|

|

|

|

|||||

|

|

Oklo is the stock market darling, with a 12-month gain of more than 1,000%.

NuScale is also near its all-time high as it races to build its first small reactor in Idaho.

The battle is on to claim supremacy of new nuclear tech in an effort to power the AI data centers of tomorrow.

You could call it the one-two punch that put NuScale Power (NYSE: SMR) and Oklo (NYSE: OKLO) on the hot-stock radar.

First, there's the ongoing artificial intelligence (AI) boom, which triggered a massive buildout of data centers and underscored the growing need for affordable and reliable energy to power them. Next, there's been a gradual and general softening of the public's long-standing reluctance to build new nuclear power plants. Investors have taken notice.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

And it is clear from a stock market standpoint that the past year has belonged to Oklo. Its astonishing 1,370% gain in the 12 months through Oct. 15, 2025, is exponentially ahead of the 290% advance by NuScale and the roughly 15% gain by the S&P 500 in that time frame.

SMR 1 Year Price Returns (Daily) data by YCharts

However, past performance is no guarantee of future results, so investors must focus on the path forward when deciding between Oklo and NuScale. Specifically, whether and when these two high-risk, developmental stage companies will start to deliver their particular nuclear power plays to the market, start generating consistent revenue and profits, and stop burning through cash.

Over the 12 months ending June 30, 2025, the Oregon-based developer of small modular reactor technology posted $56.1 million in revenue and $124 million in net losses. NuScale has missed analysts' revenue estimates in 10 of the past 12 quarters.

Based on what analysts are projecting for the next 12 months, NuScale is currently trading at a price-to-sales (P/S) ratio of 200. However, the P/S figure is projected to drop sharply if and when the business takes off and sales increase. Specifically, NuScale's revenue is projected to go from $47 million in 2025 to $152 million next year, all the way up to $5.1 billion in 2034.

In terms of profits, analysts are currently projecting three more years of losses for NuScale, before it vaults to profitability in 2030 with earnings per share (EPS) of $0.48.

Despite its recent gains and high multiples, six analysts tracked by Koyfin still rate NuScale a buy, nine have it at hold, and only one rates it a sell. Perhaps more concerning is the fact that the average 12-month price target is $41.64, which is about 20% below current levels.

Investors will get an update from the company when it reports Q3 results Nov. 6.

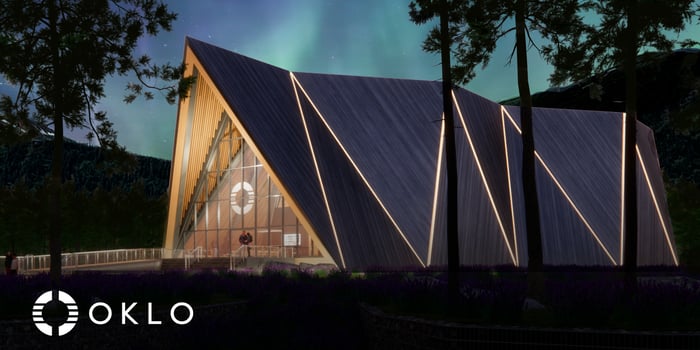

Let's turn to Oklo and the Santa Clara, California-based company's efforts to develop and commercialize what it calls "advanced fission power plants to provide clean, reliable, and affordable energy." The company says it expects to have its first plant online in Idaho by the end of the decade, with other locations, permitting, and programs in the works.

An Oklo power plant. Image source: Oklo.

So far, Oklo has yet to book any revenue and has posted combined net losses of $56.8 million over the past 12 months, thereby distorting its valuation multiples. Among analysts who currently have long-term revenue estimates, Oklo is predicted, on average, to do $55 million in sales in 2028 before rising aggressively to $6.7 billion by 2034.

In terms of profits, analysts are projecting Oklo to deliver its first positive full-year EPS of $1.05 in 2030, which means it's currently trading at 162 times those distant results. Again, like NuScale, its multiples are expected to decline sharply after crossing the breakeven point.

Given the stock's enormous move over the past 12 months, there are obviously a lot of early believers in the Oklo story, including 10 analysts who still rate it a buy, seven who say hold, and only one who considers it a sell. Together, their 12-month average price target is $101, which is about 40% below current levels.

Oklo's Q3 earnings date has yet to be scheduled but is expected in mid-November.

In short, Oklo has the momentum advantage but NuScale is ahead on revenue and licensing. Since both of these new nuclear energy stocks have been bid up substantially by investors and both are expected to remain unprofitable for several more years, a speculative buyer with a high risk tolerance could look to enter either stock on the next dip.

Alternatively, there are dozens of exchange-traded funds (ETFs) that already own both Oklo and NuScale among their top holdings. One is the Global X Uranium ETF, where Oklo is the second-largest holding at 18% of the fund, and NuScale is the fifth-largest with about a 4.8% weighting. Other dual holders include the VanEck Uranium and Nuclear ETF and the Themes Uranium & Nuclear ETF. These funds could be smart ways to invest in nuclear tech bets linked to the AI-driven power surge theme, with the added benefit of diversification.

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $646,805!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,123,113!*

Now, it’s worth noting Stock Advisor’s total average return is 1,055% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 13, 2025

Matthew Nesto has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite