|

|

|

|

|||||

|

|

Rigel Pharmaceuticals RIGL is making continued advancement related to the development of its hematology and oncology pipeline and products. The company’s first product, Tavalisse (fostamatinib disodium hexahydrate), has been driving the majority of the company’s revenues.

Tavalisse is an oral spleen tyrosine kinase inhibitor. It is approved by the FDA for adult patients with chronic immune thrombocytopenia (“ITP”) who have had an insufficient response to a previous treatment. The drug is also approved in Europe, the United Kingdom, Japan and some other countries.

In the first half of 2025, Tavalisse generated sales of $68.5 million, up around 44% year over year.

Though Tavalisse remains a key top-line driver, the company is also making good progress with its second FDA-approved product, Rezlidhia (olutasidenib). The drug is indicated for treating adult patients with relapsed/refractory acute myeloid leukemia (“AML”) with a susceptible IDH1 mutation as detected by an FDA-approved test.

Rezlidhia sales increased 31% year over year to $13.1 million during the first half of 2025.

Rigel has an exclusive license agreement with Dr. Reddy's RDY to develop and commercialize Rezlidhia in all potential indications throughout Dr. Reddy's territory, which includes Latin America, South Africa, India, Southeast Asia, North Africa, Australia and New Zealand, among others.

Rigel is entitled to receive potential regulatory and commercial milestone payments from RDY.

Rigel added a third product, Gavreto (pralsetinib), to its portfolio after it acquired commercial rights to the drug from Blueprint Medicines, now part of Sanofi SNY, in 2024. The company started recognizing Gavreto sales from June 2024. Incremental sales from the drug boosted Rigel’s top line during the first half of 2025.

Looking ahead, sales are expected to grow steadily as Rigel expands its commercial footprint and strengthens its marketing infrastructure, driving continued momentum for Tavalisse while focusing on improving demand for Rezlidhia and Gavreto.

Owing to the strong sales performance of its marketed products, Rigel increased its total revenue guidance last month. The company now projects total revenues of $270-$280 million for 2025, compared with the previous expectation of $200-$210 million.

Apart from these approved drugs, RIGL is developing other candidates. Its pipeline progress has been encouraging.

A phase Ib study is evaluating R289, a novel dual IRAK1 and IRAK4 inhibitor, in patients with lower-risk myelodysplastic syndrome (MDS). Enrollment in the dose escalation part of the study has been completed. Rigel plans to initiate the dose expansion part of the study in the second half of 2025. The updated dose escalation data is also expected later in the year.

The company is also exploring Rezlidhia’s (olutasidenib) use beyond relapsed or refractory IDH1-mutated AML into other cancers with IDH1 mutations, such as recurrent glioma.

Though still in the early days, the successful development and potential approval for its pipeline candidates can become a major catalyst for the stock and should be able to drive long-term growth prospects as competition looms large in the target market.

The FDA recently approved SNY’s Wayrilz (rilzabrutinib), a novel BTK inhibitor, for the treatment of persistent or chronic ITP in adult patients who have had an insufficient response to a previous treatment.

Though Tavalisse and Wayrilz are built on different mechanisms, a successful launch of the latter is likely to pose a significant threat to Tavalisse, given the resources available for a large drugmaker like Sanofi.

Several other companies are also developing or commercializing treatments specific to Rigel’s other marketed products — Rezlidhia and Gavreto — and its R289 program. This is also a concern. Gavreto is likely to face competition from Eli Lilly’s LLY Retevmo (selpercatinib) which is approved for treating certain cancer indications, including non-small cell lung cancer and thyroid cancer.

LLY added Retevmo to its portfolio with the acquisition of Loxo Oncology.

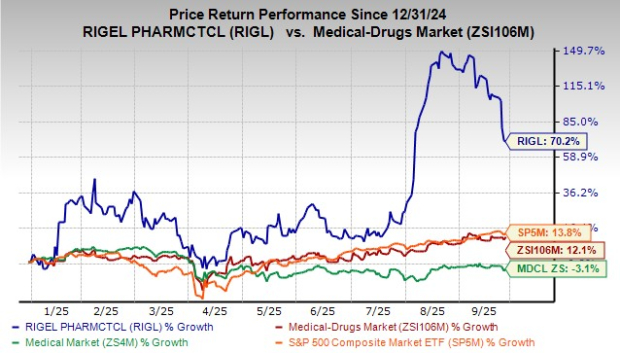

Year to date, shares of Rigel have rallied 70.2% compared with the industry’s rise of 12.1%. The stock has also outperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

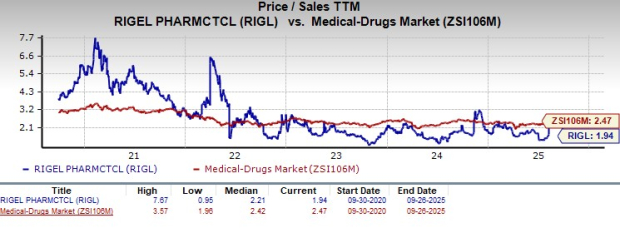

From a valuation standpoint, Rigel is trading at a discount to the industry. Going by the price-to-sales (P/S) ratio, the company’s shares currently trade at 1.94, lower than 2.47 for the industry. The stock is trading below its five-year mean of 2.21.

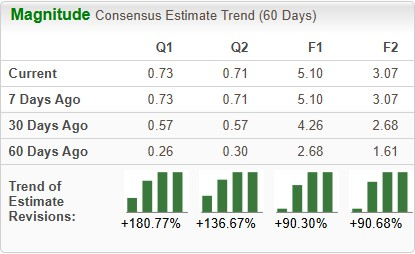

The Zacks Consensus Estimate for 2025 earnings per share (EPS) has increased from $2.68 to $5.10 over the past 60 days. During the same time frame, EPS estimates for 2026 have moved up from $1.61 to $3.07.

Rigel currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Eli Lilly builds orforglipron cache to avoid previous GLP-1RA shortages

LLY

Pharmaceutical Technology

|

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite