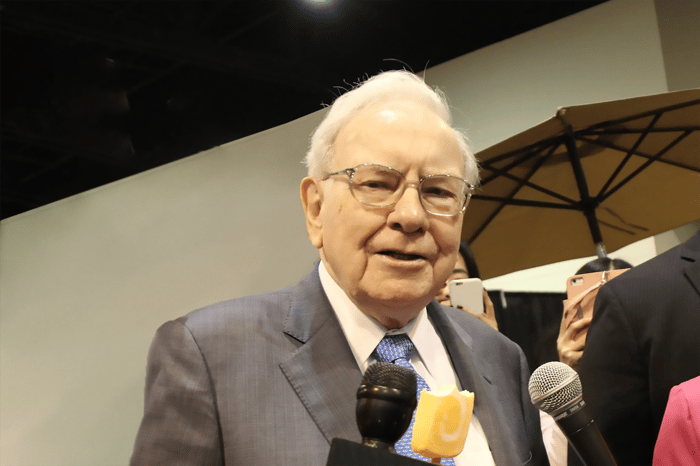

I don't know if I could pick just a single Warren Buffett quote as my favorite. There are simply too many great statements he has made through the years. However, one of his most memorable quotes came in his 1988 letter to Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) shareholders: "[W]hen we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever."

While the "Oracle of Omaha" has bought many stocks for Berkshire's portfolio through the years, only a handful have been ones that qualify for his favorite holding period. Buffett has invested roughly $138 billion in nine forever stocks. One stands out as the best of the bunch.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: The Motley Fool.

Buffett has owned stakes in American Express and The Coca-Cola Company longer than any other stocks in Berkshire Hathaway's portfolio. He refers to these two blue chip stocks often in his public statements. In his 2023 shareholder letter, Buffett mentioned that both AmEx and Coca-Cola were stocks he expected to "maintain indefinitely." He said, "The lesson from Coke and AMEX? When you find a truly wonderful business, stick with it."

The legendary investor also added six other stocks to his "forever" list in that shareholder letter. Occidental Petroleum (NYSE: OXY) received top billing. He mentioned several things he liked about Occidental, including its "vast oil and gas holdings in the U.S." and its pioneering efforts in carbon capture technology.

The other five stocks have so much in common that Buffett wrote about them as a group. Itochu, Marubeni (OTC: MARUF) (OTC: MARUY), Mitsubishi, Mitsui, and Sumitomo (OTC: SSUM.F) (OTC: SSUM.Y) are Japanese trading houses. He aptly noted that these five companies are similar to Berkshire with their diversified businesses.

Interestingly, Buffett didn't include Berkshire's largest holding -- Apple (NASDAQ: AAPL) -- as a forever stock in the 2023 shareholder letter. However, in the 2024 annual shareholder meeting, he stated that Apple was a better business than Coca-Cola. I think that high praise earns the iPhone maker a spot on the list.

It's fair to say that all nine of these companies meet Buffett's criteria of being "outstanding businesses with outstanding managements." Instead of comparing their businesses, therefore, let's look at how they stack up against each other in three areas that are important to investors.

Apple's long-term performance absolutely crushes the other stocks. There's no comparison. Over the last five years, though, Occidental Petroleum has been the biggest winner of the group, followed by Marubeni. Wall Street analysts also project that Oxy will deliver the greatest earnings growth next year. Note, though, that analysts don't cover the five Japanese stocks, which are traded over-the-counter in the U.S.

Each of these stocks pays dividends. Sumitomo's dividend yield of 3.33% is the highest. However, Coca-Cola and Mitsubishi aren't too far behind with yields of 3.09%. Also, Coke is a member of the elite group of stocks known as Dividend Kings, which must have increased their dividends for at least 50 consecutive years. The company's streak of dividend hikes stands at 63 and counting.

What about something near and dear to Buffett's heart -- valuation? Sumitomo takes the prize with a forward price-to-earnings (P/E) ratio of 8.98. The other four Japanese stocks also have relatively low valuation multiples, with Marubeni taking the runner-up spot with a forward P/E of 11.65.

If we were giving scores on each category, I think Marubeni would come out on top. It ranked second in performance over the last five years and in valuation. The Japanese conglomerate also pays an attractive dividend yield of 2.84%.

But my gut says that Apple is the best of the bunch. Yes, Buffett has significantly reduced Berkshire's position in the consumer tech giant. No, Apple isn't delivering the growth that it once did. However, I'm more excited about the potential long-term growth prospects of Apple than I am about any of Buffett's other forever stocks.

I suspect the rumors that Apple will introduce a foldable iPhone in the near future are well-founded. If so, the product will likely be a huge commercial success. I also think Apple will be a major player in the smart glasses market. Don't write off the company's AI efforts, either. Apple could still be a sleeping giant in this critical arena.

Would Buffett agree that Apple is the best of the bunch among his forever stocks? Considering that Berkshire still owns a much larger stake in the company than any other holding in its portfolio, I'd say the answer is "yes."

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

American Express is an advertising partner of Motley Fool Money. Keith Speights has positions in Apple and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

| 56 min |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 2 hours | |

| 4 hours | |

| 5 hours |

Stock Market Week: Reaction To Iran, Berkshire Earnings, Apple Event

BRK-B

Investor's Business Daily

|

| 5 hours |

Stock Market Week: Reaction To Iran, Berkshire Earnings, Apple Event

BRK-A AAPL

Investor's Business Daily

|

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite