|

|

|

|

|||||

|

|

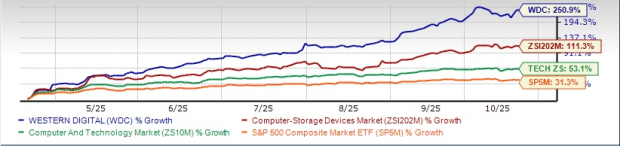

Western Digital Corporation’s (WDC) shares have skyrocketed 250.9% in the past six months, outpacing the Zacks Computer-Storage Devices industry’s rise of 111.3%. The stock has also outperformed the Zacks Computer & Technology sector and the S&P 500’s growth of 53.1% and 31.3%, respectively. Large AI models and their inferencing needs are increasing the demand for HDDs and enterprise flash, which benefits Western Digital.

The company has outdone its cut-throat rival in the HDD business, Seagate Technology Holdings plc (STX), and competitors in the broader storage space such as Pure Storage (PSTG) and NetApp, Inc. (NTAP). STX, PSTG and NTAP have gained 204.9%, 128.4% and 45.8% during the same time frame.

WDC has a 52-week high of $137.4. Following a strong rally, investors may wonder if WDC still holds meaningful upside or if expectations have outpaced fundamentals. Let’s break down the pros and cons to assess the road ahead.

Western Digital designs, manufactures and markets HDDs across external, client and data center segments. After spinning off its Flash/SSD business into SanDisk in 2025, WDC has transitioned into a focused, pure-play HDD company. The separation has strengthened its margins, cash flow and overall financial position. Rising nearline storage demand, expanding AI-driven data storage needs and improving HDD ASPs are expected to serve as major growth drivers.

HDDs continue to be the most cost-efficient and dependable solution for large-scale data storage, with Western Digital maintaining a strong position in the global storage landscape. The company’s ePMR and UltraSMR technologies deliver enhanced reliability, scalability and a low total cost of ownership (TCO). Meanwhile, its next-generation HAMR drives currently undergoing early hyperscale testing, are on track for qualification in 2027. The upcoming ePMR drives are expected to qualify by early 2026, ensuring a seamless product transition. Management expects sustained revenue growth and improved profitability in the coming quarter, driven by increasing demand for high-capacity HDDs.

WDC’s improved top-line and bottom-line performances position it to drive shareholder value through dividends and repurchases. Backed by strong cash flow and a healthy balance sheet, the board has authorized up to $2 billion in share buybacks and initiated a quarterly dividend. In the last reported quarter, it repurchased about 2.8 million shares for $149 million.

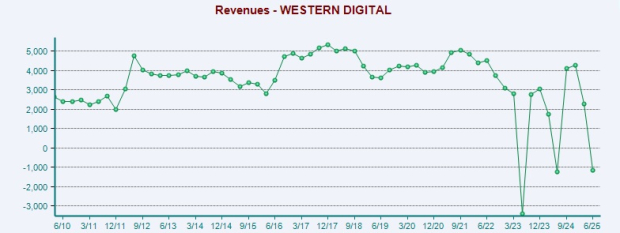

Healthy growth trends, especially in cloud storage, are bolstering expectations for a strong fiscal first quarter. At the mid-point of its guidance, Western Digital anticipates non-GAAP revenues of $2.7 billion (+/- $100 million), up 22% year over year. Management projects non-GAAP earnings of $1.54 (+/- 15 cents). It expects non-GAAP gross margin in the range of 41-42%. Non-GAAP operating expenses are expected to be between $370 million and $380 million.

A major growth catalyst for WDC has been the accelerating adoption of AI workloads and cloud services. The expansion of Agentic AI across industries is driving a surge in demand for unstructured data storage, while Western Digital itself is leveraging Agentic AI to speed up product innovation. Though still in its early phase, this trend is gaining global traction. As AI continues to generate massive amounts of data, the demand for scalable storage solutions is increasing rapidly.

Recently, the company unveiled its expanded 25,600-square-foot System Integration and Test (SIT) Lab, built to speed up customer success and shorten time to value. As AI fuels record storage demand, the facility enables quicker, more reliable qualification of Western Digital’s high-capacity HDDs. Management highlighted that nearly 80% of cloud data still resides on hard HDDs, making these drives vital for enabling data collection, retention and long-term accessibility.

However, Western Digital’s growth outlook remains constrained by high customer concentration, a leveraged balance sheet, macroeconomic volatility and intense competition from other leading storage providers. Its rival Seagate, for instance, is advancing growth through HAMR technology, which boosts areal density to meet the increasing storage requirements of hyperscale data centers, AI workloads and edge computing environments.

NTAP and WDC compete across the broader storage market—NetApp specializing in software-defined and cloud data management, while Western Digital focuses on HDD hardware. Pure Storage, with its all-flash FlashArray and FlashBlade systems, targets high-performance workloads. Growing data demand continues to drive strong prospects for both PSTG and WDC in the expanding storage landscape.

WDC’s heavy debt burden continues to pose a major headwind. As of June 27, 2025, WDC had cash and cash equivalents of $2.1 billion, while long-term debt (including the current portion) was $4.7 billion. The high debt level jeopardizes its ability to pursue accretive acquisitions and other growth endeavors. It is required to constantly generate adequate cash flows to meet debt requirements.

Nonetheless, it reduced debt by $2.6 billion in the June quarter through cash utilization and a debt-for-equity exchange, strengthening its balance sheet and achieving its net leverage target of 1–1.5x. During the quarter, WDC exchanged about 21 million SanDisk shares to reduce Term Loan A by $800 million while retaining 7.5 million shares. The company also redeemed $1.8 billion of senior unsecured notes, lowering gross debt to $4.7 billion at fiscal 2025 year-end.

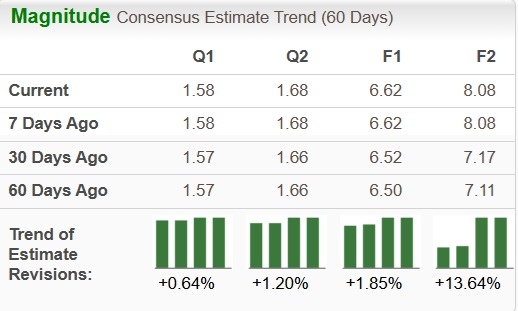

WDC’s estimates revisions are on an upward trajectory currently. The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised north 1.85% to $6.62 over the past 60 days, while the same for fiscal 2027 has gone up 13.64% to $8.08.

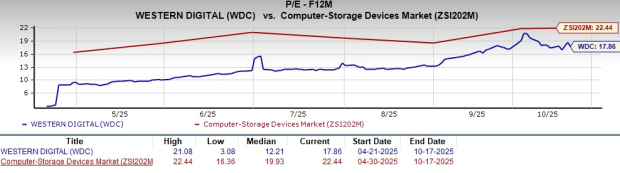

From a valuation standpoint, WDC appears to be trading relatively cheaper compared to the industry but above its mean. Going by the price/earnings ratio, the company’s shares currently trade at 17.86 forward earnings, lower than 22.44 for the industry but above the stock’s mean of 12.21.

Western Digital’s robust growth and profitability fueled by increasing AI-driven demand, accelerating adoption of high-capacity drives and strong customer partnerships are likely to drive a positive outcome. The company continues to deliver higher margins, solid free cash flow, debt reduction and consistent capital returns. Backed by hyperscale customer commitments and ongoing innovation in storage technology, management remains confident in continued revenue growth and margin expansion, projecting a strong outlook for fiscal 2026.

Boasting a Zacks Rank #1 (Strong Buy) at present, WDC seems to be good investment bet now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 |

Iran Says Khamenei Killed As U.S.-Israeli Attacks Continue; Dow Jones Futures Loom

WDC STX

Investor's Business Daily

|

| Feb-28 |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

STX WDC

Investor's Business Daily

|

| Feb-28 | |

| Feb-28 |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

WDC STX

Investor's Business Daily

|

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite