|

|

|

|

|||||

|

|

Tesla TSLA delivered 497,099 electric vehicles (EVs) in the third quarter of 2025, up 7.4% year over year and surpassing our estimate of 435,370 units. Deliveries included 481,166 Model 3/Y and 15,933 other vehicles, marking the highest quarterly total in the company’s history. With the $7,500 EV tax credit expiration at the end of September, many customers likely rushed to purchase vehicles to take advantage of the incentive, fueling third-quarter demand.

It wasn’t just Tesla that benefited from this “pull forward” effect. Auto giants like Ford F and General Motors GM also logged record EV sales for three months ending September. Ford’s EV sales surged more than 30%, while GM more than doubled its tally.

With that being the general momentum across the broader industry, the key question is whether it is wise to buy Tesla stock now?

While Tesla doesn’t officially break down sales by region, the third-quarter jump likely came from the United States. In Europe, however, the company has been facing weakening demand amid intensifying competition from both legacy automakers and Chinese EV players, alongside a backlash tied to Elon Musk’s political activities. The European Automobile Manufacturers’ Association reported that Tesla sold 8,220 vehicles in the EU in August, down about 37% year over year, as cited by Yahoo Finance.

China presents a slightly better picture. According to the China Passenger Car Association (CPCA), Tesla’s August deliveries declined 9.9% year over year but climbed more than 40% from July, per CnEVPost. Between January and August, Tesla only posted year-over-year growth in March and June but September is expected to be stronger. In August, Tesla also launched the Model Y L — a stretched, six-seat version of its popular SUV designed for Chinese families seeking larger vehicles. The new variant is anticipated to help reignite demand in the region.

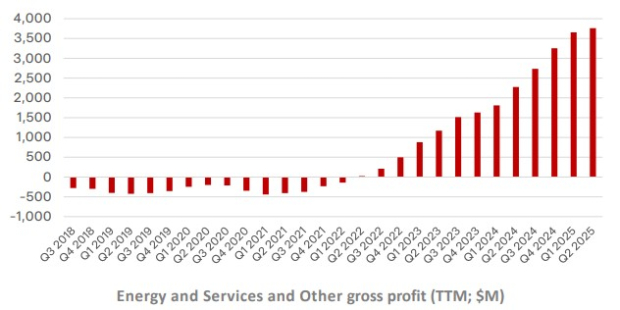

Tesla's Energy Generation and Storage business continues to grow rapidly, driven by strong demand for Megapack and Powerwall products. This segment now delivers the company’s highest margins. Tesla deployed 12.5 GWh of energy storage products in the third quarter of 2025, setting a new quarterly record.

Tesla Energy allows utilities to expand reliance on intermittent solar and wind power by stabilizing the grid with Megapacks. With U.S. grids under strain, utilities are increasingly turning to Tesla solutions. Since becoming profitable in mid-2022, the unit has generated profits for 13 straight quarters.

The company is now pivoting big into artificial intelligence (AI), autonomous driving and robotics. Tesla’s robotaxi services, launched in June in Austin, have since expanded to California, Nevada and Arizona.The company’s fleet advantage—millions of vehicles already equipped with self-driving hardware—positions it for scale once regulations allow.

The latest Full Self-Driving (FSD) v14 was launched last week, with v14.2 coming soon. Tesla is also advancing its Optimus humanoid robot, expected to enter mass production next year. Already performing tasks in Tesla factories, Optimus underscores management’s view that autonomy and AI represent Tesla’s greatest competitive edge.

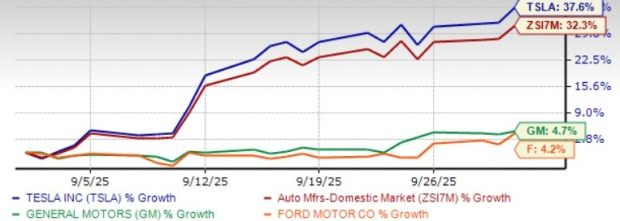

Last month, shares of Tesla rose roughly 37%, outperforming the industry and legacy U.S. automakers — Ford and General Motors.

The surge was fueled by Musk’s declaration of stepping away from politics, the board’s proposed $1 trillion pay package, and Musk’s $1 billion stock purchase. Investors viewed these developments as signals of renewed commitment.

The proposed compensation plan ties payouts to ambitious milestones, boosting adjusted EBITDA 25-fold to $400B by 2035, achieving an $8.5T market cap (from ~$1.3T today), selling 20M vehicles annually, and deploying 1M each of robotaxis and humanoid robots. The board’s move underscores its reliance on Musk’s leadership to deliver on Tesla’s long-term AI and autonomy ambitions. (Can Musk's $1T Pay Package Keep Tesla on the Fast Track?)

Shortly after, Musk scooped up $1 billion worth of company shares. Basically, the board bet that Musk’s leadership is the only way Tesla can successfully pivot into AI, autonomous vehicles and robotics. And Musk’s $1 billion share purchase added to that narrative of commitment.

But should investors look past Tesla’s ongoing challenges and just bet on promises that may take years to materialize?

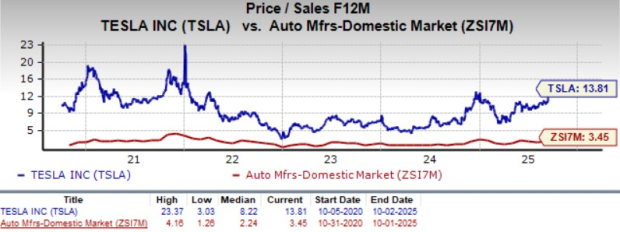

From a valuation perspective, Tesla appears stretched. Based on its price/sales ratio, the company is trading at a forward sales multiple of 13.81, way higher than the industry as well as its own 5-year average.

Through the first three quarters of 2025, Tesla sold over 1.2 million vehicles, down on a year-over-year basis. The third quarter was strong, but it was largely in line with industry momentum. Investors should note that Musk warned of “rough quarters ahead” on the last earnings call, making third-quarter commentary crucial. Historically, Tesla boosts sales through incentives and price cuts in the fourth quarter, but such moves weigh on already pressured margins. The Zacks Consensus Estimate for Tesla’s 2025 revenues and EPS implies a year-over-year contraction of 5.2% and 31.4%, respectively.

While recent events—Musk’s stock purchase, pay package, record third-quarter deliveries—have fueled optimism, questions over Tesla’s demand trajectory, especially overseas, still linger. Rising competition and long-term projects (AI, robotaxis, humanoids) may take years to materially impact results. So, it’s better to wait for more clarity before rushing to buy the stock. The stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Elon Musk: Tesla FSD Coming To Europe, Alongside Cybercab, Optimus Production

TSLA

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite