|

|

|

|

|||||

|

|

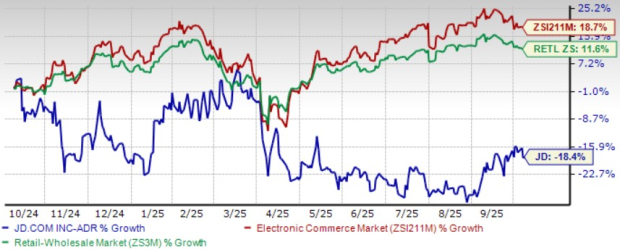

JD.com JD shares have plunged 18.4% in the past year, underperforming the Zacks Internet-Commerce industry’s growth of 18.7% and the Zacks Retail-Wholesale sector’s return of 11.6%. The decline reflects cautious sentiment toward JD’s shifting business mix, near-term margin pressures and slower cash flow recovery as it invests in new verticals and international operations.

This sharp divergence from industry peers raises the question of whether the current price levels present a buying opportunity or signal further challenges ahead for investors considering this Chinese e-commerce giant. Let’s delve deeper to find out.

JD’s ambitious expansion into food delivery has become a notable drag on financial performance, with the new businesses segment reporting an operating loss of RMB 14.8 billion in the second quarter of 2025. Launched less than a year ago, the venture has achieved strong order growth but at unsustainable cost levels. Competitive intensity is likely to remain elevated through late 2025, compelling JD to continue offering heavy subsidies and promotional incentives to sustain user and merchant growth. The company’s rapid onboarding of over 1.5 million restaurants and a delivery workforce exceeding 150,000 underscores the scale of operational spending and the uncertainty surrounding its near-term returns.

The initiative marks a structural pivot for JD, from a centralised, inventory-driven retail model to a hyperlocal, on-demand logistics network that will define its next phase of growth. Over the coming quarters, the company is expected to deepen integration between food delivery and core retail categories like supermarkets and lifestyle goods to drive higher user engagement and repeat spending. However, achieving scale efficiency in real-time logistics will take time. Unit economics are projected to remain under pressure through 2025, with meaningful margin recovery likely only once route density improves and subsidy intensity eases.

JD faces a dual challenge as intensifying competition and diversification weigh on its financial flexibility. PDD Holdings PDD continues to expand its market share through aggressive discounting and social commerce promotions, compelling JD to maintain higher marketing spend. Alibaba BABA is deepening its asset-light marketplace strategy, sustaining price pressure across categories such as fashion and consumer goods, where margins are already thin. Globally, Amazon AMZN sets the benchmark for delivery speed and membership benefits, shaping user expectations that JD must increasingly meet.

At the same time, JD’s diversification into new verticals such as food delivery, property and overseas logistics is absorbing significant capital. The company’s free cash flow has narrowed sharply to RMB 10.1 billion on a trailing twelve-month basis, down from RMB 56 billion a year earlier, reflecting investment-heavy growth and working capital pressure. The Zacks Consensus Estimate for JD’s third-quarter 2025 revenues is pegged at $41.21 billion, indicating an 11.06% year-over-year increase, while the consensus mark for 2025 revenues is pegged at $183.33 billion, suggesting a modest 5.15% rise. The slower pace signals that cash generation may remain tight even as top-line growth continues.

Although JD holds RMB 223 billion in cash and short-term investments, ongoing investments in logistics, food delivery and international ventures could constrain liquidity. PDD Holding’s lean model shows profitability is achievable despite price competition, while Alibaba’s restructuring underscores the difficulty of balancing diversification with efficiency. Without high-margin offsets like Amazon’s cloud operations, JD must emphasise cost discipline and capital efficiency to stabilise margins and rebuild investor confidence over time.

JD shares are undervalued, as suggested by the Value Score of A, indicating that the stock trades below intrinsic value levels relative to peers. JD currently trades at a forward 12-month price-to-earnings ratio of 10.34x, well under the industry’s average of 24.11x and the sector’s average of 24.5x. In comparison, PDD Holdings trades at 11.63x, Alibaba at 19.57x and Amazon.com at 30.42x, suggesting the depth of JD’s valuation discount within the global e-commerce group.

The valuation discount also reflects JD’s ongoing transition toward a more diversified growth model. The proposed CECONOMY acquisition in Europe could strengthen its international presence and add a new revenue stream from higher-margin markets once integration is completed. Continued investment in food delivery, logistics and overseas operations is expanding JD’s ecosystem reach and positioning it to capture incremental consumer demand beyond its core retail base.

These initiatives may weigh on near-term margins but are aimed at building scalable platforms with stronger long-term monetisation potential. As operating efficiency improves and new businesses begin contributing meaningfully to earnings, the current valuation gap could narrow, unlocking upside over time.

The Zacks Consensus Estimate for JD’s third-quarter 2025 earnings is pegged at 44 cents per share, unchanged over the past 30 days. The estimate implies a 64.52% year-over-year decline, highlighting continued cost pressure from food delivery, overseas expansion and marketing spend. While revenue growth remains subdued, margins are likely to stay compressed through 2025 as JD balances diversification with cash flow constraints.

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

Execution discipline will remain critical. The pace of cost optimisation and integration of its European operations will determine when margins begin to stabilise. For now, JD is expected to remain in a reinvestment phase with a focus on strengthening its ecosystem rather than near-term earnings expansion.

JD’s 18.4% share price decline over the past year reflects investor caution amid slower cash flow recovery and margin pressure from diversification. The company’s reinvestment strategy, while weighing on near-term profitability, aims to build a broader, more resilient ecosystem spanning retail, logistics and on-demand services. Competitive intensity from peers continues to shape the operating landscape, but JD’s supply-chain strengths and execution discipline could support gradual improvement once spending normalises.

JD currently carries a Zacks Rank #3 (Hold), suggesting prudent investors may consider holding positions while waiting for attractive entry points in the future. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite