|

|

|

|

|||||

|

|

Demand for power generation equipment and ongoing infrastructure spending support the buy case.

The company faces notable cost increases due to tariff actions and is struggling with pricing.

Caterpillar remains a cyclical stock, and the stock's valuation must be considered within that context.

Caterpillar (NYSE: CAT) stock has been on a strong run recently, up almost 32% year to date. The move reflects solid underlying demand, optimism over long-term infrastructure spending, and the company's surprisingly strong exposure to the artificial intelligence/data center investing theme.

Is all this enough to make the stock a buy at current levels? Here's the lowdown.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

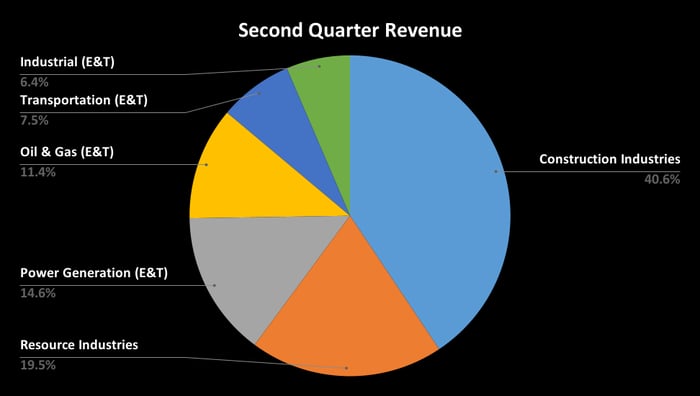

The company reports four segments: core construction industries, resource industries, energy and transportation (E&T), and a financial products segment that supports the other three. Resource industries are focused on mining machinery, quarrying, and aggregates (mainly for road building), construction industries sells into the infrastructure and building construction markets, and the most diverse segment (E&T) sells equipment to oil and gas, power generation, transportation (marine and rail), and industrial customers.

See the chart below for a breakdown of Caterpillar's revenue for the second quarter. The AI/data center angle comes into play when examining power generation revenue, which is now a significant part of Caterpillar's business and continues to grow strongly.

CEO Joseph Creed discussed the matter on a recent earnings call, saying, "Energy & Transportation sales to users increased by 9%. Power generation grew by 19%, primarily due to demand for reciprocating engines for data center applications."

Data source: Caterpillar presentations. Chart by author.

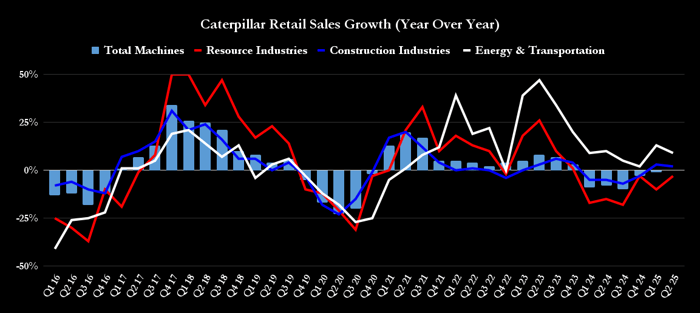

As such, the bullish case for the stock argues that a combination of solid underlying demand for construction machinery (see the chart below) and burgeoning demand for power generation equipment, driven by AI/data center spending, supports its value.

The following chart shows Caterpillar's retail sales growth (not to be confused with its revenue growth, as Caterpillar primarily sells through distributors). The strength in E&T (led by power generation) is apparent, and note that the construction industries segment's retail sales are growing again.

Data source: Caterpillar presentations. Chart by author.

With this in mind, you could easily build a case for buying the stock, particularly if you believe a long-term commodity supercycle could be on the way, driven by demand for mining commodities like copper, lithium, and nickel to support the electrification-of-everything megatrend that includes electric vehicles, charging networks, smart infrastructure, and, of course, AI driven data centers.

There are three key arguments in favor of the bears. First, Caterpillar remains a highly cyclical company. For example, the construction industries segment also contains equipment that relies on commodity-related capital spending, such as oil and gas and mining infrastructure spending. As such, Caterpillar's commodity-related revenue exceeds the 31% implied by adding up the resource industries and the oil and gas component.

In addition, building construction is a cyclical activity in any case, and even if infrastructure and power generation revenue are set for secular growth, it's highly unlikely to fully offset the cyclicality of the industries discussed above.

Second, Caterpillar continues to face substantial increases in costs coming from the impact of tariffs. During the second-quarter earnings call in early August, management estimated that those costs would be $1.3 billion to $1.5 billion in 2025. Fast forward a few weeks, and the company issued an SEC filing with an updated estimate of $1.5 to $1.8 billion for 2025.

Third, Caterpillar has relied on price realization (the change in revenue resulting from changes in sales volumes, which reflects discounts given, among other factors) in recent years, particularly when sales volumes were declining. However, it is finding it increasingly challenging to do so in 2025.

Data source: Caterpillar presentations. Chart by author.

All told, Caterpillar's pricing power is weakening at a time when it's also facing rising tariff-related costs. Moreover, it's a cyclical company that's trading at almost 29 times Wall Street's estimates of free cash flow (FCF) in 2025. While Wall Street does expect profit and cash flow improvement in 2026, management's estimate for FCF through the cycle is $5 billion to $10 billion, placing Caterpillar's current market cap of $222 billion at just over 22 times the high end of its cyclical FCF range.

While the infrastructure and data center/AI angle is fine, and supports the stock's valuation, and a commodity supercycle could be on the way, a lot of things have to go right to justify Caterpillar's current valuation.

Before you buy stock in Caterpillar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Caterpillar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| 4 hours | |

| 7 hours | |

| 10 hours | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite