|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

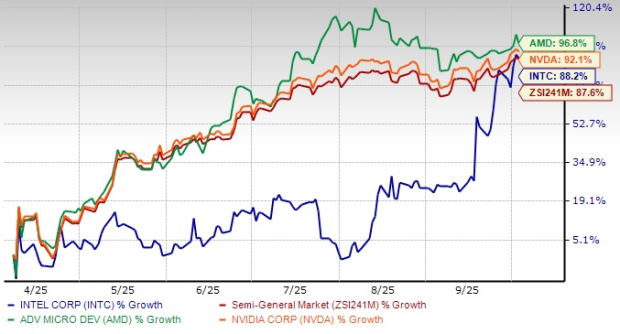

Intel Corporation INTC has surged 88.2% in the past six months compared with the industry’s growth of 87.6%. It has, however, lagged its peers, Advanced Micro Devices, Inc. AMD and NVIDIA Corporation NVDA. Advance Micro has gained 96.8%, while NVIDIA has soared 92.1% over the same period.

One-Year INTC Stock Price Performance

With the appointment of David Zinsner and Michelle Johnston Holthaus as interim Co-CEOs, replacing former CEO Pat Gelsinger, Intel is undertaking a comprehensive review of its businesses to put the company back on its growth trajectory. Interim management has vouched to keep the core strategy unchanged despite efforts to drive operational efficiency and agility. The company is emphasizing the diligent execution of operational goals to establish itself as a leading foundry.

Intel is witnessing healthy traction in Artificial Intelligence (AI) PCs that have taken the market by storm. It remains firmly on track to ship more than 100 million by the end of 2025. Panther Lake — the chip based on Intel 18A and the architectural successor to the well-received Lunar Lake – is slated to be launched this month, while Clearwater Forest — the first Intel 18A server product — is likely to be unveiled in the first half of 2026.

The company has introduced Intel Core Ultra, which features a neural processing unit that enables power-efficient AI acceleration with 2.5x better power efficiency than the previous generation. With superior GPU and CPU capabilities, it can speed up AI solutions. The company also launched the new vPro platform with an Intel Core Ultra processor that delivers enhanced power efficiency. With dedicated AI acceleration capability spread across the CPU, GPU and the new neural processing unit, it will unlock an endless new wave of AI experiences across all apps. This is likely to give healthy competition to NVIDIA and Advanced Micro's new GPU lineups for PC gaming.

Intel has secured a $5 billion investment from NVIDIA to jointly develop cutting-edge solutions that are likely to play an integral role in the evolution of the AI infrastructure ecosystem. Leveraging the core strengths of both firms, namely NVIDIA’s AI and accelerated computing and Intel’s CPU technologies and x86 ecosystem, the collaboration is expected to sow the seeds of innovation through the development of state-of-the-art custom data center and PC products.

In August 2025, Softbank invested $2 billion in Intel to propel AI research and development initiatives that support digital transformation, cloud computing and next-generation infrastructure. The investment enabled Softbank to gain about 2% ownership in Intel, with the former paying $23 per share. This followed $7.86 billion in direct funding from the U.S. Department of Commerce under the U.S. CHIPS and Science Act to advance critical semiconductor manufacturing and advanced packaging projects in Arizona, New Mexico, Ohio and Oregon. The significant capital infusions will enable Intel to expand its manufacturing capacity to accelerate its IDM 2.0 (Integrated Device Manufacturing) strategy.

Despite the uptrend, it appears that Intel has a lot of work to do to catch up with its rivals. While most competitors evolved with changing demand patterns, Intel fell behind others as it clung to its legacy products. For example, despite making significant inroads in AI chips, Intel lagged NVIDIA on the innovation front with the latter’s H100 and Blackwell graphics processing units (GPUs) being runaway successes. This offered a competitive advantage to NVIDIA, with leading technology companies reportedly piling up NVIDIA’s GPUs to build clusters of computers for their AI work.

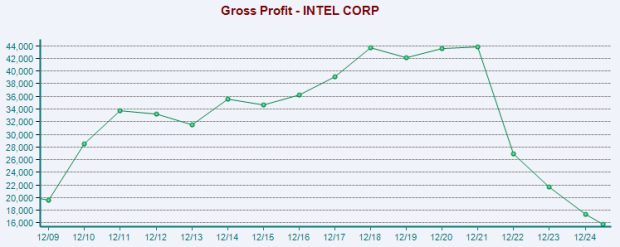

Moreover, Intel has been facing challenges due to the disruptive rise of over-the-top service providers in this dynamic industry. This has affected its margins. Price-sensitive competition for customer retention in the core business is expected to intensify in the coming days. An accelerated ramp-up of AI PCs has significantly affected Intel’s short-term margins, as it shifted production to its high-volume facility in Ireland, where wafer costs are typically higher. Margins were also adversely impacted by higher charges related to non-core businesses, charges associated with unused capacity and an unfavorable product mix. Competitive pricing pressure from rivals has further dented its profitability.

China accounted for more than 29% of Intel's total revenues in 2024, making it the single largest market for the company. However, the communist nation's purported move to replace U.S.-made chips with domestic alternatives significantly affected INTC’s revenue prospects. The directive to phase out foreign chips from key telecom networks by 2027 underscores Beijing's accelerating efforts to reduce reliance on Western technology amid escalating U.S.-China trade and tariff tensions.

As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in critical industries. This shift poses a dual challenge for Intel, as it faces potential market restrictions and increased competition from domestic chipmakers. In addition, weaker spending across consumer and enterprise markets, especially in China, resulted in elevated customer inventory levels.

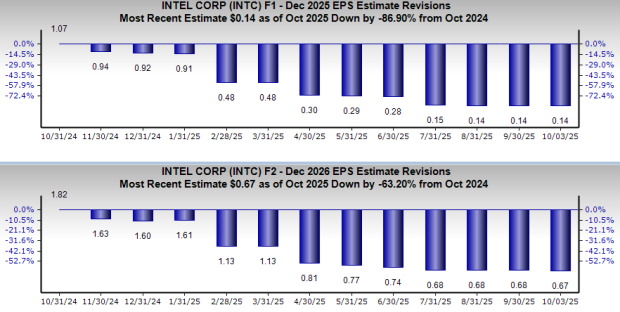

Earnings estimates for Intel for 2025 have moved down 86.9% to 14 cents over the past year, while those for 2026 have declined 63.2% to 67 cents. The negative estimate revision depicts bearish sentiments for the stock.

Intel's innovative AI solutions hold immense promise for the broader semiconductor ecosystem. By addressing the challenges of scalability, performance and interoperability, it is paving the way for widespread AI adoption across enterprises worldwide. Management is focusing on simplifying parts of its portfolio to unlock efficiencies and create value. Significant capital infusion to revive its lost glory is likely to spur growth. All these efforts appear to resonate well, as exhibited by an uptrend in the stock price performance.

However, the recent product launches appear “too little too late” for Intel. In addition, margin woes amid strict export restrictions, unfavorable product mix and elevated customer inventory levels weigh on its bottom line. Declining earnings estimates remain an overhang. With a Zacks Rank #3 (Hold), Intel appears to be treading in the middle of the road, and investors could be better off if they exercise caution and stay invested for long-term gains. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 40 min | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

AMD NVDA

Investor's Business Daily

|

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 12 hours | |

| 12 hours | |

| 14 hours | |

| 15 hours | |

| 15 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite