|

|

|

|

|||||

|

|

The robotic surgery market is undergoing rapid transformation, driven by technological advancements, increasing adoption in hospitals, and a shift toward minimally invasive procedures. As of 2025, it’s growing rapidly, focusing on precision, AI integration, and expanding its use across specialties like urology, gynecology, orthopedics, and general surgery. While Intuitive Surgical ISRG is a leading name in soft-tissue surgery with the da Vinci portfolio, Zimmer Biomet ZBH has a strong presence in Orthopedic surgery with its systems for joint replacement and musculoskeletal procedures. Here we offer an insight into the companies and decide which one has better upside potential currently.

Per a Grand View Research report, the global surgical robotics market was valued at approximately $4.31 billion in 2024 and is projected to reach $9.6 billion by 2033, at a CAGR of 9.3%. This growth is part of a broader global trend, where North America holds about 39.6% of the worldwide market share in 2025.

A strong recurring revenue stream from the wide global installed base of Intuitive Surgical helps it to maintain nearly 60% of the global share. Its unparalleled data advantage, like case insights in the da Vinci 5 system, enhances surgical precision and outcomes. Meanwhile, Zimmer Biomet is actively broadening its robotic surgery portfolio through strategic acquisitions, product innovations, and R&D investments, positioning itself as a comprehensive provider in orthopedic and musculoskeletal robotics.

Intuitive Surgical’s growth story remains firmly anchored in robotics, led by its flagship da Vinci Surgical System, which has transformed minimally invasive surgery since 1999. Over the years, the platform has evolved through five generations, integrating artificial intelligence, advanced instrumentation, immersive 3D imaging, and, most recently, Force Feedback technology. These innovations not only enhance surgeon precision but also expand the system’s applicability across a wider range of procedures.

The latest model, da Vinci 5, is gaining rapid traction. By mid-2025, 180 placements had been made, bringing the installed base to nearly 700 systems. Early clinical data underscore its clinical edge, from faster bowel recovery in kidney surgeries to improved outcomes for novice surgeons. Regulatory approvals in South Korea, Europe, and Taiwan have accelerated global adoption, positioning the system for long-term expansion in high-growth international markets.

Beyond hardware, Intuitive has built a high-margin recurring revenue engine. Instruments, accessories, and digital services, such as My Intuitive and Intuitive Hub, generate 85% of revenues, with per-procedure I&A spend remaining steady at nearly $1,800. This steady cash flow offsets the lumpiness of capital sales, ensuring predictable financial performance. The company’s accessory innovation, such as FDA-approved SureForm staplers, further supports this model.

Meanwhile, the Ion endoluminal platform is quietly emerging as Intuitive Surgical’s next growth lever. With over 900 systems installed and procedures rising more than 50% year over year, Ion is redefining lung biopsy diagnostics. Its ability to access deep lung tissue with stability enhances early cancer detection — an area with vast unmet demand and international runway.

With procedure volumes rebounding post-COVID, Intuitive has raised its 2025 growth outlook to 15.5-17%. Fueled by rising adoption of da Vinci 5, recurring revenues from accessories, and Ion’s accelerating penetration, the company appears well-positioned to sustain double-digit growth in the years ahead.

Intuitive Surgical, Inc. price | Intuitive Surgical, Inc. Quote

Zimmer Biomet is leaning on its expanding knee portfolio and a disciplined innovation strategy to solidify its footing in the musculoskeletal market. The company’s ROSA Robotic Platform, paired with the Persona OsseoTi Cementless Knee and the Oxford Partial Cementless Knee, is gaining traction in the U.S. knee market, where sequential growth improved 150 basis points in 2025 and adoption trends are encouraging. Nearly half of surgeons trained on Oxford’s cementless knee have incorporated it into practice, with some converting from competitors — a signal of growing brand strength.

In Europe, the launch of the Persona Revision Knee has surpassed the 100-account mark, with momentum expected to accelerate as training volumes scale. By the company’s estimates, the knee business is positioned to witness a CAGR of 3.5% through 2027, supported by rising adoption of cementless and robotic solutions.

Complementing product momentum is a broader three-point strategic plan. First, Zimmer Biomet is investing in people and culture, including strengthening leadership with the appointment of Kevin Thornal as Group President. Second, its focus on operational excellence is visible in ASC expansion, supported by a new distribution partnership with Getinge to deliver turnkey OR solutions. Third, innovation and diversification are reshaping its portfolio. The “Magnificent 7” product cycle is already fueling growth in hips, knees, and S.E.T., while acquisitions such as Paragon 28 and the pending deal for Monogram Technologies add depth in foot, ankle, and robotics.

Despite ongoing pricing pressures, the global musculoskeletal market is showing signs of stability. Zimmer Biomet’s execution has delivered steady gains, with 1.8% growth in knees, 4.0% in hips, and 4.9% in S.E.T during the second quarter. The company’s blend of robotics, smart implants, ASC partnerships, and selective acquisitions positions it to capture above-market growth over the coming years.

Zimmer Biomet Holdings, Inc. price | Zimmer Biomet Holdings, Inc. Quote

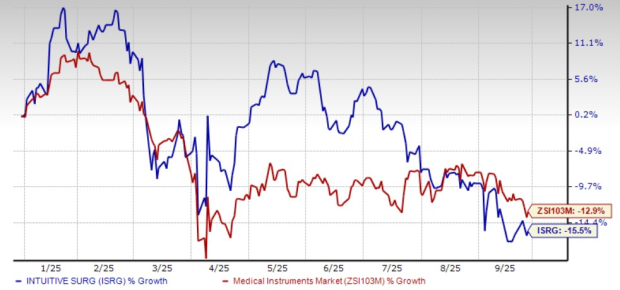

After gaining early in 2025, shares of both Intuitive Surgical and Zimmer Biomet have declined for the most part of the year. While shares of ISRG have declined 15.5% in the year-to-date period, ZBH stock is down 12.9%. The decline in shares of the companies primarily reflects uncertainty related to tariffs. ISRG is also facing gross margin pressure as it launches da Vinci 5, coupled with higher costs and increased depreciation.

Meanwhile, ZBH has lowered its earnings outlook on its second-quarter earnings call due to weak sales and rising costs. However, both companies maintain strong long-term prospects in robotic surgery.

YTD Performance: ISRG vs ZBH

Although shares of Intuitive Surgical are declining, it is making it cheaper with the forward 12-month price-to-earnings falling below the 5-year median. The company’s valuation has declined along with falling share prices, but it still trades above the industry. Despite the stock price correction earlier this year, Zimmer Biomet’s valuation has remained relatively stable and continues to trade at a significant discount to the industry average. While ISRG is overvalued as suggested by the Value Score of ‘D’, ZBH looks attractive with a Value score of ‘A’.

ISRG 5-year P/E F12M vs Industry

ZBH 5-year P/E F12M vs Industry

Both companies stand to benefit from the rising demand for robotic surgery, particularly the strong uptake in the United States. Both companies are also expanding their product portfolio in tandem with market opportunities. However, tariff uncertainty is likely to mar the near-term prospects for both companies as they continue to face rising costs. Meanwhile, Zimmer Biomet offers an opportunity to buy currently due to its lower valuation compared to its industry as well as Intuitive Surgical. Moreover, ISRG is trading above its industry’s valuation, raising concerns about the continuation of the correction in its stock price.

Zimmer Biomet currently carries a Zacks Rank #2 (Buy), while Intuitive Surgical has a Zacks Rank #4 (Sell), making Zimmer Biomet the better pick at present levels.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite