|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Data is growing at an accelerated pace, fueled by cloud adoption, AI, IoT and Big Data. Traditional HDDs and SSDs continue to serve enterprises and consumers, while advanced DRAM, NAND and HBM solutions power cutting-edge applications like AI training and hyperscale data centers. Two major U.S. players dominating discussions in this space are Western Digital Corporation (WDC) and Micron Technology (MU). Both operate in the storage and memory segments, with their unique strategies, market exposures and buyback programs.

Western Digital is a diverse storage company offering a broad portfolio of products, from traditional HDDs to NAND-based SSDs, catering to both consumer and enterprise markets. Idaho-based Micron is a leading global provider of semiconductor memory solutions, manufacturing high-performance DRAM, NAND, NOR, 3D XPoint and other memory technologies under brands like Micron, Crucial and Ballistix, for use in computing, consumer, networking and mobile products.

Per a report by Precedence Research, the global semiconductor memory market is projected to reach around $215.36 billion by 2034, at a CAGR of 6.92% from 2025 to 2034. Further, the global data storage market is projected to grow from $250.8 billion in 2025 to $483.9 billion by 2030 at a CAGR of 14% as stated by Mordor Intelligence. Both WDC and MU are well-positioned to benefit from these growing trends, attracting renewed investor interest. However, if investors must choose between the two, which stock should they consider based on fundamentals, valuations, growth potential and risks?

Let’s explore this in detail.

Western Digital is a key player in the global data infrastructure space, capturing a major chunk of the HDD market. It is committed to innovation, advancing HDD technology to provide drives with greater capacity, enhanced performance, improved energy efficiency and the lowest total cost of ownership. One of the company’s key strategic moves in 2025 was spinning off its flash memory business, SanDisk, to streamline operations and potentially unlock shareholder value.

Going ahead, WDC anticipates that the rise of generative AI will drive device refresh cycles and boost content growth across smartphones, gaming, PCs and consumer devices. As AI adoption jumped from 33% in 2023 to 65% in 2024, storage demand is growing for both HDDs and Flash at the edge and core. HBM is increasingly critical for AI servers, while NAND flash powers fast and efficient SSDs for text, images and video.

Agentic AI applications are further accelerating unstructured data generation, creating new storage needs. While eSSDs are favored for speed and reliability, HDDs remain the cost-effective backbone for large-scale data storage, supporting global infrastructure. The company is already using AI to boost product development, while industry-wide adoption is generating data at unprecedented levels.

The company has significantly improved its profitability by focusing on higher-capacity drives and disciplined cost management. These efforts are boosting efficiency, margins and capacity for reinvestment. Management remains focused on enhancing shareholder value through dividends and buybacks. Backed by strong cash flow and a solid balance sheet, the board authorized up to $2 billion in share repurchases and initiated a quarterly dividend. In the fiscal fourth quarter, the company repurchased about 2.8 million shares for $149 million.

However, one of the biggest challenges for WDC has been its high debt load. The high debt level jeopardizes its ability to pursue accretive acquisitions and other growth endeavors. It is required to generate adequate cash flows to meet debt requirements constantly. As of June 27, 2025, cash and cash equivalents totaled $2.1 billion, while long-term debt (including the current portion) amounted to $4.7 billion.

Nonetheless, it reduced debt by $2.6 billion in the June quarter through cash utilization and a debt-for-equity exchange, strengthening its balance sheet and achieving its net leverage target of 1–1.5x. During the quarter, WDC exchanged about 21 million SanDisk shares to reduce Term Loan A by $800 million while retaining 7.5 million shares. The company also redeemed $1.8 billion of senior unsecured notes, reducing gross debt to $4.7 billion at fiscal 2025 year-end.

Micron is capitalizing on the rapidly growing AI-driven memory and storage markets, with improved inventory across multiple end markets supporting top-line growth. Strong demand for its HBM products has been encouraging. For MU, AI is not only driving demand but also boosting productivity across the company, from product design and technology development to manufacturing.

Its adoption has led to a 30–40% productivity uplift in areas like code generation. In design, AI accelerates the silicon-to-systems cycle, while in manufacturing, it has increased wafer image analysis fivefold and doubled useful data collection, improving yield performance. These capabilities help Micron achieve higher product quality, faster time-to-market and stronger overall financial and competitive performance.

Data center server demand in 2025 is now expected to rise about 10%, higher than MU’s earlier forecasts of mid-single-digit growth. Traditional server demand, which was previously flat, is projected to grow in the mid-single-digit range, supported by increasing enterprise workloads and the rising use of AI agents. Alongside strong momentum in AI servers, this combined growth in traditional and AI servers is fueling robust demand for DRAM products.

Micron’s data center business has become a major growth driver, contributing 56% of total revenue in fiscal 2025 with strong 52% margins. The HBM segment continues to post consistent growth, with fiscal fourth quarter revenue reaching nearly $2 billion, reflecting an annualized run rate of about $8 billion fueled by HBM3E adoption. Looking ahead, Micron expects its HBM market share to continue rising, aligning with its broader DRAM share targets.

AI-driven workloads like cache tiering and database indexing are boosting demand for high-performance NAND SSDs, while AI server expansion is increasing the need for large-capacity storage. Micron is strengthening its position with customer-focused execution, advanced technology and the launch of its G9 NAND products, including the first PCIe Gen6 SSDs. In the near term, MU expects HDD supply shortages to further support NAND demand and create a more balanced market environment.

Micron has a strong cash-flow generating ability, which enables it to improve its cash balance and lower debt. In the last reported quarter, MU lowered its debt by $900 million, including a $700 million term loan repayment and the repurchase of about $200 million in senior notes. The quarter closed with $14.6 billion in total debt and $11.9 billion of cash and investments, supported by low net leverage and a weighted-average maturity extending to 2033.

However, MU faces tough competition in the memory market, with rival capacity expansions potentially affecting DRAM and NAND pricing. Trade tensions may also push Chinese firms toward non-U.S. suppliers like Samsung. While acquisitions boost revenue opportunities and product mix, they also introduce integration risks and may divert attention from organic growth. Additionally, a higher NAND mix, falling memory prices and limited cost declines are likely to weigh on margins.

Over the past year, MU and WDC have registered gains of 51.6% and 56.5%, respectively.

MU looks more attractive than WDC from a valuation standpoint. Going by the price/earnings ratio, MU’s shares currently trade at 9.4 forward earnings, lower than 15.87 for WDC.

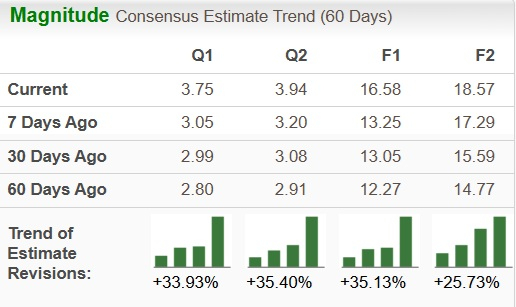

The Zacks Consensus Estimate for MU’s earnings for fiscal 2026 has been revised north 35% to $16.58 over the past 60 days.

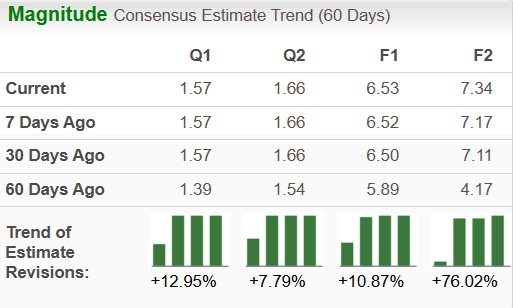

The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised up 10.9% to $6.53 over the past 60 days.

Both WDC and MU are poised to capitalize on the emerging data storage industry, capturing growth across multiple end-markets, from AI to enterprise to consumer storage.

MU at present sports a Zacks Rank #1 (Strong Buy), while WDC has a Zacks Rank #3 (Hold). Consequently, in terms of Zacks Rank and valuation, MU seems to be a better pick at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 46 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 12 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite