|

|

|

|

|||||

|

|

Jabil, Inc. JBL reported strong fourth-quarter fiscal 2025 results, with both bottom and top lines surpassing the Zacks Consensus Estimate. The company reported a top-line expansion year over year, driven by healthy traction in the data center infrastructure, capital equipment, healthcare and retail automation end-markets.

JBL recorded a GAAP net income of $218 million or $1.99 per share compared with $138 million or $1.18 in the prior-year quarter. The improvement was primarily driven by top-line growth. Non-GAAP net income improved to $360 million or $3.29 per share from $270 million or $2.3 in the prior-year quarter. The bottom line surpassed the Zacks Consensus Estimate of $2.95. Net sales during the quarter increased to $8.3 billion from $6.96 billion reported in the year-ago quarter. The top line beat the consensus estimate of $7.66 billion. Solid demand in the Intelligent Infrastructure segment boosted the top line.

Jabil’s focus on end-market and product diversification is a key catalyst. The company’s target that “no product or product family should be greater than 5% operating income or cash flows in any fiscal year” is commendable. The diversification increases the reliability of the company’s earnings and revenues, thereby driving long-term returns for investors.

In addition, Jabil’s top-line growth is benefiting from strength in healthcare, cloud, retail and industrial. The company is likely to gain from the increasing adoption of 5G wireless and cloud computing in the long haul. It is benefiting from solid demand in key end markets, excellent operational execution and skillful management of supply chain dynamics.

With a presence across 100 locations in 30 countries, Jabil is likely to gain from secular growth drivers with strong margins and cash flow dynamics. Moreover, its unmatched end-market experience, technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility.

Jabil's extensive manufacturing footprint and strong expertise position it as an ideal partner in the burgeoning AI/ML ecosystem. The company's commitment to providing unparalleled value to customers underscores its strategic importance in the optical module space. The company’s 800G silicon photonics-based optical transceiver modules are designed to fuel the AI/ML revolution, promise unparalleled performance and scalability, thanks to the collaborative efforts of industry giants.

The breakthrough technology leverages Intel Corporation's INTC cutting-edge silicon photonics platform, renowned for its manufacturing efficiency and reliability. Coupled with Jabil's world-class manufacturing capabilities and Intel’s technology prowess, the collaboration sets a new standard for speed, efficiency and reliability in data transmission. Intel's volume-proven silicon photonics platform, with on-chip laser sources fabricated, tested and burned-in at wafer scale, ensures unparalleled reliability and simplicity in module integration. With a focus on reliability, scalability and performance, the new 800G optical transceiver modules are poised to drive significant advancements in data-intensive applications.

However, the tense geopolitical situations between the United States and China, as well as the wars in Europe and the Middle East, remain headwinds for Jabil. Against the backdrop of this global uncertainty, low demand in some consumer-centric markets is negatively impacting the company’s margins. In addition, Jabil operates in a highly competitive environment, facing competition from both domestic and international electronic manufacturers, manufacturing service providers and design providers. Moreover, it has been witnessing a slowdown in multiple end markets in recent quarters. Demand softness in connected living, network and communications verticals is affecting revenues. Fluctuating demand patterns in the electric vehicle market, induced by changes in EV tariffs and government incentives in some regions, are hurting net sales.

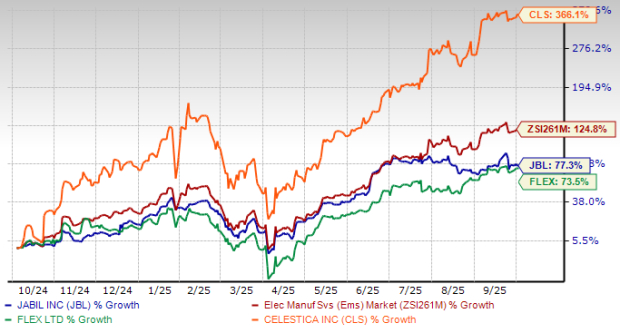

Jabil has gained 77.3% over the past year compared with the industry’s growth of 124.8%. It has outperformed peers like Flex Ltd. FLEX but lagged Celestica Inc. CLS over this period. While Flex gained 73.5%, Celestica was up 366.1%.

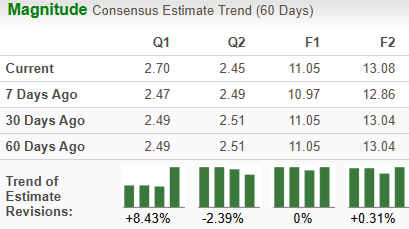

The Zacks Consensus Estimate for Jabil’s fiscal 2026 earnings has increased to $11.05 per share from $10.97 over the past seven days, while the same for fiscal 2027 has increased 1.7% to $13.08. The positive estimate revision depicts bullish sentiments about the stock’s growth potential.

Jabil is bullish on its long-term prospects. The company is well-positioned to capitalize on growth opportunities in areas such as AI data center hardware, power and energy infrastructure, software-defined electric and hybrid vehicles, and healthcare. Strong margins and robust free cash flow are likely to enable continued investment in profitable growth and capital returns to shareholders.

However, stiff competition and softness in key end markets are likely to put pressure on the bottom-line growth. High R&D costs erode its profitability to a large extent. Jabil is facing a tough operating environment amid escalating tariffs and rising raw material costs. With a Zacks Rank #3 (Hold), JBL appears to be treading in the middle of the road, and investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite