|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Bio-Techne TECH continues to expand its portfolio and enter adjacent markets via acquisitions and strategic investments. Strength in international markets underscores the company’s growth potential. Sound financial health further bodes well for the stock. Meanwhile, adverse macroeconomic impacts and intense competition may pose operational risks for Bio-Techne.

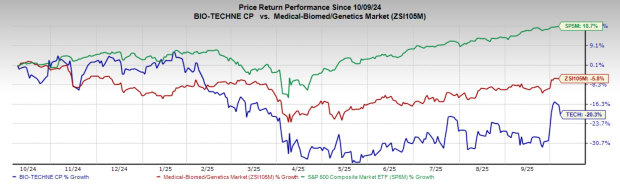

In the past year, shares of this Zacks Rank #3 (Hold) company have declined 20.3% compared with the industry’s 5.8% fall. Meanwhile, the S&P 500 composite has risen 18.7% in the same time frame.

The renowned life sciences company has a market capitalization of $9.64 billion. TECH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 9.2%.

Let’s delve deeper.

Expansion Through Strategic Acquisitions: In fiscal 2024, the company completed the acquisition of Lunaphore. Despite recent order timing delays in certain regions, the platform delivered nearly 50% growth for the full year, with momentum supported by strong order trends. Bio-Techne also owns a 20% stake in Wilson Wolf and remains on track to acquire the remaining ownership by the end of calendar year 2027 or earlier, contingent upon milestone achievements. Wilson Wolf delivered more than 20% growth in fiscal 2025 while maintaining EBITDA margins above 70%, underscoring its value as a growth driver.

In addition, the company introduced its ProPak GMP Cytokines, optimized for use with Wilson Wolf’s G-Rex bioreactors, supporting closed-system CAR-T and TCR-T manufacturing workflows. Bio-Techne reinforced its leadership in RUO assays through a strategic distribution partnership with Sphere Bio, building on its prior participation in Sphere Bio’s $45 million Series A funding round in 2024. This collaboration will expand access to ultrasensitive immunoassays targeting key Alzheimer’s disease biomarkers, such asp-tau217 and NfL.

International Prospects: Bio-Techne’s core portfolio of research reagents and diagnostic tools, which includes a catalog of more than 6,000 protein and 400,000 antibody types, remains foundational to virtually all life science academic and biopharma research labs globally. In terms of organic growth by region, in the fiscal fourth quarter, sales in the Americas increased in the low single digits, supported primarily by large pharma demand. Sales in Europe expanded in mid-single digits on strength from biopharma and steady academic activity.

APAC, excluding China, grew in the low single digits, while China delivered a positive surprise, increasing by low double digits as demand improved ahead of anticipated tariff impacts. This growth was broad-based across research reagents, GMP products, analytical instrumentation and spatial biology solutions, reflecting stabilization in the region and a return to modest growth momentum.

Stable Solvency: With a total debt of $346 million as of June 30, 2025, Bio-Techne looks quite comfortable from the liquidity point of view. The company’s cash and cash equivalents were $162 million at the end of the fourth quarter of fiscal 2025. Although the quarterly debt was much higher than the corresponding cash and cash equivalent level, the company had no short-term payable debt on its balance sheet.

A Choppy Macro Environment: The challenging macroeconomic scenario continues to drive higher-than-anticipated increases in raw material and labor costs. These pressures have had broader economic impacts, weighing on the company’s business through calendar years 2024 and 2025. In addition, escalating global tariffs, most notably China’s duties on U.S.-exported proteomic analytical instruments, have introduced new operational headwinds and placed temporary pressure on margins despite Bio-Techne’s mitigation efforts. Reflecting these dynamics, in the fourth quarter of fiscal 2025, the company’s cost of sales rose 15%, while selling, general and administrative expenses increased 47.2% year over year.

Competitive Landscape: Bio-Techne encounters a wide variety of competitors, including a number of large, global companies or divisions of such companies with substantial capabilities and resources, as well as a number of smaller, niche competitors with specialized product offerings. The company has seen increased competition in several of its markets due to the entry of new companies into certain markets, the entry of competitors based in low-cost manufacturing locations and increasing consolidation in particular markets. Consolidation trends in the pharmaceutical, biotechnology and diagnostics industries have created fewer customer accounts and concentrated purchasing decisions for some customers, resulting in increased pricing pressure on the company.

In the past 30 days, the Zacks Consensus Estimate for the company’s fiscal 2026 earnings has remained constant at $2.00.

The Zacks Consensus Estimate for fiscal 2026 revenues is pegged at $1.24 billion, suggesting a 1.7% rise from the year-ago reported number.

Some better-ranked stocks in the broader medical space are Phibro Animal Health PAHC, Masimo MASI and Cardinal Health CAH.

Phibro Animal Health has an earnings yield of 6.5% compared with the industry’s 0.5% growth. Shares of the company have surged 69.6% against the industry’s 0.2% fall. PAHC’s earnings outpaced estimates in each of the trailing four quarters, with the average surprise being 27.9%.

PAHC sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo, carrying a Zacks Rank #2 (Buy), has an earnings yield of 3.77% against the industry’s 4.4% fall. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 13.8%. MASI shares have rallied 4.7% against the industry’s 12.8% drop in the past year.

Cardinal Health, carrying a Zacks Rank #2, has an estimated long-term earnings growth rate of 12.5% compared with the industry’s 9.7% growth. Shares of the company have risen 36.7%, outpacing the industry’s growth of 1.9%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 9.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite