|

|

|

|

|||||

|

|

Sprouts Farmers Market, Inc. SFM has carved out a unique niche by tapping into the growing demand for fresh and organic groceries. This focused strategy has driven strong financial performance and set the company apart in a crowded market. However, after a significant pullback in its stock price, investors are evaluating whether the recent decline presents a buying opportunity or if holding the stock remains the safer choice.

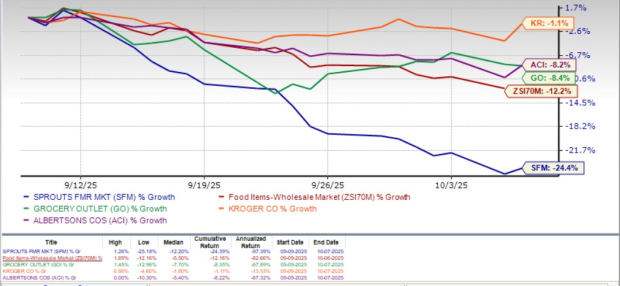

Shares of SFM closed at $102.84 yesterday, reflecting a 24.4% decline over the past month and underperforming the industry’s 12.2% drop.

Sprouts Farmers has also lagged behind competitors such as Grocery Outlet Holding Corp. GO, Albertsons Companies, Inc. ACI and The Kroger Co. KR. While shares of these peers have also dropped, their declines have been more moderate compared to SFM, with Grocery Outlet, Albertsons Companies, and Kroger falling 8.4%, 8.2% and 1.1%, respectively.

Despite the recent drop, SFM’s valuation remains elevated relative to the broader industry, reflecting the market’s confidence in its strong position in the fresh and organic grocery segment.

Sprouts Farmers currently trades at a forward 12-month price-to-sales (P/S) multiple of 1.04, which positions it at a premium compared to the industry’s average of 0.24. At the same time, SFM is trading below its 12-month median P/S of 1.69X, suggesting that the recent decline may offer a more reasonable entry point for long-term investors.

This premium positioning is especially notable when compared to peers like Grocery Outlet (with a forward 12-month P/S ratio of 0.32), Albertsons Companies (0.11) and Kroger (0.29).

Sprouts Farmers' commitment to providing fresh produce and health-oriented products aligns with the increasing consumer demand for healthier food options. This strategic focus continues to distinguish it in a competitive grocery landscape, supported by a premium product mix, digital momentum, loyalty program and disciplined new-store openings. These strengths were evident in the second quarter of 2025, when net sales increased 17% year over year, fueled by a 10.2% surge in comparable-store sales. Traffic accounted for the majority of the comparable-sales gain, suggesting demand strength rather than pricing effects.

The company’s product mix and private-label expansion remain major growth drivers. The Sprouts brand contributed 24% of total sales in the quarter, and management plans to introduce more than 350 new Sprouts-branded SKUs this year. Meanwhile, organic merchandise accounts for nearly one-third of total sales and more than half of produce sales, reinforcing Sprouts Farmers’ leadership in a segment where consumer spending continues to outpace the broader grocery industry. The company’s high-protein assortment, now encompassing roughly 3,700 SKUs with 450 more to be added this year, further diversifies its product reach into fast-growing nutritional categories.

Digital and omnichannel initiatives have also become a meaningful contributor to sales. E-commerce revenues surged 27%, now representing about 15% of total sales. The company’s own platform, shop.sprouts.com, continues to post the fastest gains in penetration, while partnerships with delivery providers like Instacart, DoorDash, and Uber Eats strengthen convenience and accessibility. SFM is further capitalizing on this digital trend through its Sprouts Reward loyalty program, which it plans to roll out on a full scale. The results from test programs were compelling, showing that enrolled members are demonstrating superior engagement and are spending more per basket.

Sprouts Farmers' expansion strategy remains disciplined yet ambitious. The company opened 12 new stores in the second quarter, reaching 455 locations (as of June 29) across 24 states, and plans at least 35 openings in 2025, with more than 130 approved sites in its pipeline — many in high-potential regions like the Midwest and Northeast. The company is building out its self-distribution infrastructure. For instance, a new Northern California distribution center is slated to open in early 2026, and a multi-year DC expansion program is underway. Sprouts Farmers has also begun insourcing fresh meat and seafood operations, giving more control over freshness and supply-chain costs.

Sprouts Farmers’ focus on health-conscious consumers is paying off, driving steady traffic and sales growth. By emphasizing attribute-driven products such as gluten-free, organic and vegan offerings, the company is effectively catering to a growing demographic that prioritizes wellness and transparency in food choices. This supports SFM’s full-year 2025 guidance, which includes net sales growth of 14.5% to 16%, with comparable store sales growth of 7.5% to 9%.

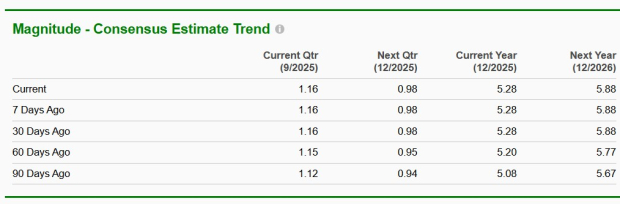

Over the past 60 days, the Zacks Consensus Estimate for the current fiscal year has moved up by 8 cents to $5.28, while the estimate for the next fiscal year has risen by 11 cents to $5.88. These estimates indicate expected year-over-year growth rates of 40.8% and 11.3%, respectively.

Sprouts Farmers’ recent stock decline appears more like a short-term blip rather than a reversal in its long-term growth story. The company’s core strengths — premium product positioning, growing digital reach, margin discipline and an expanding store network — remain firmly intact. While near-term volatility may persist as valuations adjust, SFM’s fundamentals continue to point toward a business with durable demand and improving profitability. For investors with a long-term horizon, the current situation presents an attractive opportunity to accumulate shares at a more favorable entry point. SFM currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

GoTo Foods announces former Roark Capital executive Brett Ubl as new CFO

ACI

Nation's Restaurant News

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite