|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

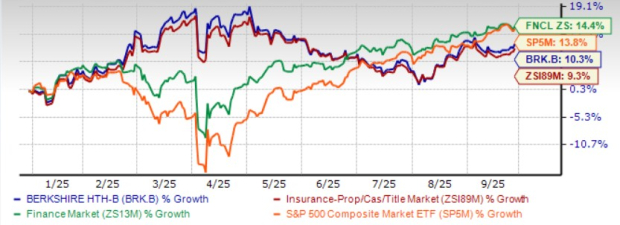

Shares of Berkshire Hathaway Inc. (BRK.B) have gained 10.3% year to date, compared with the industry’s increase of 9.3%, the sector’s rise of 14.4% and the Zacks S&P 500 composite’s gain of 13.8%.

Berkshire Hathaway is a conglomerate with more than 90 subsidiaries engaged in diverse business activities. This, in turn, provides it stability in various economic cycles.

BRK.B is now trending below its 50-day simple moving average (SMA), indicating the possibility of a downside ahead.

Shares of BRK.B’s peers, Chubb Limited CB and The Progressive Corporation PGR, have gained 1.6% each year to date.

Chubb, a premier global provider of property and casualty insurance and reinsurance, is targeting growth in the middle-market segment across both domestic and international markets. Chubb is enhancing its core package solutions and expanding its specialty insurance portfolio. With focused strategic initiatives, Chubb seeks sustainable growth and stronger competitive positioning.

Progressive, one of the top auto insurers in the United States, is well-positioned to sustain profitability through its strong market presence, broad product offerings and disciplined underwriting. Progressive is advancing its strategy by promoting bundled auto insurance, limiting exposure to high-risk properties, and enhancing segmentation with targeted, innovative solutions. With this approach, Progressive continues to strengthen its competitive edge.

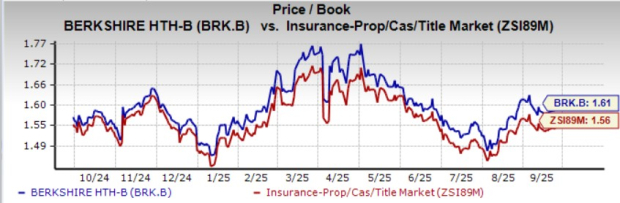

The stock is overvalued compared with its industry. It is currently trading at a price-to-book multiple of 1.61, higher than the industry average of 1.56.

Berkshire is relatively cheap compared to Progressive but expensive compared to Chubb.

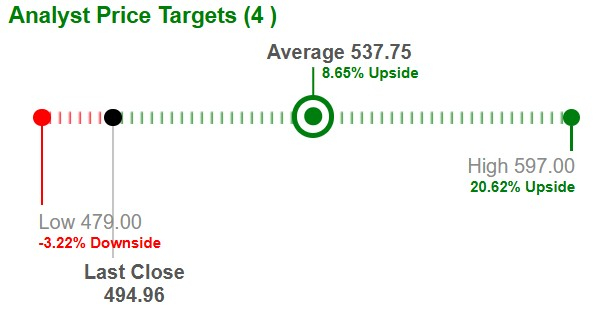

Based on short-term price targets offered by four analysts, the Zacks average price target is $537.75 per share. The average suggests a potential 8.7% upside from the last closing price.

Berkshire Hathaway, though a conglomerate, continues to anchor its business model around insurance operations, which account for roughly a quarter of total revenues. The segment remains a cornerstone of long-term growth, supported by disciplined underwriting, broad market reach and resilient performance even in difficult environments.

That resilience is strengthened by Berkshire’s diversification. Berkshire Hathaway Energy (BHE), its regulated utility arm, generates stable cash flows while prioritizing renewable investments, aligning with global electrification and sustainability trends. The Utilities and Energy division also includes Burlington Northern Santa Fe (BNSF), a strategically important rail business currently pressured by an unfavorable freight mix and reduced fuel surcharge revenues. Still, steady utility demand should provide longer-term support.

The Manufacturing, Service, and Retail segment offers cyclical upside, poised to benefit from a stronger economy and rising consumer spending, which lifts both sales and margins.

On the financial side, Berkshire maintains an exceptionally conservative capital allocation strategy, with more than $100 billion — or about 90% — of holdings in short-term U.S. Treasuries and government-backed securities. Elevated interest rates have boosted investment income, even as the Federal Reserve cut rates and signaled more reductions ahead. This approach preserves liquidity for opportunistic acquisitions while providing a reliable yield.

Berkshire has also been reshaping its equity portfolio. It has exited its position in BYD, trimmed holdings in Apple and Bank of America, but expanded stakes in Japanese trading companies such as Mitsubishi and Mitsui since first investing in the region in 2019. These moves highlight a focus on steady cash flow generation, which can be redirected toward share buybacks or new investments.

A major advantage remains Berkshire’s insurance float—the low-cost capital created by premiums collected before claims are paid. This float has grown from $114 billion in 2017 to $174 billion by mid-2025, funding investments in durable, cash-generating assets such as Apple, Coca-Cola, BNSF and utilities.

Backed by its fortress balance sheet, Berkshire continues disciplined share repurchases, further enhancing shareholder value and underscoring its strong capital management.

Return on equity (“ROE”) in the trailing 12 months was 7%, underperforming the industry average of 7.8%. Return on equity, a key profitability measure, reflects how effectively a company utilizes its shareholders’ funds. It is noteworthy that though BRK.B’s ROE lags the industry average, the metric has been improving consistently.

The same holds true for return on invested capital (ROIC), which has increased every year since 2020. This reflects BRK.B’s efficiency in utilizing funds to generate income. However, ROIC in the trailing 12 months was 5.6%, lower than the industry average of 5.9%.

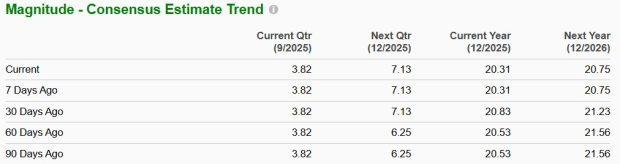

The Zacks Consensus Estimate for 2025 earnings implies a 7.7% year-over-year decrease, while the same for 2026 suggests a 2.2% increase. The expected long-term earnings growth rate is pegged at 7%, in line with the industry average.

The consensus estimate for 2025 earnings has moved down 2.5% in the past 30 days, while that for 2026 has moved down 2.2% in the same time.

Berkshire Hathaway has long added strength and stability to investors’ portfolios, delivering consistent shareholder value for nearly six decades under Warren Buffett’s leadership.

The attention now turns to the company’s future as Greg Abel prepares to step in as CEO on Jan. 1, 2026, with Buffett remaining as executive chairman.

However, with Berkshire trading at a premium valuation, witnessing modest returns on capital, facing near-term earnings headwinds, and having a cautious analyst outlook, a wait-and-see approach seems prudent for this Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Huge AI Jobs Disruption Is Coming. What It Means For The S&P 500 And You.

CB

Investor's Business Daily

|

| Feb-18 |

The AI Jobs Inflection Is Here; What It Means For The S&P 500, The Fed And You

CB

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite