|

|

|

|

|||||

|

|

Novo Nordisk NVO and Eli Lilly LLY dominate the diabetes and obesity market on the back of the tremendous success of their GLP-1 products. Lilly markets its dual GIP and GLP-1 receptor agonist, tirzepatide, as Mounjaro for type II diabetes and as Zepbound for obesity. Novo Nordisk markets its semaglutide drugs as Ozempic pre-filled pen and Rybelsus oral tablet for type II diabetes and as Wegovy injection for weight management.

Lilly’s Cardiometabolic Health segment, which includes Mounjaro, Zepbound and other medicines for type II diabetes, generated almost $30 billion in sales in 2024. Novo Nordisk’s Diabetes and Obesity care segment generated $39.4 billion (DKK 271.8 billion) in sales in 2024. While Lilly’s Cardiometabolic Health segment generates around 66% of its total revenues, NVO’s Diabetes and Obesity care segment accounts for a huge 93.6% of its total sales.

Both Lilly and Novo Nordisk are seeing exceptional sales and earnings growth. But which one is a better investment today? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

Lilly boasts a wide range of products that serve a vast number of therapeutic areas. The company focuses primarily on cardiometabolic health, neuroscience, oncology and immunology, which are all high-growth areas with significant commercial potential.

Despite being on the market for less than three years, Mounjaro and Zepbound became key top-line drivers for Lilly in 2024, with demand rising rapidly. The drugs generated combined sales of $16.5 billion in 2024, accounting for around 36% of the company’s total revenues.

However, quarter-over-quarter growth of Zepbound and Mounjaro in 2024 was hurt by supply and channel dynamics. Slower-than-expected growth and unfavorable channel dynamics hurt sales of Mounjaro and Zepbound in the second half, raising concerns about moderating demand for these drugs.

Nevertheless, investors were impressed by the company’s outlook for 2025 provided in February, particularly the expectations for improvement in sales of Mounjaro/Zepbound. Lilly is hopeful that sales of Mounjaro and Zepbound will pick up in 2025 as it ramps up manufacturing capacity and through label and geography expansions.

Other than Mounjaro and Zepbound, Lilly has gained approvals for some other new drugs in the past couple of years across different therapeutic areas like Omvoh, Jaypirca, Ebglyss and Kisunla (donanemab). Lilly expects its new drugs, Mounjaro, Zepbound, Omvoh, Jaypirca, Ebglyss and Kisunla, along with the expanded use of existing drugs, to drive sales growth in 2025.

On capital allocation, LLY returned $3 billion to shareholders in 2024 via share repurchases and dividends. The board of directors of Lilly approved a new $15 billion stock buyback plan and also announced a 15% increase in its quarterly dividend in 2024.

Lilly has its share of problems. Sales of its key medicine, Trulicity, are declining in the United States due to competitive dynamics, including Mounjaro switches and supply constraints. Prices of most of Lilly’s products are declining in the United States. Potential competition in the GLP-1 diabetes/obesity market is another headwind.

Novo Nordisk has a strong presence in the diabetes care market, with one of the broadest diabetes portfolios in the industry. NVO’s success in the past few years is underscored by its semaglutide medicines, mainly Ozempic, Rybelsus and Wegovy, which are seeing great demand trends and driving the top line. In 2024, Novo Nordisk’s GLP-1 sales in diabetes increased 21%, depicting greater patient outreach and market capture. NVO controls 63% of the global GLP-1 agonist market. Among its GLP-1 products, Wegovy sales rose 86% in 2024.

Novo Nordisk has been addressing the supply constraints of Wegovy by making investments to increase production. The closing of the Catalent deal in December last year is also expected to help NVO counter supply issues for its GLP-1 products.

Label expansions of its semaglutide medicines in cardiovascular and other indications will likely boost sales.

Both Lilly and NVO have reduced the prices of their obesity drugs, Zepbound and Wegovy, respectively, for patients paying by cash. The lowered price can improve access to medicines and drive their sales. The FDA also removed Lilly’s tirzepatide medicines from its shortage list in December 2024 and NVO’s semaglutide products from the list in late February 2025. This means that the shortage of these products is resolved and the agency is confident that the company can meet its current and future demand.

Novo Nordisk is making good progress with its pipeline, which includes several other new candidates for type-II diabetes and obesity, as well as candidates for treating hemophilia.

However, the stock has been under pressure due to disappointing data from two late-stage studiesfor its next-generation subcutaneous obesity candidate, CagriSema, a follow-up drug to Wegovy. In these studies, CagriSema demonstrated a lower-than-expected reduction in body weight.

Lilly’s Zepbound had earlier outperformed Wegovy (20.2% compared with 13.7%) in a head-to-head weight-loss study. This could lead to a shift in patient preference from Wegovy to Zepbound, potentially resulting in a loss of market share.

Competition in the obesity market is heating up as the obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs. Lilly and Novo presently dominate the market. In order to maintain their position, both NVO and LLY are investing broadly in obesity and have several new molecules currently in clinical development.

Several companies like Amgen AMGN and Viking Therapeutics VKTX are also making rapid progress in the development of GLP-1-based candidates in their clinical pipeline.

Amgen plans to conduct a broad phase III program on its dual GIPR/GLP-1 receptor agonist, MariTide, across obesity, obesity-related conditions and type-II diabetes, with the first studies to begin in the first half of 2025. Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity.

Others like Roche, Merck and AbbVie are also looking to enter the obesity space by in-licensing obesity candidates from smaller biotechs, which could threaten Novo Nordisk and Eli Lilly’s dominance in the market.

The Zacks Consensus Estimate for LLY’s 2025 sales and EPS implies a year-over-year increase of 33.2% and 81.1%, respectively. While EPS estimates for 2025 have risen over the past 30 days, that for 2026 have remained stable over the same timeframe.

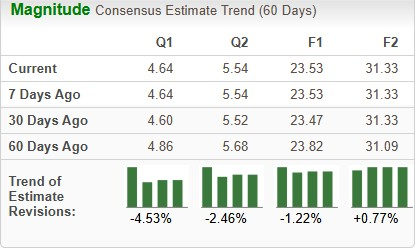

The Zacks Consensus Estimate for Novo Nordisk’s 2025 sales and EPS implies a year-over-year increase of 17.6% and 15.9%, respectively. EPS estimates for both 2025 and 2026 have been trending southward over the past 30 days.

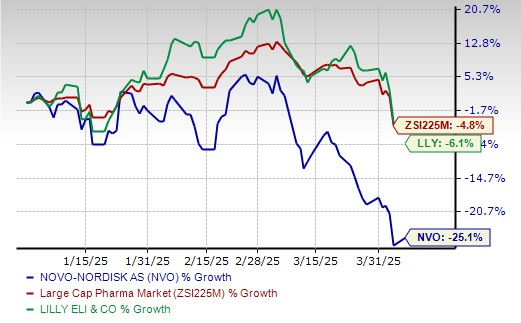

Year to date, while LLY’s stock has declined 6.1%, Novo Nordisk’s stock has plunged 25.1% compared with the industry’s decrease of 4.8%

Stocks of both LLY and NVO also declined recently as Medicare excluded these expensive weight-loss medicines from its Part D prescription drug coverage.

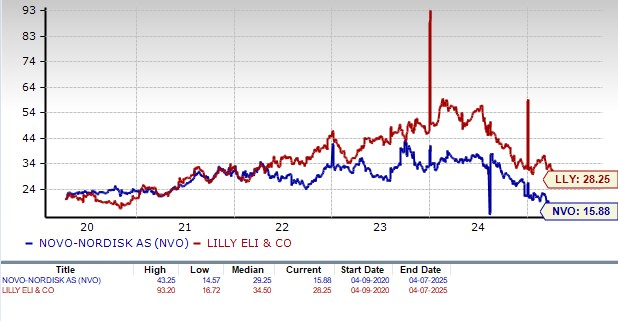

Both Lilly and NVO are priced higher than the industry from a valuation standpoint. Lilly is more expensive than Novo Nordisk, going by the price/earnings ratio. Lilly’s shares currently trade at 28.25 forward earnings, higher than 15.88 for NVO. However, with the markets hitting new lows amid the tariff impact, both NVO and LLY are trading at discounts to their 5-year mean.

Lilly’s dividend yield is 0.8%, while NVO’s is much higher at around 2.6%.

Lilly’s return on equity of 85.2% is higher than NVO’s 84.7%

Both Lilly and Novo Nordisk have a Zacks Rank #3 (Hold), which makes choosing one stock a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Novo Nordisk is a good stock to have in one’s portfolio with strong growth prospects. However, given a choice between NVO and LLY, it’s better to go for Lilly, as NVO’s recent pipeline and regulatory setbacks have resulted in the stock crashing 45% in the past six months. This has created a bearish sentiment around the stock.

Lilly, on the other hand, with its much more diversified product and pipeline portfolio, robust growth prospects and rising estimates is a clear-cut winner despite its expensive valuation. Lilly is also a much bigger company than Novo Nordisk. Lilly’s market cap is around $700 billion while NVO’s market cap is around $281 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 48 min | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite