|

|

|

|

|||||

|

|

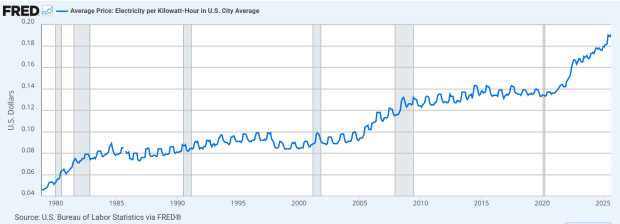

Since 2020, the average electricity price per kilowatt-hour in the US has soared from $0.133 to $0.188, a 30% increase in just the past 5 years. In the next few years, many experts fear that the United States will face an electricity crisis (although one can argue it’s already in the early stages of one).

Below are four factors driving higher energy prices:

· An Aging Electrical Grid: The US’s electrical grid is aging. With an already massive fiscal deficit, major grid upgrades are unlikely any time soon. Grid issues have become more prevalent recently and are likely to persist.

· Extreme Weather Events: Climate change has increased the frequency of extreme weather events over the past few years. For instance, a 2021 Texas winter storm left 2 million Texans without electricity.

· Persistent Inflation: Although the inflation rate has slowed since its 2022 peak, inflation is still driving up the costs of the equipment and materials needed to generate electricity.

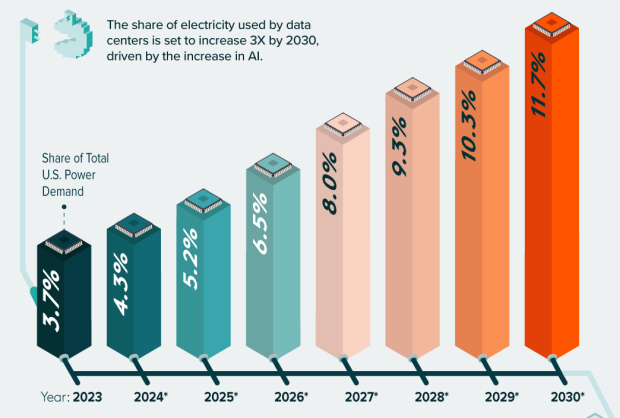

· EVs & the AI Buildout: As electric vehicle adoption continues to grow, the need for charging infrastructure is also increasing. Meanwhile, the artificial intelligence buildout is the most significant driver of higher electricity prices. Currently, data centers comprise ~5% of total electricity use in the United States. However, McKinsey & Company expects that data center electricity use will triple by 2030, accounting for 11.7% of total consumption.

Chris Wright, the US Secretary of Energy, had a nuclear energy background prior to joining the Trump Administration, having previously served on the board of directors of Oklo (OKLO). With that in mind, it should be little surprise that the Trump Administration is pro-nuclear. Thursday, news broke that the US plans to buy and own as many as 10 nuclear reactors. Earlier this month, the Trump Administration also announced a $1 billion federal loan to restart the Three Mile Island nuclear plant that is managed by Constellation Energy (CEG).

But can nuclear energy solve US energy issues? Nuclear energy is one of the cleanest, most reliable, and cheapest forms of energy. However, nuclear energy is unlikely to be the solution to the US power woes in the short-to-intermediate-term because building a plant typically takes a decade. Additionally, nuclear energy companies face regulatory red tape, public opinion issues, and environmental concerns that are unlikely to be remedied any time soon.

Although the above-mentioned nuclear challenges hold for most nuclear projects in the United States, Constellation Energy is an exception. Constellation Energy is unique in the nuclear industry because it has already received regulatory approval and funding and has provided an estimate of when its massive nuclear project will launch. CEG’s restoration of the “Three Mile Island” nuclear plant in Pennsylvania, renamed the “Crane Energy Center,” will be online in 2027. Additionally, CEG has landed 20-year power agreements to supply electricity to two big tech juggernauts – Microsoft (MSFT) and Meta Platforms (META).

Although it’s reasonable for investors to believe that nuclear power will be a long-term power solution for the AI revolution, doing so now is unrealistic. Since the AI buildout is unlikely to slow down any time soon, traditional energy sources such as natural gas are the answer in the short-term due to their practicality and low cost.

Bloom Energy has differentiated itself from other energy providers through its solid oxide fuel cell (SOFC) technology. BE’s technology takes natural gas (and other gases), mixes it with air, and creates electricity. However, unlike other natural gas providers, Bloom’s technology produces electricity without combustion, making its energy “cleaner”. Additionally, Bloom’s technology is self-sufficient and produced on-site, meaning that data center owners are not susceptible to grid outages.

Now that solar energy is cheaper than ever, it is poised to be a major winner in the AI-driven energy demand boom. Solar is relatively cheap, clean, renewable, and can scale rapidly.

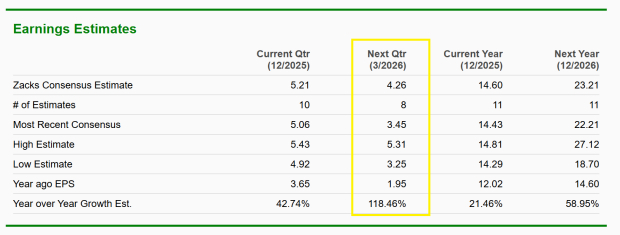

First Solar is a leading domestic solar provider. FSLR benefits from increasing solar demand. Additionally, the company benefits from the Inflation Reduction Act (IRA), which provides generous tax credits and shields it from Chinese competition. Wall Street analysts expect FSLR EPS to more than double next quarter.

Meanwhile, Nextpower is another company that will benefit from the electricity super-cycle. Nextpower’s software and services help solar projects run more efficiently.

Bottom Line

Electricity demand in the US is accelerating rapidly, and the early signs of a long-term power crisis are already visible. While nuclear offers a powerful long-term, solution, the urgency of the AI buildout means that natural gas, advanced fuel cell technology, and solar will drive the first wave of investment opportunities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite