|

|

|

|

|||||

|

|

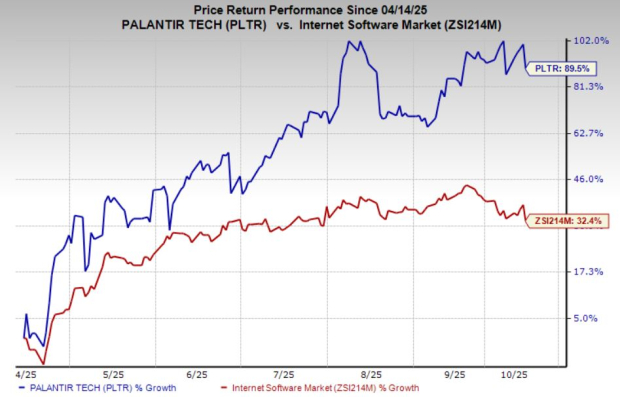

Palantir Technologies Inc. PLTR has soared 90% in the past six months, far outpacing the broader industry’s 32% growth and the Zacks S&P 500 composite’s 23% advance. The question now facing investors: Does PLTR still offer an attractive entry point, or is it smarter to wait for a pullback?

At the heart of Palantir’s recent breakout is its Artificial Intelligence Platform (AIP), which is rapidly evolving into its primary growth engine. In the second quarter of 2025, U.S. commercial revenues surged 93% year over year. Thanks to AIP, the total U.S. commercial contract value skyrocketed 222% YoY, while the remaining deal value climbed 145% to $2.79 billion. Customer count also grew 43% year over year, underscoring PLTR’s ability to scale rapidly while maintaining high satisfaction.

Palantir’s AIP bootcamps, intensive onboarding and implementation sessions, have been instrumental in accelerating adoption. These programs equip enterprise clients to deploy production-ready AI solutions in record time, drastically reducing the time-to-value and demonstrating the platform’s intuitive interface and scalability.

At its core, AIP enables organizations to embed autonomous AI agents across workflows, shrinking decision timelines and scaling productivity by multiples, not mere percentages. While competitors focus on AI model development, PLTR is winning on deployment, offering turnkey, enterprise-ready solutions that drive real results from day one. The U.S. commercial business has now become Palantir’s most dynamic revenue driver, and AIP is the key accelerant.

Tech giants like Microsoft MSFT, Alphabet’s GOOGL Google and Salesforce CRM are also ramping up their AI initiatives. Microsoft continues to expand its Copilot integrations across Office and Azure while strengthening AI governance. Google enhances Workspace and Vertex AI, with a growing emphasis on security and compliance. Meanwhile, Salesforce is layering AI across its CRM ecosystem through Einstein Copilot and Data Cloud, pushing toward deeply personalized user experiences.

Despite this intensifying competition from Microsoft, Google and Salesforce, Palantir stands apart. Its strength lies in serving mission-critical sectors, such as defense, intelligence, and healthcare, where security, trust and performance are non-negotiable. While Salesforce, Microsoft and Google excel in customer-facing tools and broad AI frameworks, Palantir delivers deeply embedded, operational AI that drives high-stakes decision-making. That is a competitive edge that we believe its peers have yet to match.

Palantir’s financial foundation remains robust. As of June 30, 2025, the company held $6 billion in cash and reported zero debt, giving it the flexibility to reinvest aggressively in growth without relying on external capital.

Revenue momentum also remains strong. Second-quarter sales climbed 48% year over year, the first time the software firm crossed the $1 billion quarterly revenue threshold, a major psychological and financial milestone. The company closed 157 deals worth at least $1 million, including 42 over $10 million, a testament to rising enterprise demand and deeper platform penetration.

The Zacks Consensus Estimate for third-quarter 2025 EPS stands at 17 cents, indicating a 70% jump from the prior year. Earnings are forecasted to grow 61% in 2025, followed by 31% growth in 2026. Sales projections are similarly upbeat, with expected revenue growth of 51% in the third quarter, and full-year top-line expansion of 46% in 2025 and 35% in 2026.

PLTR’s valuation remains a meaningful overhang. Palantir trades at a forward P/E of 214, nearly six times the industry average of 37. This lofty multiple is baked into extremely high expectations surrounding future AI monetization and the strength of government contracts.

Such an aggressive valuation leaves little room for error. Any misstep in execution or downward earnings revision could trigger outsized volatility, underscoring the need for discipline and patience among prospective buyers.

Palantir is proving its capability as a serious contender in enterprise AI, backed by a compelling product, strong financials, and growing commercial traction. But the current valuation suggests the optimism is already largely priced in.

Long-term investors should continue holding their positions. However, new entrants may benefit from exercising caution. A more favorable entry point could emerge following a pullback or valuation reset, especially if near-term sentiment cools.

PLTR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 32 min | |

| 32 min | |

| 41 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Software Stock Nemesis Anthropic To Host Enterprise Market Event. AI Agent News Coming?

GOOGL

Investor's Business Daily

|

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite