|

|

|

|

|||||

|

|

Core Laboratories Inc. CLB is a global leader in providing innovative technology and expertise that helps oil and gas companies unlock the full potential of their reservoirs. The company specializes in reservoir description, production enhancement and reservoir management services, delivering critical insights that drive smarter decision-making and increased hydrocarbon recovery.

Core Labs plays a vital role in the oil and gas sector by offering precise, data-driven solutions that improve exploration success, optimize production and extend the life of oil and gas fields. CLB’s cutting-edge technologies and deep reservoir knowledge make it an indispensable partner in meeting the world’s energy demands efficiently and sustainably.

However, CLB has underperformed significantly year to date (“YTD”), with a decline of 29.9%, lagging behind the Oil & Gas Field Services sub-industry (ZS131M), which fell only 2.2%. Among its peers, RPC Inc. RES also declined by a smaller margin of 19.4% YTD, showing better resilience compared with CLB. But, Liberty Energy LBRT and ProPetro Holding PUMP experienced even steeper YTD losses of 35.1% and 40.9%, respectively.

This indicates that while CLB has struggled more than the overall sub-industry and some competitors, it has performed better than the weakest peers, such as Liberty Energy, reflecting mixed investor confidence and challenging market conditions across the oilfield services industry.

Although CLB, the Houston-based oil and gas equipment and services firm, has experienced a recent downturn, it continues to capture the interest of investors. Many see its lower stock price as a potential entry point. As market focus shifts toward future prospects, it is crucial to analyze the factors driving the company’s current performance.

Recent setbacks have raised questions about CLB’s trajectory. Are they signs of deeper issues or the groundwork for a rebound? Let us examine the fundamentals and risk factors influencing the outlook.

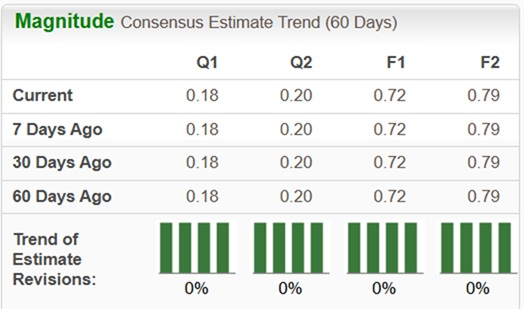

Over the past 60 days, the Zacks Consensus Estimate for CLB’s earnings per share has remained unchanged for both 2025 and 2026, indicating a stable outlook from analysts.

Strong Sequential Financial Improvement and Profitability Expansion: CLB demonstrated a solid recovery in the second quarter of 2025, with revenues increasing 5% sequentially to $130.2 million. More importantly, the company significantly improved its profitability metrics, operating income excluding items rose more than 23% sequentially and operating margins expanded 160 basis points to 11%. This performance, highlighted by incremental margins of 41%, indicates effective operational leverage and cost control, implying the company can deliver substantial profit growth as revenues continue to climb.

Disciplined Capital Allocation Focused on High Returns: CLB’s management remains sharply focused on its long-standing financial tenets of maximizing free cash flow and return on invested capital. The company's asset-light model ensures capital expenditures are minimal, historically ranging from 2.5% to 4% of revenues. This discipline is reflected in a return on invested capital of 9% for the second quarter, demonstrating efficient use of capital to generate value for shareholders.

Strategic Expansion in Key Growth Regions Like the Middle East: CLB is proactively capitalizing on growth opportunities in strategically important regions. The company opened a new state-of-the-art Unconventional Core Analysis Laboratory in Dammam, Saudi Arabia, in the second quarter. This expansion allows Core Labs to directly support early-stage development of unconventional resources, leveraging proprietary technologies. While Liberty Energy also targets international growth, CLB’s advanced laboratory capabilities may give it a technological edge in emerging markets.

Industry-Leading Proprietary Technology and Product Deployment: The company continues to distinguish itself through proprietary technologies, which solve critical client problems and create high-value revenue streams. For example, the Plug and Abandonment Circulation system saved a client an estimated $4 million on a North Sea plug-and-abandonment operation and the 3AB tracer technology enabled a West Texas operator to optimize proppant designs quickly. These innovations reinforce CLB's technological moat, positioning it ahead of competitors like RPC, which relies more heavily on traditional service offerings.

Limited Near-Term Growth Guidance for Reservoir Description: CLB's guidance for the third quarter of 2025 projects Reservoir Description revenues to be flat sequentially. This indicates that the strong sequential rebound seen in the second quarter may be stalling, reflecting the ongoing uncertainties in the market. Unlike ProPetro Holding, which is seeing more aggressive growth in fracturing services, CLB’s stagnation in its largest segment may dampen investor enthusiasm.

Modest Dividend Yield: CLB pays a quarterly dividend of 1 cent per share. While returning cash to shareholders is positive, this translates to a very modest dividend yield. Income-focused investors may find this payout unattractive compared with other income-generating investments, as the primary component of shareholder returns is currently expected to come from share repurchases and potential capital appreciation.

Intense Competitive Pressure in the Oilfield Services Sector: CLB operates in a highly competitive sector where its technologies are continuously benchmarked against rivals. For instance, in a recent shaped charge performance test in Canada, Core Labs outperformed competitors, including Liberty Energy. However, the ongoing need to prove technological superiority highlights the pressure on maintaining pricing power and market share in an industry where players like ProPetro Holding are expanding aggressively.

Ongoing Geopolitical and Trade Policy Headwinds: Geopolitical conflicts, evolving sanctions and tariffs create significant uncertainty for CLB. These external factors disrupted demand for high-margin lab services tied to crude oil trading in the first quarter and remain a headwind. While all industry peers, including RPC and Liberty Energy, face similar challenges, CLB’s specific exposure to laboratory assay services makes it more vulnerable to these unpredictable swings.

CLB has shown notable sequential financial improvement, with rising revenues and expanded profitability, supported by disciplined capital allocation and a strong focus on high-return investments. The company's strategic expansion into high-growth regions like the Middle East and deployment of industry-leading proprietary technologies further strengthen its competitive positioning.

However, limited near-term growth guidance for its key Reservoir Description segment, a modest dividend yield, and ongoing competitive and geopolitical pressures pose significant challenges. These factors may constrain near-term upside despite the company's operational strengths. Given this mix of strengths and potential challenges, investors should wait for a more opportune entry point instead of adding this Zacks Rank #3 (Hold) stock to their portfolios.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| Feb-17 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite