|

|

|

|

|||||

|

|

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the electronic components & manufacturing industry, including Rogers (NYSE:ROG) and its peers.

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

The 10 electronic components & manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.5% while next quarter’s revenue guidance was in line.

Luckily, electronic components & manufacturing stocks have performed well with share prices up 11.3% on average since the latest earnings results.

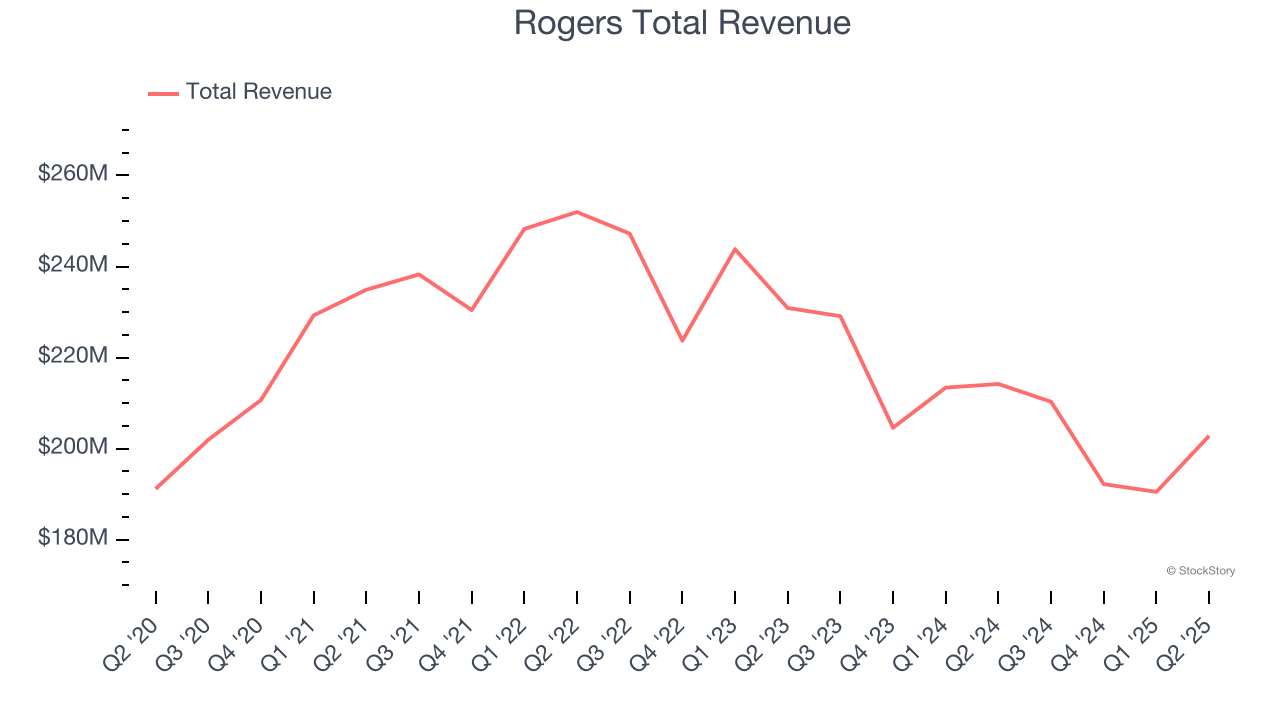

With roots dating back to 1832, making it one of America's oldest continuously operating companies, Rogers (NYSE:ROG) designs and manufactures specialized engineered materials and components used in electric vehicles, telecommunications, renewable energy, and other high-performance applications.

Rogers reported revenues of $202.8 million, down 5.3% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS guidance for next quarter estimates.

"As anticipated, second quarter sales increased sequentially due to incremental improvements across most end markets,” stated Ali El-Haj, Rogers' Interim President and CEO.

Interestingly, the stock is up 28.8% since reporting and currently trades at $84.49.

Read our full report on Rogers here, it’s free for active Edge members.

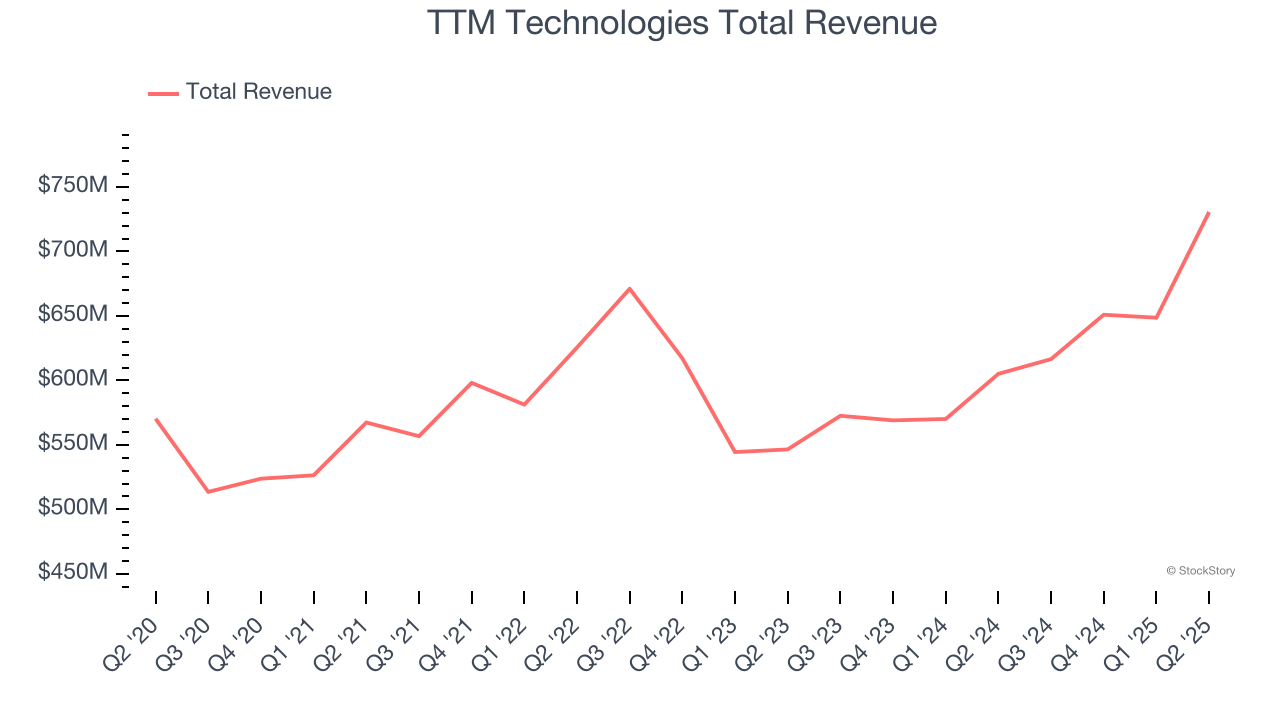

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ:TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

TTM Technologies reported revenues of $730.6 million, up 20.7% year on year, outperforming analysts’ expectations by 9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS guidance for next quarter estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 24.5% since reporting. It currently trades at $60.70.

Is now the time to buy TTM Technologies? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating as a critical behind-the-scenes partner for complex technology products since 1979, Benchmark Electronics (NYSE:BHE) provides advanced manufacturing, engineering, and technology solutions for original equipment manufacturers across aerospace, medical, industrial, and technology sectors.

Benchmark reported revenues of $642.3 million, down 3.5% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a mixed quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations.

As expected, the stock is down 1.7% since the results and currently trades at $38.59.

Read our full analysis of Benchmark’s results here.

With roots dating back to 1896 and a global manufacturing footprint, CTS (NYSE:CTS) designs and manufactures sensors, connectivity components, and actuators for aerospace, defense, industrial, medical, and transportation markets.

CTS reported revenues of $135.3 million, up 4% year on year. This number surpassed analysts’ expectations by 2%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

CTS had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $40.09.

Read our full, actionable report on CTS here, it’s free for active Edge members.

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

Knowles reported revenues of $145.9 million, down 28.7% year on year. This result topped analysts’ expectations by 4.4%. It was a very strong quarter as it also put up an impressive beat of analysts’ EPS guidance for next quarter estimates and revenue guidance for next quarter slightly topping analysts’ expectations.

Knowles had the slowest revenue growth among its peers. The stock is up 30.8% since reporting and currently trades at $24.41.

Read our full, actionable report on Knowles here, it’s free for active Edge members.

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite