|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

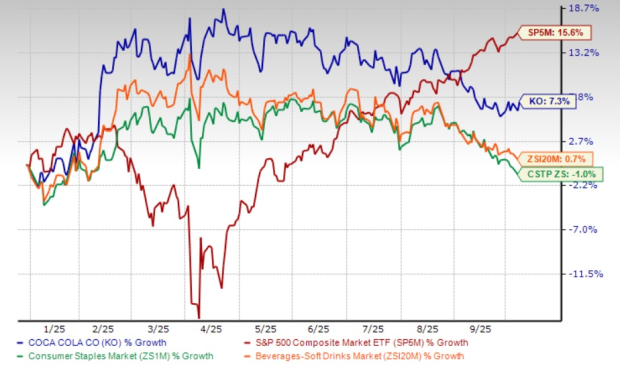

The Coca-Cola Company KO has been witnessing resilient business trends on a strong brand portfolio, investments across the business and revenue growth across its operating segments. In the past three months, KO shares have rallied 7.3% compared with the broader industry’s 0.7% rise and the Zacks Consumer Staples sector’s 1% decline. However, the stock has underperformed the S&P 500’s rally of 15.6% in the same period.

KO’s performance is notably weaker than that of its competitors, PepsiCo Inc. PEP, Keurig Dr Pepper Inc. KDP and Westrock Coffee Company WEST, which have declined 7.5%, 21.2% and 29.8%, respectively, in the past three months.

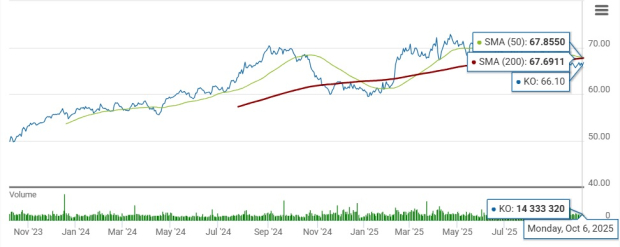

At its current price of $66.79, the KO stock trades 10.1% above its 52-week low mark of $60.62 and 10.2% below its 52-week high mark of $74.38.

Coca-Cola is trading below its 50-day and 200-day moving averages, indicating a bearish sentiment. It highlights fading investor confidence and slower buying interest. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations. This approach also provides a clearer perspective on a stock's long-term direction.

Coca-Cola’s recent rally can be attributed to a combination of resilient performance, strategic execution and an optimistic outlook reinforced in its second-quarter 2025 earnings call. Despite a volatile operating environment, the company delivered solid organic revenue growth and expanded margins, reflecting effective pricing, productivity gains and disciplined cost control. Management highlighted Coca-Cola’s ability to adapt through its “all-weather strategy,” emphasizing agility and local responsiveness across markets. Strong marketing transformation, innovation in core brands like Coca-Cola Zero Sugar and Sprite, and value share gains for the 17th consecutive quarter strengthened investor confidence.

Another key driver of the rally was management’s upbeat tone and raised full-year earnings guidance. The company reaffirmed organic revenue growth of 5-6% and guided for 8% comparable currency-neutral EPS growth, signaling robust operational momentum. Margin expansion, aided by productivity initiatives and improved marketing efficiency, underscored Coca-Cola’s ability to balance investment and profitability. The company’s strong cash flow, low leverage and continued capital return commitment further reinforced its financial stability amid global macro uncertainty.

Beyond the numbers, Coca-Cola’s innovation and digital execution have invigorated its growth narrative. Initiatives such as AI-based pricing tools, product launches like Sprite + Tea and localized campaigns have boosted engagement and market share. Coupled with solid recovery in the United States and Europe, resilience in emerging markets, and optimism around the fairlife and refillables businesses, these factors have revived investor enthusiasm. The company’s mix of strategic agility, brand strength and improved profitability has collectively fueled KO’s stock rally.

Despite KO’s ongoing strength, several headwinds can affect its growth momentum. The company faced a 1% volume decline in the second quarter, pressured by adverse weather in key markets, softening consumer demand and tough year-over-year comparisons.

Management acknowledged consumer pressure in regions like North America, Mexico and India, where early monsoons, geopolitical tensions and affordability issues weighed on demand. Additionally, macroeconomic challenges in parts of Africa and Southeast Asia, coupled with currency headwinds and a higher effective tax rate, continue to pose operational hurdles.

Management also flagged potential margin normalization in the second half of 2025, with reinvestment and dynamic global trade conditions likely to limit upside. Capacity constraints in the high-growth fairlife segment and a slower recovery in some emerging markets further add to near-term uncertainty. While the company’s agile “all-weather” strategy mitigates risk, these challenges highlight the delicate balance between sustaining growth and managing volatility.

The Zacks Consensus Estimate for Coca-Cola’s 2025 EPS has moved down by a penny in the past 30 days, while the EPS estimate for 2026 has been unchanged. For 2025, the Zacks Consensus Estimate for KO’s revenues and EPS implies 3% and 3.1% year-over-year growth, respectively. The consensus mark for 2026 revenues and earnings suggests 5.7% and 8.2% year-over-year growth, respectively.

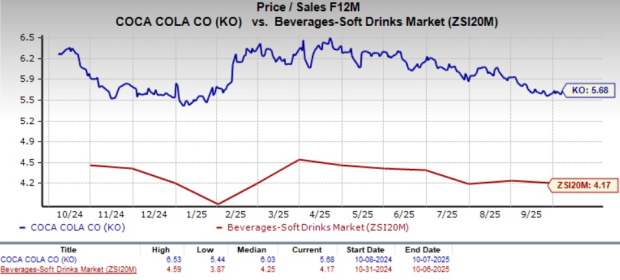

Coca-Cola currently trades at a forward 12-month price-to-sales (P/S) multiple of 5.68X, which positions it at a premium compared with the industry’s average of 4.17X. However, the stock is trading slightly below its median P/E level of 6.03X observed in the past year.

This premium positioning is especially notable when compared with peers like PepsiCo (with a forward 12-month P/E ratio of 2.02X), Keurig Dr Pepper (2.05X) and Westrock Coffee (0.34X).

Coca-Cola commands a high valuation, reflecting its strong market positioning, brand power and long-term growth potential compared with other non-alcoholic beverage companies. The company’s ability to deliver on its promise of offering something for everyone to drink, with a focus on innovation and digital expansion, is crucial.

While Coca-Cola’s recent rally underscores the company’s resilience and execution strength, investors should tread carefully. The company’s steady performance and strategic adaptability point toward sustained positive trends, yet persistent headwinds, including slowing volume growth, margin pressures and capacity constraints, suggest that near-term momentum may face hurdles. Moreover, the downward revision in earnings estimates reflects softened expectations regarding future growth.

Given Coca-Cola’s elevated price-to-sales multiple, the stock appears to be trading at stretched levels relative to its peers. Despite its strong fundamentals and global leadership, the current valuation may already factor in much of its near-term strength. Therefore, with the Zacks Rank #4 (Sell) signaling likely underperformance ahead, investors should exercise caution, as the stock appears overvalued and may face further downside before presenting a compelling entry opportunity.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| 8 hours | |

| 9 hours | |

| 11 hours | |

| 14 hours | |

| 16 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite