|

|

|

|

|||||

|

|

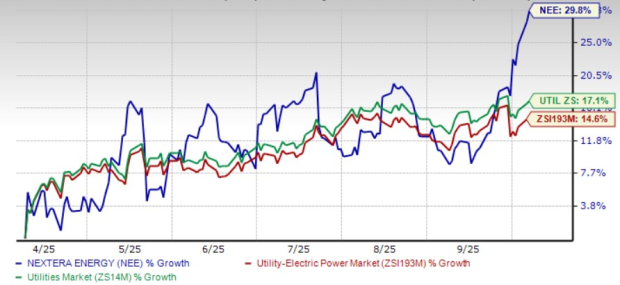

Shares of NextEra Energy (NEE) have gained 29.8% in the past six months compared with the Zacks Utility - Electric Power industry’s rally of 17.1%. The company has also outperformed the Zacks Utilities sector’s return of 14.6% in the same time frame.

NextEra Energy’s climbing share price reflects its robust operational performance and expanding customer base, which continue to drive demand for its services. Meanwhile, declining interest rates are expected to lower capital costs, further strengthening the outlook for this capital-intensive utility.

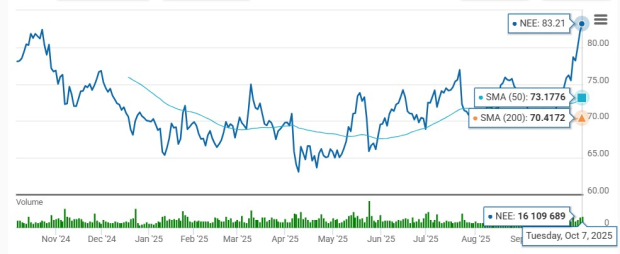

NextEra is trading above its 50-day and 200-day simple moving average (SMA), signaling a bullish trend. The 50-day and 200-day SMAs are key indicators for traders and analysts to identify support and resistance levels. It is considered particularly important, as this is the first marker of an uptrend or downtrend of the stocks.

Should you consider adding NEE to your portfolio only based on positive price movements? Let’s delve deeper and find out the factors that can help investors decide whether it is a good entry point to add NEE stock to their portfolio.

The strengthening Florida economy is boosting NextEra Energy’s growth prospects by creating new demand opportunities. With rising demand for clean electricity, the company is well-positioned to meet it through strategic investments in infrastructure upgrades and expansion. Additionally, its subsidiary, Florida Power & Light Company (“FPL”), offers residential rates well below the national average, providing a key competitive edge that continues to attract new customers.

NextEra Energy remains deeply committed to long-term clean energy expansion. Its subsidiary, NextEra Energy Resources (“NEER”), aims to add 36.5-46.5 gigawatts (GW) of renewable capacity between 2024 and 2027 through a series of strategic projects. From 2025 to 2029, the unit plans to invest approximately $25 billion to further strengthen and grow its operations. With nearly 30 GW of contracted projects in its backlog, NextEra Energy Resources has solid visibility into the continued growth of its clean energy portfolio.

NextEra Energy is advancing on its clean energy transition by pairing renewable generation with increasing battery storage. While solar and wind remain vital components of its portfolio, the company’s increasing investment in large-scale storage projects is emerging as a crucial growth driver. As of Dec. 31, 2024, FPL operated 469 megawatts (“MW”) of battery storage, while NEER managed 3,379 MW connected to the transmission system. NEER has plans to invest nearly $5.5 billion in the period of 2025-2029 to add 4,265 MW of storage projects to support its renewable energy-based projects.

NextEra Energy, a capital-intensive company with a domestic focus, stands to gain from the Federal Reserve's decision to cut interest rates. The Fed has reduced the benchmark rate by 25basis points, lowering it from the 4.25-4.5% range to 4.00-4.25%. More rate cuts are anticipated, which could further reduce the company’s capital servicing costs.

NextEra Energy maintains one of the lowest cost structures in the utility industry, thanks to its operational efficiency, economies of scale in renewable energy, and strategically located projects. These strengths support robust profit margins and provide a clear competitive advantage.

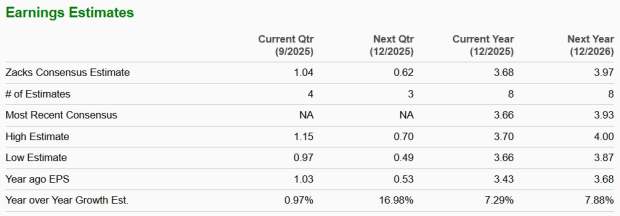

The Zacks Consensus Estimate for NEE’s 2025 and 2026 earnings per share indicates year-over-year growth of 7.3% and 7.9%, respectively. The company expects to increase its earnings per share in the range of 6-8% annually through 2027 from the 2024 level.

Another utility, Dominion Energy (D), is also having a large volume of clean energy generation capability like NextEra. The Zacks Consensus Estimate for D’s 2025 and 2026 earnings per share indicates year-over-year growth of 22.4% and 5.8%, respectively.

Courtesy of the efficient execution of plans and smart capital investment, NextEra Energy was able to surpass earnings per share expectations in the fourth quarter. The company surpassed expectations in all the past four quarters, with an average earnings surprise of 3.51%.

Dominion Energy also registered positive earnings surprise in each of the last four reported quarters, courtesy of solid performance and execution of its plans. The company surpassed expectations in all the past four quarters, with an average earnings surprise of 10.85%.

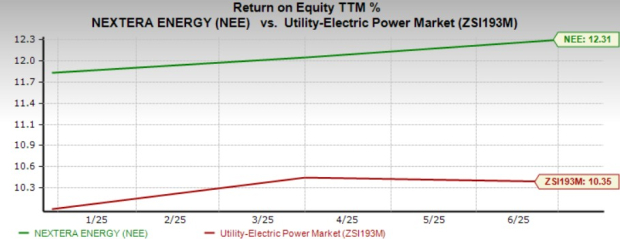

NextEra Energy’s trailing 12-month return on equity (ROE) is 12.31%, ahead of the industry average of 10.35%. ROE is a financial ratio that measures how well a company uses its shareholders’ equity to generate profits. The current ROE of the company indicates that it is using shareholders’ funds more efficiently than its peers.

The ROE of Duke Energy (DUK) was lower than the industry average. Duke Energy provides efficient electricity and gas services to millions of customers in the United States. DUK’s current ROE is 9.85%.

NextEra Energy plans to increase the dividend rate annually by 10%, at least through 2026, from the 2024 base, subject to its board’s approval. The current annual dividend of the company is $2.27 per share, and the dividend yield of 2.72% is better than the Zacks S&P 500 Composite’s yield of 1.5%. NextEra Energy has increased its dividend five times in the last five years. Check NEE’s dividend history here.

Duke Energy’s current annual dividend is $4.26 per share, reflecting a dividend yield of 3.39%. DUK has also raised its dividend five times in the last five years.

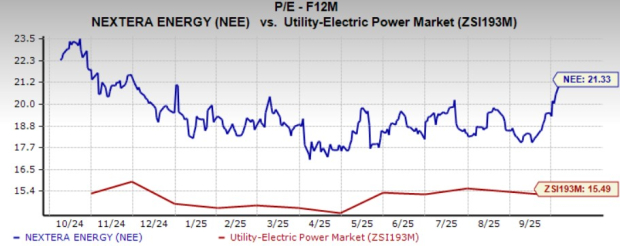

The company is currently valued at a premium compared to its industry on a forward 12-month P/E basis. NextEra Energy is currently trading at 21.33X compared with the industry average of 15.49%.

NextEra Energy continues to deliver steady performance, supported by growing demand for clean energy across its service areas. The company is consistently expanding its portfolio of clean energy assets to meet this increasing need. Florida’s strong economic environment is generating new growth opportunities for the utility.

Given the improvement in earnings estimates and return on equity, it will be wise to remain invested in this Zacks Rank #3 (Hold) utility. Since NEE is trading at a premium, it is better to wait for a while and look for a better entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 7 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite