|

|

|

|

|||||

|

|

Nebius Group N.V. NBIS is an upcoming player in the AI-infrastructure market, while Microsoft Corporation MSFT is an established tech behemoth. Microsoft’s Azure cloud platform is the second-largest cloud platform after Amazon Web Services or the AWS platform. MSFT’s investment in OpenAI has made it the go-to platform for innovative AI applications.

Per an IDC report, spending on AI infrastructure is expected to exceed $200 billion by 2028. This uptrend in spending benefits both Microsoft and Nebius, but not equally. So, if an investor wants to make a smart buy in the AI infrastructure space, which stock stands out?

Should investors back a high-volatility pure play like NBIS, or do you lean into the stability and scale of Microsoft? Let us delve a little deeper to assess which is the better stock pick?

NBIS is a specialized AI infrastructure, a neo cloud company with hyper revenue growth. In the last reported quarter, NBIS revenues surged 625% year over year to $105.1 million. AI cloud infrastructure revenues grew more than nine times year over year, driven by demand for copper GPUs and near-peak GPU utilization. With the new Blackwell GPUs entering the market at scale and its data center capacity expanding significantly in parallel, the company expects a substantial increase in sales by year-end.

The company expects the additional capacity, which comes online later in the year, to help it achieve updated ARR guidance. NBIS has raised its year-end ARR guidance to $900 million to $1.1 billion (previous estimate: $750 million to $1 billion), underscoring the strength of its contracted pipeline and near-term visibility. NBIS plans to secure 220 megawatts (“MW”) of connected power (active or ready for GPU deployment), including 100 MW of active power by 2025. The 1 GW capacity target by 2026 positions Nebius to capture incremental upside from accelerating demand for AI compute.

As companies build GPU-intensive data centers, Nebius emerges as one of the key beneficiaries. The recent deal with MSFT involves NBIS providing dedicated GPU capacity to Microsoft from its new data center in Vineland, NJ, beginning later this year. The GPU services will roll out in several tranches during 2025 and 2026, with the agreement valued at approximately $17.4 billion through 2031. Microsoft could also purchase extra services or capacity as per the terms of the deal, which would raise the total value to around $19.4 billion. While this represents NBIS’ first major long-term contract with a big tech firm, the company has indicated that more multi-faceted deals will likely follow, further solidifying its capacity and reach in the booming AI cloud space.

While the scale-up demands capital, management pointed to significant cash on hand and an opportunistic approach to raising capital on the last earnings call. NBIS has reaffirmed its 2025 capex guidance at $2 billion.

Higher capex can be a concern if revenues do not keep up the required pace to sustain such high capital intensity, especially in a macro environment where AI demand cycles could fluctuate due to competitive pricing. On the last earnings call, NBIS highlighted that it raised $4 billion in debt. NBIS recently announced the closing of its public offering of Class A ordinary shares and private offering of convertible senior notes, which have gross proceeds of nearly $4.2 billion as of Sept. 15, 2025. Other than the MSFT deal, it plans to use some of the proceeds from financing for accelerating business growth, including the purchase of additional compute power and hardware and well-located land plots for expansion of its data center footprint, and for general corporate purposes.

Microsoft is a giant in the tech space, with Azure Cloud being one of the dominant forces in the cloud infrastructure space. MSFT is now rapidly making inroads in the AI infrastructure space. Microsoft is investing aggressively in AI infrastructure, including building its own custom AI chips like Azure Maia and Azure Cobalt. The company is rapidly expanding its data center footprint and has altered every Azure region into an AI-first environment with liquid cooling capabilities, positioning itself at the forefront of the AI infrastructure wave. Over the past year, it has added more than 2 GW of new datacenter capacity and now has over 400 datacenters across 70 regions.

MSFT is integrating across AI capabilities (Copilot) across Office, GitHub and Dynamics, and is focused on innovation to address client requirements. In August 2025, Microsoft unveiled Dion, a model-optimization method improving scalability and efficiency for large-scale AI training. MSFT also introduced its first proprietary AI models, MAI-Voice-1 and MAI-1-preview.

The crown jewel of Microsoft’s AI strategy is its multi-billion-dollar partnership with OpenAI. MSFT has invested $13 billion in OpenAI and has rights to OpenAI IP (includes both model and infrastructure) for use within its products like Copilot, Azure and Bing. Moreover, the Azure platform is the exclusive cloud provider for OpenAI. Through the Azure OpenAI Service agreement, developers can directly access leading OpenAI models supported by Azure and AI infrastructure and tools. The tech giant invests in innovative early-stage tech companies through its M12 venture fund to gain access to the latest technologies.

The efforts are yielding desired results, with the AI business alone having surpassed a $13 billion annual revenue run rate, growing an astounding 175% year over year in the fourth quarter of fiscal 2025, while Microsoft Cloud revenues exceeded $168 billion with 23% growth. Azure and other cloud services achieved a remarkable $75 billion in annual revenue with 34% growth. Given this, the company is planning more than $30 billion in capital expenditures for the first quarter of fiscal 2026 alone, given that it had a massive backlog of $368 billion across MSFT cloud at the end of the fiscal fourth quarter of 2025.

Moreover, its diversified businesses and stupendous financial resources give it an edge. As of June 30, 2025, cash and cash equivalents were $94.56 billion, while operating cash flow generated in the fiscal fourth quarter stood at nearly $42.6 billion. That said, intense competition from other incumbents and emerging players is a concern. Heavy capex spend could strain margins if AI returns do not materialize.

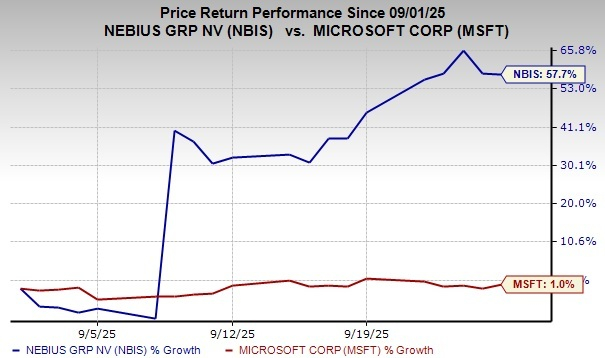

Over the past month, NBIS shares have gained 57.7% while MSFT stock has inched up 1%.

Valuation-wise, both Nebius and Microsoft are overvalued, as suggested by the Value Score of F and D, respectively.

In terms of Price/Book, NBIS shares are trading at 6.73X, lower than MSFT’s 11.07X.

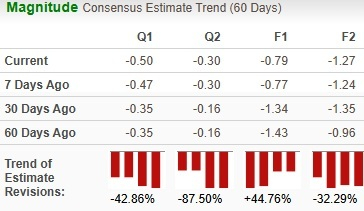

Analysts have significantly revised their earnings estimates for NBIS’ bottom line for the current year.

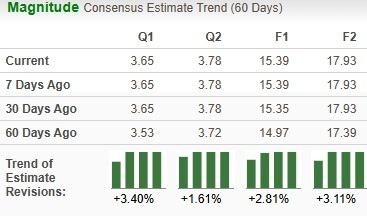

For MSFT, there is a marginal upward revision.

NBIS carries a Zacks Rank #3 (Hold) at present, while MSFT has a Zacks Rank #2 (Buy). Consequently, in terms of Zacks Rank, MSFT seems to be a better pick at the moment.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

AI Stealth Play Receives Bullish Initiation; Data Center Revenue Expected To Grow 64%

NBIS

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite