|

|

|

|

|||||

|

|

Chipotle Mexican Grill, Inc. CMG and McDonald’s Corporation MCD represent two giants in the U.S. dining landscape, but their approaches could not be more different. McDonald’s reigns as the world’s largest quick-service restaurant, with a presence in more than 100 countries and a proven playbook built on scale, value and consistency. Chipotle, meanwhile, has carved out its dominance in the fast-casual category by championing a “food with integrity” ethos, emphasizing fresh ingredients and customizable menu options.

For investors, both names carry strong appeal, but for very different reasons. McDonald’s offers stability, a global footprint and steady cash flows supported by its franchise-heavy model. Chipotle, on the other hand, has become a growth darling, consistently delivering double-digit same-store sales gains and margin expansion that rivals even the biggest players in the sector. With both companies sitting at the intersection of consumer demand shifts, pricing power and international expansion, the question becomes: which stock is the better buy for now?

Chipotle continues to showcase strong brand momentum and operational discipline, even amid a challenging consumer environment. The company’s leadership highlighted that despite a slight dip in comparable sales, momentum returned in late second-quarter 2025 as marketing campaigns like Summer of Extras reignited customer engagement and digital transactions.

With more than 20 million active loyalty members, Chipotle’s digital ecosystem remains a key driver of customer retention and incremental visits. Management reaffirmed its long-term target of mid-single-digit comparable sales growth and more than $4 million average unit volumes, supported by menu innovation such as Honey Chicken and Adobo Ranch, both of which received strong customer feedback.

Chipotle’s financial and operational foundation also remains rock solid. It maintains $2.1 billion in cash with zero debt, providing ample flexibility for expansion and shareholder returns. The company opened 61 new restaurants in second-quarter 2025, most with Chipotlanes, and remains on track for up to 345 openings in 2025, signaling continued unit growth. Its international operations are gaining traction, particularly in Canada, Europe and the Middle East, where margins are approaching U.S. levels. Combined with efficiency upgrades like the produce slicer and dual-sided plancha, Chipotle is enhancing throughput, consistency and scalability, key ingredients for sustaining margin growth and long-term profitability.

Despite its strengths, Chipotle faces near-term headwinds tied to consumer sentiment and pricing sensitivity. Management acknowledged that the company has not been getting sufficient “credit” from consumers for its value proposition, as lower-income diners trade down toward cheaper fast-food options. Comparable sales are expected to remain roughly flat for the year, indicating cautious discretionary spending and intensified competition from quick-service rivals offering low-cost meal bundles. Additionally, marketing and tariff-related expenses are pressuring restaurant-level margins, which declined to 27.4%, down 150 basis points year over year.

Another challenge lies in maintaining growth at scale. As Chipotle expands toward the 7,000-store goal, sustaining its historic mid-single-digit comp growth becomes increasingly difficult. The company’s U.S. traffic has shown volatility and new menu introductions, while successful, risk consumer fatigue if not spaced and marketed effectively. Furthermore, cost inflation in key proteins like chicken and steak, combined with higher labor costs, could continue to weigh on margins. While management remains confident in the long-term strategy, Chipotle’s near-term trajectory hinges on a rebound in consumer confidence and flawless execution of its operational upgrades.

McDonald’s continues to prove its resilience with strong global performance despite a challenging consumer environment. In second-quarter 2025, comparable sales rose nearly 4% worldwide, fueled by steady demand across both developed and emerging markets. Value-focused strategies like the $5 Meal Deal, the reintroduction of Snack Wraps at a $2.99 price point and expanded affordable menu bundles in Europe have helped sustain traffic. The company’s scale, combined with disciplined pricing and a franchise-driven model, enables it to capture market share even when consumer spending tightens.

At the same time, MCD is pushing hard on innovation and digital engagement. McDonald’s loyalty program now boasts more than 185 million 90-day active users, driving repeat visits and higher frequency of transactions. Global campaigns, such as the Minecraft Movie tie-in, proved effective in boosting traffic across multiple regions. On the operational side, investments in technology, including AI-enabled systems, geofencing for faster service and edge computing, are designed to enhance customer experience while delivering efficiencies to franchisees. This blend of digital engagement and operational modernization underscores the brand’s ability to stay relevant and competitive at scale.

The biggest challenge lies in the U.S. market, where low-income consumers, traditionally heavy QSR users, have pulled back sharply due to pressure on real incomes and inflation fatigue. McDonald’s acknowledged that high menu prices, with some combo meals exceeding $10, are hurting value perceptions and discouraging visits. While its loyalty program and value bundles are cushioning the impact, only about half of U.S. traffic is currently captured through these initiatives. This leaves a large segment of consumers disengaged, underscoring the risk that sluggish traffic trends could persist if affordability concerns are not fully addressed.

The Zacks Consensus Estimate for Chipotle’s 2025 sales and EPS implies year-over-year growth of 6.9% and 7.1%, respectively. However, earnings estimate revisions for 2025 have witnessed downward revisions of 0.8% in the past 30 days.

The Zacks Consensus Estimate for MCD’s 2025 sales and EPS implies year-over-year increases of 3% and 5.5%, respectively. Earnings estimates for 2025 have witnessed upward revisions of 0.1% in the past seven days.

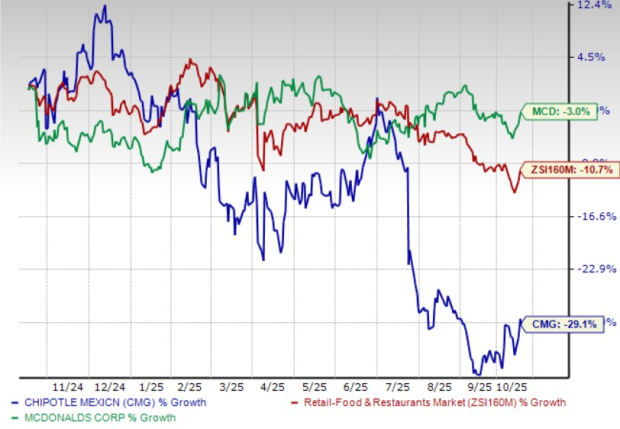

CMG stock has tanked 29.1% in the past year. Conversely, MCD’s shares have declined 3% in the same time frame.

CMG is trading at a forward 12-month price-to-earnings ratio of 30.76X, below its median of 39.82X over the last year. MCD’s forward earnings multiple sits at 23.19X, below its median of 23.8X over the same time frame.

From a valuation and performance standpoint, Chipotle looks less compelling for investors right now. Despite the strong long-term growth story, the stock has faced a sharp decline and the near-term challenges, ranging from weak traffic trends and value perception issues to cost pressures, make it a riskier bet at current levels.

McDonald’s, on the other hand, has shown far greater resilience, with steady sales momentum, upward earnings revisions and a business model that thrives even in tighter consumer spending environments. For investors seeking stability and dependable returns, McDonald’s appears worth holding, while it may be prudent to stay on the sidelines with Chipotle until clearer signs of recovery emerge.

MCD currently carries a Zacks Rank #3 (Hold), but CMG has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite