|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Investment banking (IB) is at the center of global capital flows, from multibillion-dollar mergers and acquisitions (M&A) transactions to high-profile IPOs. Among the sector’s key players, Morgan Stanley MS and Jefferies Financial Group JEF have two very different models: one a global bulge-bracket powerhouse and the other a niche mid-market challenger.

Though deal-making activity was uneven in the first half of 2025, near-and medium-term prospects are encouraging. Following an early-year surge, activity cooled after trade-policy shocks, but IB fee pools have shown a steady recovery in recent months. Against this backdrop, which IB stock—Morgan Stanley or Jefferies—offers the more compelling upside?

Morgan Stanley has leaned heavily into the IB business, though it has been diversifying into more stable revenue-generating sources like asset and wealth management businesses, creating a more balanced revenue stream across market cycles. The company’s IB revenues surged 36% last year to $6.71 billion after plunging in 2023 and 2022.

However, the performance of the company’s IB business was subdued during the first six months of this year, with the metric rising just 1% from the prior-year period. Nonetheless, MS remains cautiously optimistic about the performance of the IB business this year, supported by a stable and diversified M&A pipeline. Hence, given the improving macroeconomic scenario, the company will be able to capitalize on it.

Moreover, Morgan Stanley’s trading business performance has been stellar over the past several quarters, attributable to uncertainty surrounding the tariff plans and macroeconomic headwinds. As market volatility and client activity are expected to remain decent, the company’s trading business will likely continue to grow.

As mentioned above, MS is focusing on expanding its wealth and asset management operations, which supported its financials during the post-pandemic slowdown in the IB business. Both businesses’ aggregate contribution to total net revenues jumped to more than 55% in 2024 from 26% in 2010. The momentum persisted in the first six months of 2025, with total client assets across both segments reaching $8.2 trillion. This brings the company closer to its longstanding $10 trillion asset management goal set by former CEO James Gorman.

Jefferies, while expanding into lending and merchant banking, remains primarily an investment banking-driven firm with a strong foothold in mid-market advisory and capital markets. In fiscal 2024, the company’s total IB fees soared 52% to $3.31 billion after declining in fiscal 2023 and fiscal 2022.

Although IB revenues declined in the first half of fiscal 2025 due to tariff-related ambiguity and market volatility, clarity on several matters is now expected to support deal-making activities in the near term.

Clarity on tariff plans and other economic data shows that IB business is picking up pace, as businesses adapt to the changing environment. The healthy IB pipeline, an active M&A market and Jefferies’ established mid-market position could enable stronger growth amid potential rate cuts.

Further, JEF has been benefiting from strategic partnerships and joint ventures (JVs). As of Nov. 30, 2024, Sumitomo Mitsui Financial Group, Inc. held a 14.5% fully diluted stake in Jefferies. Building on that position, in September 2025, SMFG agreed to increase its equity stake to up to 20% and signed a memorandum of understanding to form a Japan-based JV, expected to be launched in January 2027.

Beyond the IB business, Jefferies operates in the asset management business, which is much smaller than IB. Nearly 1.2% of its revenues comes from asset management fees, which is likely to grow as the Fed lowers interest rates to ease inflationary pressures and support the labor market, which will induce investments in the markets.

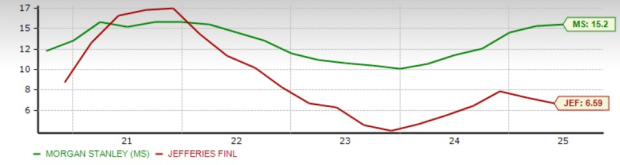

While 2025 started on a positive note, Trump’s tariff plans and resultant massive market volatility upended bullish investor sentiments. Nonetheless, since then, the situation has turned favorable to some extent. So far this year, shares of Morgan Stanley have risen 27.4%, while Jefferies has lost 14.9%.

JEF & MS YTD Price Performance

Additionally, JEF has lagged the Zacks Investment Bank industry and the S&P 500 Index. On the other hand, MS has outperformed the broader index while lagging the industry. Hence, in terms of investor sentiments, Morgan Stanley clearly has the edge.

In terms of valuation, Jefferies is currently trading at a 12-month forward price-to-earnings (P/E) of 16.67X. MS stock, on the other hand, is currently trading at a 12-month forward P/E of 17.03X.

P/E F12M

Therefore, Jefferies is inexpensive compared to Morgan Stanley.

JEF’s return on equity (ROE) of 6.59% is below Morgan Stanley’s 15.20%. Also, MS outscores the industry’s ROE of 14.32% while JEF does not. This reflects MS’ efficient use of shareholder funds to generate profits.

ROE

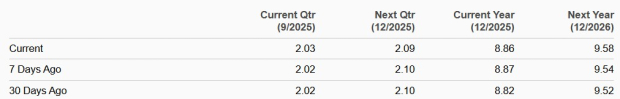

The consensus mark for MS’ 2025 and 2026 revenues suggests a year-over-year increase of 8.6% and 4.4%, respectively. Also, the consensus estimate for earnings suggests 11.5% and 8.2% growth for 2025 and 2026, respectively. Earnings estimates for both years have been revised north over the past 30 days.

MS Estimate Revision

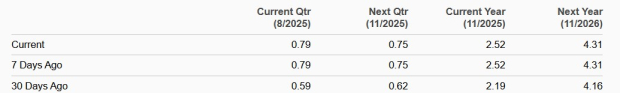

On the contrary, analysts are more bullish on Jefferies’s prospects in the long term. While the Zacks Consensus Estimate for JEF’s 2025 revenues implies a marginal year-over-year rise, for 2026, revenues are expected to jump 16.6%. Also, the consensus estimate for 2025 earnings indicates a 17.7% fall, while the same is anticipated to soar 70.8% for 2026. Earnings estimates for both years have been revised upward over the past month.

JEF Estimate Revision

Jefferies stands out over Morgan Stanley as a more concentrated play on IB, with growth potential enhanced by strategic partnerships and its niche mid-market positioning. The company’s IB fees are likely to improve as the Fed implements rate cuts, inducing deal-making activities. Its asset management arm is expected to thrive with the improving macroeconomic clarity, fostering confidence among investors.

Also, strategic collaborations are likely to expand its overseas presence. This reflects higher growth as suggested by analyst optimism in 2026, resulting in a lower forward P/E. Thus, JEF offers compelling upside in light of better growth prospects.

At present, Jefferies offers a more compelling upside for growth-focused investors, while Morgan Stanley provides scale, diversification and more consistent returns across market cycles. With Jefferies carrying a Zacks Rank #2 (Buy) versus Morgan Stanley’s Zacks Rank #3 (Hold), the near-term risk-reward appears tilted in JEF’s favor. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite