|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

MercadoLibre MELI shares have declined 13% over the past three months, underperforming the Zacks Retail-Wholesale sector and the Zacks Internet-Commerce industry’s growth of 3.4% and 5.7%, respectively.

The decline in MELI’s performance reflects investor concerns over its rapid credit expansion, heavy dependence on Latin American markets and intensifying competition from global peers. The stock’s pullback signals growing caution toward near-term business momentum and earnings visibility amid these structural challenges.

MELI’s fintech arm, Mercado Pago, is expanding at a pace that looks increasingly unsustainable. Fintech revenues jumped 40% year over year in the second quarter of 2025 to $2.95 billion, outpacing commerce revenue growth of 22% in the same period. Total payment volume climbed 39% to $64.6 billion, while the credit portfolio surged 91% year over year to $9.3 billion, a growth rate that raises serious questions about discipline and asset quality.

Credit cards accounted for 43% of MELI’s loan book during the second quarter, up from 37% a year ago, suggesting a shift toward higher-risk assets. Non-performing loans over 90 days remained high at 18.5%, and provisions continued to increase as MELI issued more than 1.5 million new cards during the quarter. Net Interest Margin After Losses fell to 23% from 31.1% last year, showing that returns are weakening even as exposure grows.

The Zacks Consensus Estimate for third-quarter 2025 total payment volume is pegged at $71.66 billion, indicating an increase of 32.9% year over year. While this points to continued traction in Mercado Pago, it also suggests the scale of exposure MELI carries into a volatile credit environment. Sustaining such growth without tightening lending standards could pressure future earnings and weigh on balance-sheet resilience.

Such rapid credit expansion leaves MELI vulnerable to default cycles in economies already facing inflationary pressures and volatile interest rates. Rather than reinforcing its fintech moat, this credit-driven growth strategy is amplifying risk concentration and undermining the stability of future earnings. Unless the company imposes stricter underwriting standards and reduces dependence on credit-led growth, its fintech arm could shift from a growth catalyst to a structural liability.

Rising competition is testing MELI’s leadership across Latin America. Amazon AMZN is expanding its logistics and delivery network in Brazil and Mexico, narrowing MELI’s fulfilment advantage. Amazon’s scale and its ability to cross-subsidise e-commerce with profits from cloud and advertising give it flexibility that MELI lacks. To counter Amazon’s growing reach, MELI continues to lower shipping thresholds and increase marketing spend, moves that lift volume but pressure efficiency.

Sea Limited’s SE Shopee platform has gained traction in Brazil and Mexico by targeting value-focused shoppers through flash discounts and gamified engagement. Shopee’s rise is prompting MELI to defend its share in price-sensitive categories such as fashion and consumer electronics. As Sea Limited broadens its seller base, competition for merchants is intensifying.

Meanwhile, eBay EBAY is expanding its cross-border marketplace, offering regional sellers global visibility at lower fees. eBay’s established brand trust and strategic partnerships are drawing merchants from MELI’s ecosystem. Collectively, Amazon, Sea Limited and eBay are reshaping Latin America’s e-commerce market, forcing MELI to spend more to sustain growth.

MELI’s reliance on Brazil, Argentina and Mexico leaves it heavily exposed to regional volatility, offering little protection against policy or currency shocks. These three markets accounted for more than 90% of total revenues in the second quarter of 2025, highlighting the company’s limited geographic breadth.

In Brazil, FX-neutral gross merchandise volume grew 29% year over year in the second quarter of 2025, helped by lower free-shipping thresholds that lifted transaction volumes but weighed on pricing discipline. The Zacks Consensus Estimate for third-quarter 2025 Brazil revenues is pegged at $3.62 billion, up 17.4% year over year, while consensus marks for Argentina and Mexico revenues are pegged at $1.56 billion and $1.54 billion, increasing 14.2% and 10.3%, respectively.

Argentina remains the primary challenge within MELI’s regional mix. The economy continues to struggle with persistent inflation and currency volatility, both of which have weighed on consumer spending and business confidence. These conditions led to a $117 million foreign-exchange loss in the second quarter of 2025, directly impacting profitability. With such concentrated exposure, MELI’s earnings outlook remains vulnerable to further currency depreciation and uneven recovery trends across Latin America.

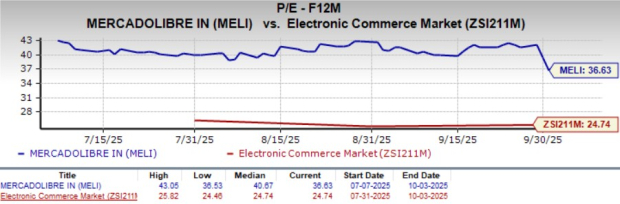

MELI is trading at a premium compared to the broader Zacks Internet-Commerce industry. The stock currently carries a forward P/E of 36.63X, well above the industry average of 24.74X and the broader Retail-Wholesale sector’s 24.9X. MELI holds a Value Score of D, reinforcing an unattractive valuation setup at present.

This premium appears difficult to justify given the company’s rapid credit expansion, concentrated exposure to Brazil, Argentina and Mexico and rising competition from Amazon, eBay and Sea Limited. Each of these factors adds pressure to earnings visibility and amplifies risk at a time when growth is already moderating.

The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $9.88 per share, unchanged over the past 30 days. While the estimate still points to 26.18% year-over-year growth, the combination of an elevated valuation, slowing momentum, and persistent regional uncertainty makes the stock’s risk-reward profile unattractive at current levels.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

MercadoLibre’s near-term outlook remains challenged by rising credit exposure, intensifying competition and heavy reliance on a few volatile markets. Despite continued top-line growth, profitability pressures and an overstretched valuation make the stock look unattractive at current levels. Given these trends, MercadoLibre’s Zacks Rank #4 (Sell) appears well-justified, and investors should stay away from the stock for now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite