|

|

|

|

|||||

|

|

The Progressive Corporation PGR is expected to report an improvement in its top and bottom lines when it reports third-quarter 2025 results on Oct 15, before the opening bell.

The Zacks Consensus Estimate for PGR’s third-quarter revenues is pegged at $22.3 billion, indicating 14.9% growth from the year-ago reported figure.

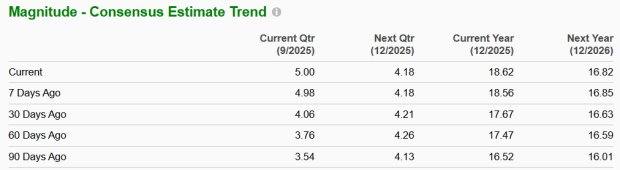

The consensus estimate for earnings is pegged at $5.00 per share. The Zacks Consensus Estimate for PGR’s third-quarter earnings has moved up two cents in the past seven days. The estimate indicates year-over-year growth of 39.7%.

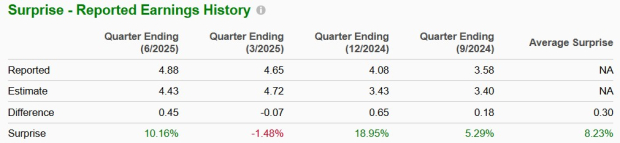

Progressive’s earnings beat the Zacks Consensus Estimates in three of the trailing four quarters while missing in one, the average surprise being 8.23% This is depicted in the following chart.

Our proven model predicts an earnings beat for Progressive this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: PGR has an Earnings ESP of +2.33%. This is because the Most Accurate Estimate of $5.12 is pegged higher than the Zacks Consensus Estimate of $5.00.

The Progressive Corporation price-eps-surprise | The Progressive Corporation Quote

Zacks Rank: PGR carries a Zacks Rank of 3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

An increase in premiums, higher net investment income and fees and service revenues are likely to have favored revenues in the third quarter. The quarterly results are likely to benefit from improved personal auto products as well as commercial lines.

A compelling product portfolio, leadership position, strength in the Vehicle and Property businesses, healthy policies in force and solid retention are likely to have aided net premiums earned. The Zacks Consensus Estimate for net premiums earned is pegged at $21.1 billion, up 15.3% from the year-ago reported number.

The personal auto business is likely to have benefited from personal auto products and new and renewal application growth, which is expected to have been mainly attributable to increased advertising spend, competitively priced products and the agency incentive compensation programs. Both agency and direct auto channels are likely to have driven policy growth. The consensus estimate for personal auto policies in force is pegged at 25.3 million.

A larger invested asset base is likely to have aided improvement in net investment income. The Zacks Consensus Estimate for the metric is pegged at $914 million, up 23.5% from the year-ago reported number.

The insurer is likely to have benefited from pretax net realized gains on securities. The Zacks Consensus Estimate for the metric is pegged at $135 million.

Higher loss and loss-adjustment expenses, policy acquisition costs and other underwriting expenses are likely to have increased expenses. The consensus mark for expense ratio is pegged at 29.8.

The third quarter escaped the brutality of catastrophic events, which is likely to benefit underwriting results. This, coupled with prudent underwriting, is likely to have aided improvement in the combined ratio. The consensus mark for the combined ratio is pegged at 77.

Some other P&C insurance stocks with the right combination of elements to deliver an earnings beat this time around are:

Cincinnati Financial Corporation CINF has an Earnings ESP of +9.57% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $1.79 per share, indicating a year-over-year decrease of 26.1%

CINF’s earnings beat estimates in three of the last four reported quarters and missed in one.

The Travelers Companies TRV has an Earnings ESP of +4.92% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $5.56 per share, indicating a year-over-year increase of 6.1%.

TRV’s earnings beat estimates in each of the last four reported quarters

Chubb Limited CB has an Earnings ESP of +8.57% and a Zacks Rank of 3 at present. The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at $5.67 per share, indicating a year-over-year decrease of 0.9%.

CB’s earnings beat estimates in each of the last four reported quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite