|

|

|

|

|||||

|

|

Microsoft MSFT has evolved from a software leader into an artificial intelligence powerhouse, with its aggressive healthcare AI expansion positioning the stock as a compelling investment opportunity for 2025. Trading around $524 after posting year-to-date gains of 24.5%, the critical question for investors centers on timing: buy now or wait for a better entry point? The evidence increasingly suggests immediate action makes sense.

The company's October 2025 partnership with Harvard Medical School represents a watershed moment in healthcare AI development. Microsoft is integrating Harvard Health Publishing content into its Copilot AI assistant to deliver medical-grade health information to millions of users. This move demonstrates a commitment to reducing OpenAI dependence while building proprietary healthcare capabilities that could generate substantial revenue streams. The partnership complements Microsoft's processing of 50 million health-related queries daily through Copilot and Bing, creating a data advantage competitors cannot easily replicate.

The financial results underlying these strategic initiatives prove remarkably robust. Microsoft delivered $76.4 billion in revenues during its fourth quarter of fiscal 2025, representing 18% year-over-year growth, while net income surged 24% to $27.2 billion. Full fiscal 2025 revenues reached $281.7 billion, with operating income climbing 17% to $128.5 billion. Most impressively, Azure cloud computing revenues surpassed $75 billion annually with 39% growth in the latest quarter, substantially driven by artificial intelligence services that contributed 16 percentage points to overall Azure expansion. The company's AI business alone now exceeds a $13 billion annual run rate, making it the fastest-growing segment in Microsoft's history.

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $74.99 billion, indicating 14.35% growth year over year. The consensus mark for earnings is pegged at $3.66 per share, indicating an increase of 10.91% from the year-ago period.

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

Healthcare AI specifically showcases Microsoft's ability to commercialize cutting-edge technology. The company launched Dragon Copilot in March 2025, creating the healthcare industry's first unified voice AI assistant combining natural language dictation with ambient listening capabilities. Clinical studies demonstrate that doctors using this technology save five minutes per patient encounter, enabling 13 additional appointment slots monthly while improving work-life balance by 70%. With more than 600 healthcare organizations already deploying ambient AI solutions, Dragon Copilot addresses the administrative burden costing the U.S. healthcare system an estimated 25% of total expenditure.

The June 2025 unveiling of Microsoft's AI Diagnostic Orchestrator achieved remarkable results, demonstrating 85% diagnostic accuracy on complex cases compared to just 20% accuracy from experienced physicians. This four-fold improvement came at a lower cost than traditional testing, suggesting enormous potential for healthcare cost reduction in an industry where spending approaches 20% of U.S. GDP.

Strategic positioning further enhances investment appeal. Unlike Amazon AMZN or Alphabet GOOGL-owned Google, Microsoft operates as a trusted enterprise partner, enabling deeper collaborations with major health systems, including Cleveland Clinic, Mayo Clinic, and Stanford Health Care. The 20-year partnership with Epic Systems provides distribution advantages that new entrants cannot replicate.

Microsoft currently trades at a forward price-to-sales ratio of 11.68x, representing a premium to the Zacks Computer-Software industry average of 8.69 times. While this elevated valuation might typically signal caution, several factors justify the premium. The company's accelerating Azure growth, expanding margins, and leadership position in the AI revolution support higher multiples. Microsoft's operating margin expanded to 44.9% in the fiscal fourth quarter, demonstrating improved efficiency even while investing heavily in AI infrastructure.

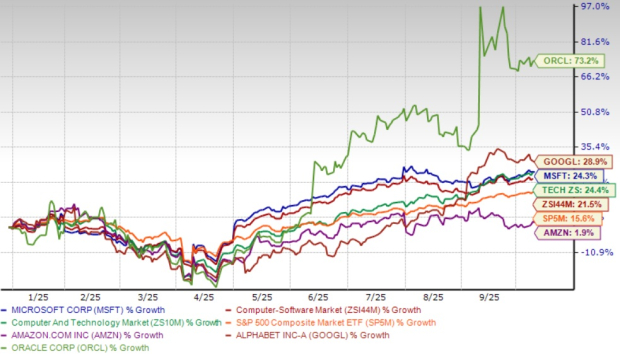

Amazon Web Services launched its Health Data Accelerator and partnered with General Catalyst on healthcare generative AI initiatives, yet Amazon stock gained only 1.9% year to date in 2025. Google Cloud introduced Vertex AI Search for Healthcare with multimodal capabilities and Agent Garden for agentic AI deployment, driving Google stock up 28.9% in 2025. Oracle ORCL unveiled its next-generation cloud-based EHR with embedded AI agents and launched an AI Center of Excellence for Healthcare, propelling Oracle shares up 73.2% year-to-date. Despite competitive healthcare AI advancements from Amazon, Google, and Oracle, Microsoft maintains structural advantages through its Epic partnership and comprehensive cloud ecosystem that justify premium valuation multiples.

The healthcare AI market's explosive trajectory from $37 billion in 2024 toward $187 billion by 2030 represents a 37% compound annual growth rate, and Microsoft's platform approach positions it to capture disproportionate share. For investors weighing whether to buy now or wait, Microsoft's combination of financial strength, technological leadership, strategic partnerships, and massive addressable market suggests the risk-reward balance favors immediate action. The time to buy Microsoft is now, before the market fully prices in its healthcare AI opportunity. Microsoft currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 12 min | |

| 17 min | |

| 36 min | |

| 2 hours |

Nvidia Beats Back Bubble Fears With Record $68 Billion in Sales in Fourth Quarter

AMZN

The Wall Street Journal

|

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Quantum Computing Stocks: IonQ Earnings, Revenue Beat Amid Acquisitions

MSFT GOOGL

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite