|

|

|

|

|||||

|

|

Hologic HOLX is a long-standing innovator in developing and advancing technologies to help detect and treat breast cancer. The Massachusetts-based MedTech firm rang the Nasdaq opening bell for the 19th consecutive year to mark Breast Cancer Awareness Month, an annual event that highlights the critical role of early detection, which can lead to a 99% survival rate. With recent survey findings revealing nearly half of women who are recommended a mammogram either skip or delay the exam, Hologic’s #BustTheMyth patient education campaign continues to help break down barriers around screening, educate patients about breast density and help more women access potentially lifesaving care.

On Friday, shares of Hologic ended the session at $68.22, up 0.5% from the previous close and 31.4% above its 52-week low. The stock also continues to show long-term bullish prospects, trading above both 50 and 200-day simple moving averages (SMAs).

The company is working with top researchers worldwide to advance its artificial intelligence (AI)-powered mammography technology and improve care for women. At the European Society of Breast Imaging Annual Scientific Meeting in Aberdeen, Scotland, last month, Hologic presented findings from two studies. At Massachusetts General Hospital in the United States, roughly 600 exams using Hologic’s Genius AI Detection 2.0 solution were retrospectively analyzed to determine whether AI scores are associated with tumor characteristics. Results showed that AI case scores were higher for higher-grade tumors and node-positive cancers — features associated with more aggressive disease.

Another study compared the solution with 108 radiologists reviewing 75 clinically challenging breast cancer cases. The AI technology showed similar performance to radiologists in finding cancers, with higher sensitivity but lower specificity, suggesting its potential effectiveness in early diagnosis of breast cancer. In addition, Hologic showcased its latest breast surgery innovation, including the next-generation Sentimag Gen 3 device, developed by Endomagnetics for tumor localization and breast cancer staging. It was launched in Europe earlier this year.

Throughout fiscal 2025, investors have been closely monitoring Hologic’s Breast Health segment as it worked through a challenging period and is now headed toward growth. Much of this progress is due to solid execution by the new commercial leadership team, including reorganizing the sales structure between capital and disposable product sales reps and rolling out a refined end-of-life strategy for older gantries. Even as replacement cycles for gantries have lengthened, the company is confident that its leading market share remains intact, supported by competitive wins in recent quarters.

The interventional breast health unit is also emerging as a strong growth driver, reaching $100 million for the first time in the third quarter of fiscal 2025. Hologic’s acquisition of Endomagnetics in 2024 added wire-free breast surgery localization and lymphatic tracing solutions to the portfolio. This year, the company started selling the products directly through its sales force. The move positions Hologic to address the sizable market opportunity for wireless localization.With Endomag becoming part of organic sales, it further bolsters the prospects of interventional sales.

Furthermore, Hologic plans to commercially launch the Envision Mammography Platform next year. The FDA-approved, contrast-enhanced mammography technology offers the fastest 3D scan time on the market at 2.5 seconds, alongside enhanced imaging and workflow efficiencies. Another breakthrough solution, Genius AI Detection PRO acts as an all-in-one, artificial intelligence (AI) assistant for the radiologist, combining 2D and 3D deep learning algorithms for increased accuracy and faster throughput, and providing up to a 24% reduction in reading time. Earlier this year, Hologic also secured the CE mark for its Affirm Contrast Biopsy Software since receiving the FDA clearance in October 2020.

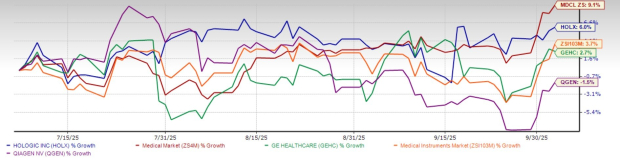

Hologic shares have gained 6% over the past three months compared with the industry’s 3.7% growth and trailing behind the Medical sector’s 9.1% rise. Among peers, GE Healthcare GEHC has climbed 2.7%, while QIAGEN QGEN is down 1.5%.

Hologic’s stock is trading at a forward five-year Price-to-Earnings (P/E) of 15.19X, lower than its median of 17.66X and 27.46X industry average. GE Healthcare and QIAGEN, in comparison, trade at P/E of 15.90X and 18.97X, respectively.

The company manufactures most of its GYN Surgical and Breast Health interventional products at its Costa Rica facility, and sources raw materials and components from China. Through changes to the global supply chain, operating model and procurement efforts, Hologic expects to bring down the quarterly gross impact to $10-$12 million for fiscal 2026 from the earlier $20-$25 million estimate. This equates to roughly 100 basis points of headwind to the gross margin compared to fiscal 2025.

Outside the United States, the Diagnostics business remains challenged. The HIV testing business in Africa continues to be affected by reduced USAID funding. Cytology, historically the largest contributor to the company’s China revenues, has been impacted by rising tariff implications, anti-American sentiment and growing local competition. To derisk itself from future geopolitical turmoil, Hologic had lowered its China revenue forecast to only $50 million.

Hologic is actively working to debunk the widely prevailing misconceptions around breast cancer, which has resulted in an alarming toll of women missing potentially lifesaving screenings. The Breast Health division is also rebounding, supported by new leadership moves, acquisitions and cutting-edge innovations. Given its technical strength and cheap valuation, the Zacks Rank #3 (Hold) stock is a good option for existing shareholders to retain. However, potential investors may opt for a better entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite